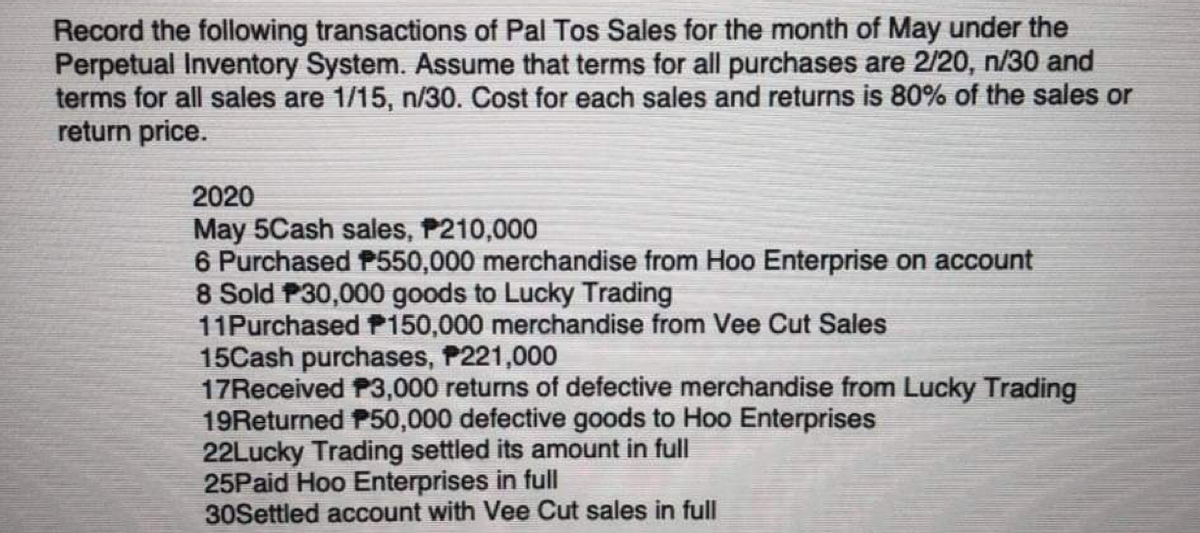

Record the following transactions of Pal Tos Sales for the month of May under the Perpetual Inventory System. Assume that terms for all purchases are 2/20, n/30 and terms for all sales are 1/15, n/30. Cost for each sales and returns is 80% of the sales or return price. 2020 May 5Cash sales, P210,000 6 Purchased P550,000 merchandise from Hoo Enterprise on account 8 Sold P30,000 goods to Lucky Trading 11Purchased P150,000 merchandise from Vee Cut Sales 15Cash purchases, P221,000 17Received P3,000 returns of defective merchandise from Lucky Trading 19Returned P50,000 defective goods to Hoo Enterprises 22Lucky Trading settled its amount in full

Record the following transactions of Pal Tos Sales for the month of May under the Perpetual Inventory System. Assume that terms for all purchases are 2/20, n/30 and terms for all sales are 1/15, n/30. Cost for each sales and returns is 80% of the sales or return price. 2020 May 5Cash sales, P210,000 6 Purchased P550,000 merchandise from Hoo Enterprise on account 8 Sold P30,000 goods to Lucky Trading 11Purchased P150,000 merchandise from Vee Cut Sales 15Cash purchases, P221,000 17Received P3,000 returns of defective merchandise from Lucky Trading 19Returned P50,000 defective goods to Hoo Enterprises 22Lucky Trading settled its amount in full

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 4PEB: Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory...

Related questions

Question

Transcribed Image Text:Record the following transactions of Pal Tos Sales for the month of May under the

Perpetual Inventory System. Assume that terms for all purchases are 2/20, n/30 and

terms for all sales are 1/15, n/30. Cost for each sales and returns is 80% of the sales or

return price.

2020

May 5Cash sales, P210,000

6 Purchased P550,000 merchandise from Hoo Enterprise on account

8 Sold P30,000 goods to Lucky Trading

11Purchased PP150,000 merchandise from Vee Cut Sales

15Cash purchases, P221,000

17Received P3,000 returns of defective merchandise from Lucky Trading

19Returned P50,000 defective goods to Hoo Enterprises

22Lucky Trading settled its amount in full

25Paid Hoo Enterprises in full

30Settled account with Vee Cut sales in full

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College