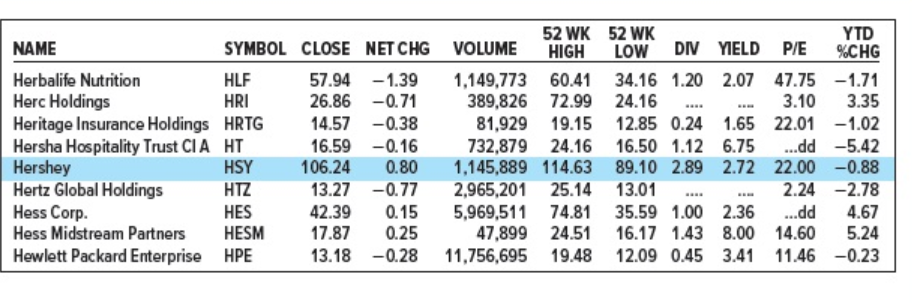

Refer to Figure and look at the listing for Hewlett Packard Enterprise. a. How many shares could you buy for $10,000?b. What would be your annual dividend income from those shares? c. What must be Hewlett Packard Enterprise's earnings per share? d. What was the firm's closing price on the day before the listing?

Refer to Figure and look at the listing for Hewlett Packard Enterprise. a. How many shares could you buy for $10,000?b. What would be your annual dividend income from those shares? c. What must be Hewlett Packard Enterprise's earnings per share? d. What was the firm's closing price on the day before the listing?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter1: Overview Of Financial Reporting, Financial Statement Analysis, And Valuation

Section: Chapter Questions

Problem 2QE: Economic Attributes Framework Applied to the Specialty Retailing Apparel Industry. Apply the...

Related questions

Question

Refer to Figure and look at the listing for Hewlett Packard Enterprise.

a. How many shares could you buy for $10,000?b. What would be your annual dividend income from those shares?

c. What must be Hewlett Packard Enterprise's earnings per share?

d. What was the firm's closing price on the day before the listing?

Transcribed Image Text:NAME

Herbalife Nutrition

Herc Holdings

Heritage Insurance Holdings

Hersha Hospitality Trust CIA

Hershey

Hertz Global Holdings

Hess Corp.

Hess Midstream Partners

Hewlett Packard Enterprise

SYMBOL CLOSE NET CHG

57.94 -1.39

26.86 -0.71

14.57

-0.38

106.24

16.59 -0.16

0.80

13.27 -0.77

HLF

HRI

HRTG

HT

HSY

HTZ

HES

HESM

HPE

42.39 0.15

17.87 0.25

13.18 -0.28

YTD

%CHG

52 WK 52 WK

VOLUME

HIGH LOW DIV YIELD P/E

1,149,773 60.41 34.16 1.20 2.07 47.75

389,826 72.99 24.16

3.10

81,929 19.15

1.65 22.01

-1.02

12.85 0.24

16.50 1.12 6.75 ...dd -5.42

732,879 24.16

1,145,889 114.63

22.00 -0.88

2.24 -2.78

89.10 2.89 2.72

2,965,201 25.14 13.01

5,969,511 74.81 35.59 1.00 2.36

47,899 24.51 16.17 1.43 8.00 14.60 5.24

19.48 12.09 0.45 3.41 11.46 -0.23

...dd

4.67

11,756,695

-1.71

3.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning