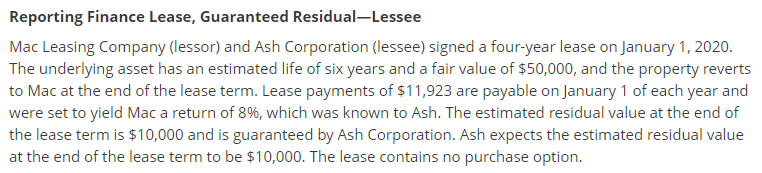

Reporting Finance Lease, Guaranteed Residual–Lessee Mac Leasing Company (lessor) and Ash Corporation (lessee) signed a four-year lease on January 1, 2020. The underlying asset has an estimated life of six years and a fair value of $50,000, and the property reverts to Mac at the end of the lease term. Lease payments of $11,923 are payable on January 1 of each year and were set to yield Mac a return of 8%, which was known to Ash. The estimated residual value at the end of the lease term is $10,000 and is guaranteed by Ash Corporation. Ash expects the estimated residual value at the end of the lease term to be $10,000. The lease contains no purchase option.

Reporting Finance Lease, Guaranteed Residual–Lessee Mac Leasing Company (lessor) and Ash Corporation (lessee) signed a four-year lease on January 1, 2020. The underlying asset has an estimated life of six years and a fair value of $50,000, and the property reverts to Mac at the end of the lease term. Lease payments of $11,923 are payable on January 1 of each year and were set to yield Mac a return of 8%, which was known to Ash. The estimated residual value at the end of the lease term is $10,000 and is guaranteed by Ash Corporation. Ash expects the estimated residual value at the end of the lease term to be $10,000. The lease contains no purchase option.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6P: Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a...

Related questions

Question

I need help on this last part (d) of this question. See photos..

Transcribed Image Text:Reporting Finance Lease, Guaranteed Residual-Lessee

Mac Leasing Company (lessor) and Ash Corporation (lessee) signed a four-year lease on January 1, 2020.

The underlying asset has an estimated life of six years and a fair value of $50,000, and the property reverts

to Mac at the end of the lease term. Lease payments of $11,923 are payable on January 1 of each year and

were set to yield Mac a return of 8%, which was known to Ash. The estimated residual value at the end of

the lease term is $10,000 and is guaranteed by Ash Corporation. Ash expects the estimated residual value

at the end of the lease term to be $10,000. The lease contains no purchase option.

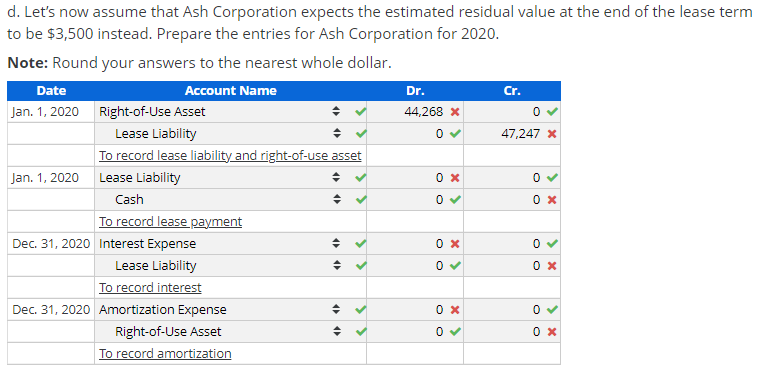

Transcribed Image Text:d. Let's now assume that Ash Corporation expects the estimated residual value at the end of the lease term

to be $3,500 instead. Prepare the entries for Ash Corporation for 2020.

Note: Round your answers to the nearest whole dollar.

Date

Account Name

Dr.

Cr.

Jan. 1, 2020 Right-of-Use Asset

44,268 x

Lease Liability

47,247 x

To record lease liability and right-of-use asset

Jan. 1, 2020

Lease Liability

Cash

To record lease payment

Dec. 31, 2020 Interest Expense

Lease Liability

To record interest

Dec. 31, 2020 Amortization Expense

0 x

Right-of-Use Asset

To record amortization

Expert Solution

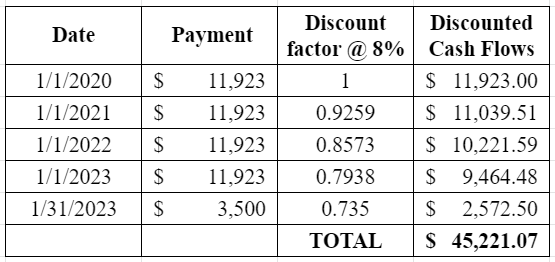

Step 1

Working Note:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning