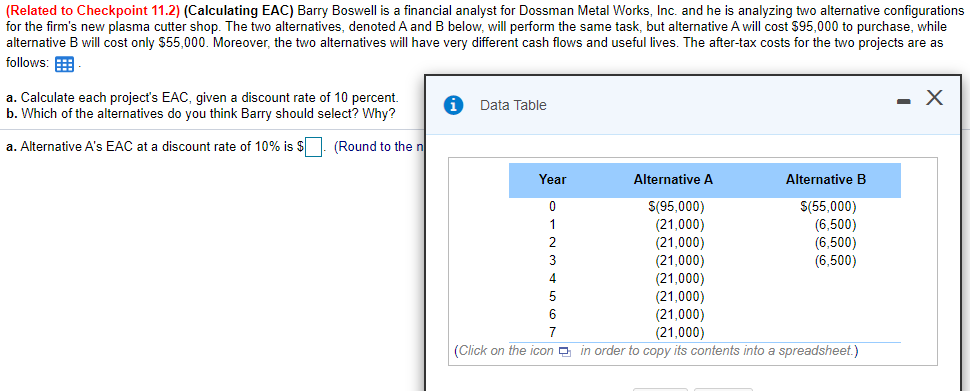

(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $95,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 10 percent. b. Which of the alternatives do you think Barry should select? Why? Data Table a. Alternative A's EAC at a discount rate of 10% is $N. (Round to the n Year Alternative A Alternative B S(55,000) (6,500) (6,500) (6,500) S(95,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (Click on the icon D in order to copy its contents into a spreadsheet.) 1 2 3 4 5

(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $95,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 10 percent. b. Which of the alternatives do you think Barry should select? Why? Data Table a. Alternative A's EAC at a discount rate of 10% is $N. (Round to the n Year Alternative A Alternative B S(55,000) (6,500) (6,500) (6,500) S(95,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (Click on the icon D in order to copy its contents into a spreadsheet.) 1 2 3 4 5

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations

for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $95,000 to purchase, while

alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as

follows: E

a. Calculate each project's EAC, given a discount rate of 10 percent.

b. Which of the alternatives do you think Barry should select? Why?

- X

Data Table

a. Alternative A's EAC at a discount rate of 10% is $. (Round to the n

Year

Alternative A

Alternative B

S(55,000)

(6,500)

(6,500)

(6,500)

S(95,000)

(21,000)

1

2

(21,000)

3

(21,000)

4

(21,000)

(21,000)

(21,000)

(21,000)

(Click on the icon O in order to copy its contents into a spreadsheet.)

5

6

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning