Required: 1. When recording the raw material purchases: a. The Raw Materials inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? 2. When recording the raw materials used in production: a. The Raw Materials inventory will increase (decrease) by how much? b. The Work in Process inventory will increase (decrease) by how much? 3. When recording the direct labor costs added to production: a. The Work in Process inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much?

Required: 1. When recording the raw material purchases: a. The Raw Materials inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? 2. When recording the raw materials used in production: a. The Raw Materials inventory will increase (decrease) by how much? b. The Work in Process inventory will increase (decrease) by how much? 3. When recording the direct labor costs added to production: a. The Work in Process inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter9: Standard Costing: A Functional-based Control Approach

Section: Chapter Questions

Problem 30P: Algers Company produces dry fertilizer. At the beginning of the year, Algers had the following...

Related questions

Topic Video

Question

100%

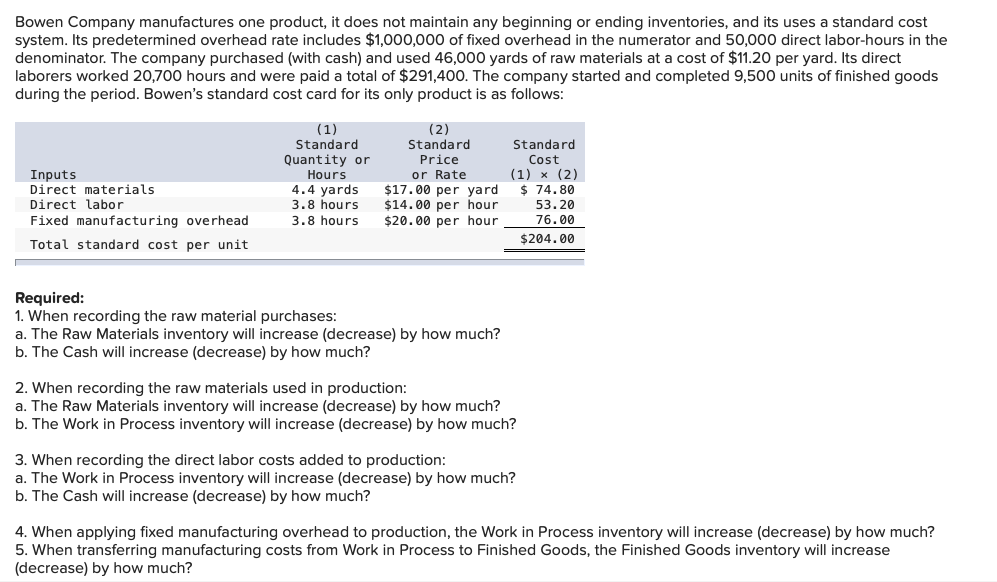

Transcribed Image Text:Bowen Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost

system. Its predetermined overhead rate includes $1,000,000 of fixed overhead in the numerator and 50,000 direct labor-hours in the

denominator. The company purchased (with cash) and used 46,000 yards of raw materials at a cost of $11.20 per yard. Its direct

laborers worked 20,700 hours and were paid a total of $291,400. The company started and completed 9,500 units of finished goods

during the period. Bowen's standard cost card for its only product is as follows:

(1)

Standard

(2)

Standard

Price

or Rate

$17.00 per yard

$14.00 per hour

Standard

Inputs

Direct materials

Direct labor

Fixed manufacturing overhead

Quantity or

Hours

4.4 yards

3.8 hours

Cost

(1) x (2)

$ 74.80

53.20

76.00

3.8 hours

$20.00 per hour

Total standard cost per unit

$204.00

Required:

1. When recording the raw material purchases:

a. The Raw Materials inventory will increase (decrease) by how much?

b. The Cash will increase (decrease) by how much?

2. When recording the raw materials used in production:

a. The Raw Materials inventory will increase (decrease) by how much?

b. The Work in Process inventory will increase (decrease) by how much?

3. When recording the direct labor costs added to production:

a. The Work in Process inventory will increase (decrease) by how much?

b. The Cash will increase (decrease) by how much?

4. When applying fixed manufacturing overhead to production, the Work in Process inventory will increase (decrease) by how much?

5. When transferring manufacturing costs from Work in Process to Finished Goods, the Finished Goods inventory will increase

(decrease) by how much?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,