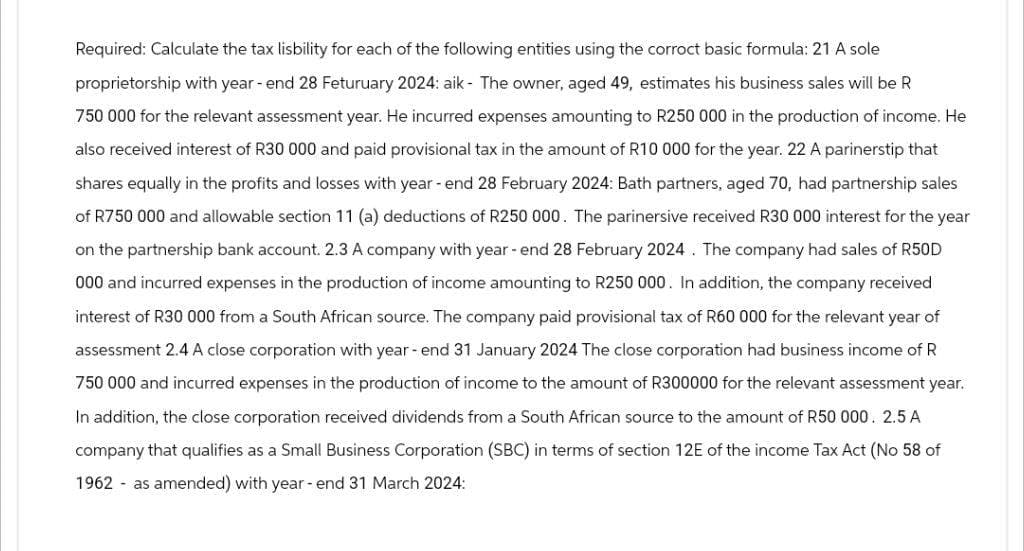

Required: Calculate the tax lisbility for each of the following entities using the corroct basic formula: 21 A sole proprietorship with year-end 28 Feturuary 2024: aik - The owner, aged 49, estimates his business sales will be R 750 000 for the relevant assessment year. He incurred expenses amounting to R250 000 in the production of income. He also received interest of R30 000 and paid provisional tax in the amount of R10 000 for the year. 22 A parinerstip that shares equally in the profits and losses with year-end 28 February 2024: Bath partners, aged 70, had partnership sales of R750 000 and allowable section 11 (a) deductions of R250 000. The parinersive received R30 000 interest for the year on the partnership bank account. 2.3 A company with year-end 28 February 2024. The company had sales of R50D 000 and incurred expenses in the production of income amounting to R250 000. In addition, the company received interest of R30 000 from a South African source. The company paid provisional tax of R60 000 for the relevant year of assessment 2.4 A close corporation with year-end 31 January 2024 The close corporation had business income of R 750 000 and incurred expenses in the production of income to the amount of R300000 for the relevant assessment year. In addition, the close corporation received dividends from a South African source to the amount of R50 000. 2.5 A company that qualifies as a Small Business Corporation (SBC) in terms of section 12E of the income Tax Act (No 58 of 1962 as amended) with year-end 31 March 2024:

Required: Calculate the tax lisbility for each of the following entities using the corroct basic formula: 21 A sole proprietorship with year-end 28 Feturuary 2024: aik - The owner, aged 49, estimates his business sales will be R 750 000 for the relevant assessment year. He incurred expenses amounting to R250 000 in the production of income. He also received interest of R30 000 and paid provisional tax in the amount of R10 000 for the year. 22 A parinerstip that shares equally in the profits and losses with year-end 28 February 2024: Bath partners, aged 70, had partnership sales of R750 000 and allowable section 11 (a) deductions of R250 000. The parinersive received R30 000 interest for the year on the partnership bank account. 2.3 A company with year-end 28 February 2024. The company had sales of R50D 000 and incurred expenses in the production of income amounting to R250 000. In addition, the company received interest of R30 000 from a South African source. The company paid provisional tax of R60 000 for the relevant year of assessment 2.4 A close corporation with year-end 31 January 2024 The close corporation had business income of R 750 000 and incurred expenses in the production of income to the amount of R300000 for the relevant assessment year. In addition, the close corporation received dividends from a South African source to the amount of R50 000. 2.5 A company that qualifies as a Small Business Corporation (SBC) in terms of section 12E of the income Tax Act (No 58 of 1962 as amended) with year-end 31 March 2024:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Required: Calculate the tax lisbility for each of the following entities using the corroct basic formula: 21 A sole

proprietorship with year-end 28 Feturuary 2024: aik - The owner, aged 49, estimates his business sales will be R

750 000 for the relevant assessment year. He incurred expenses amounting to R250 000 in the production of income. He

also received interest of R30 000 and paid provisional tax in the amount of R10 000 for the year. 22 A parinerstip that

shares equally in the profits and losses with year-end 28 February 2024: Bath partners, aged 70, had partnership sales

of R750 000 and allowable section 11 (a) deductions of R250 000. The parinersive received R30 000 interest for the year

on the partnership bank account. 2.3 A company with year-end 28 February 2024. The company had sales of R50D

000 and incurred expenses in the production of income amounting to R250 000. In addition, the company received

interest of R30 000 from a South African source. The company paid provisional tax of R60 000 for the relevant year of

assessment 2.4 A close corporation with year-end 31 January 2024 The close corporation had business income of R

750 000 and incurred expenses in the production of income to the amount of R300000 for the relevant assessment year.

In addition, the close corporation received dividends from a South African source to the amount of R50 000. 2.5 A

company that qualifies as a Small Business Corporation (SBC) in terms of section 12E of the income Tax Act (No 58 of

1962 as amended) with year-end 31 March 2024:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT