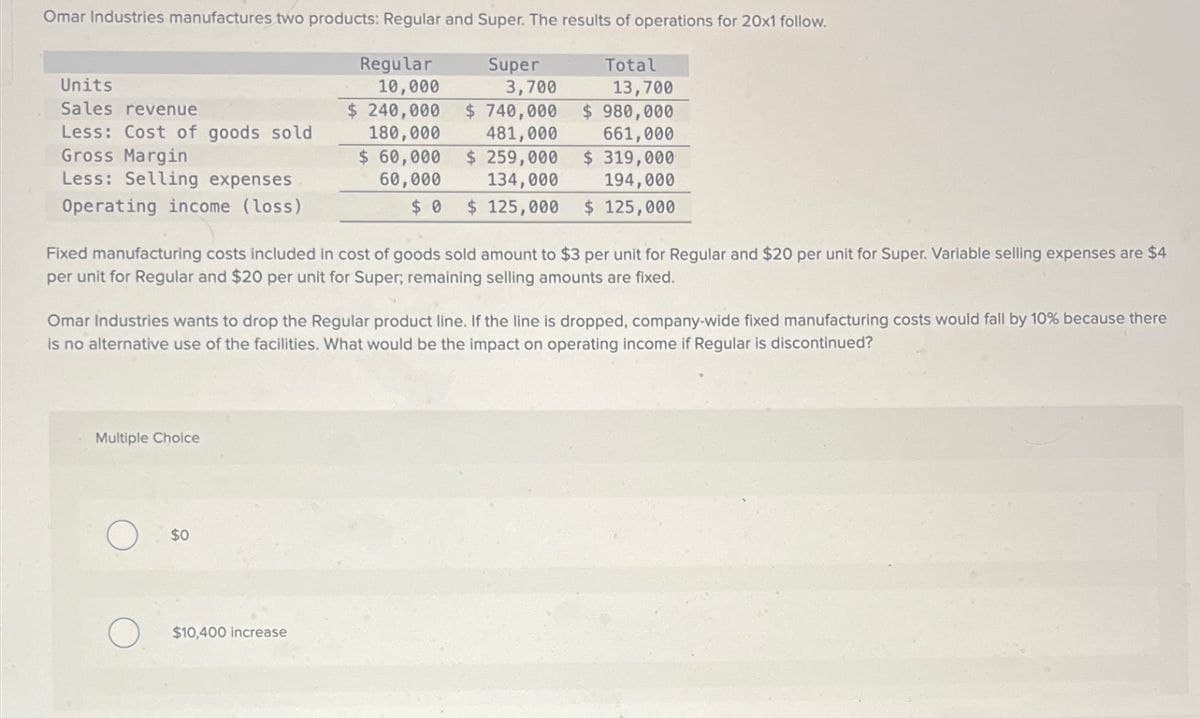

Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow. Units Regular 10,000 Sales revenue Less: Cost of goods sold $ 240,000 180,000 Gross Margin Less: Selling expenses Operating income (loss) $ 60,000 60,000 $ 0 Super 3,700 $740,000 481,000 $ 259,000 134,000 Total 13,700 $ 980,000 661,000 $ 319,000 194,000 $ 125,000 $ 125,000 Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed. Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued? Multiple Choice $10,400 increase

Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow. Units Regular 10,000 Sales revenue Less: Cost of goods sold $ 240,000 180,000 Gross Margin Less: Selling expenses Operating income (loss) $ 60,000 60,000 $ 0 Super 3,700 $740,000 481,000 $ 259,000 134,000 Total 13,700 $ 980,000 661,000 $ 319,000 194,000 $ 125,000 $ 125,000 Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed. Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued? Multiple Choice $10,400 increase

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Question

Transcribed Image Text:Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow.

Units

Regular

10,000

Sales revenue

Less: Cost of goods sold

$ 240,000

180,000

Gross Margin

Less: Selling expenses

Operating income (loss)

$ 60,000

60,000

$ 0

Super

3,700

$740,000

481,000

$ 259,000

134,000

Total

13,700

$ 980,000

661,000

$ 319,000

194,000

$ 125,000

$ 125,000

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4

per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there

is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

Multiple Choice

$10,400 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning