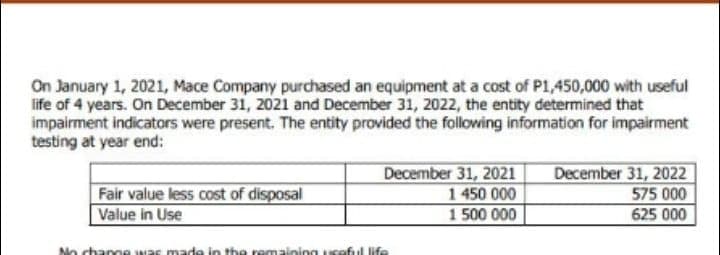

What is the impairment loss for 2021 and 2022? What is the depreciation for 2023?

Q: using hte information from the photos, can you please help me prepare the appropriate schedules to…

A: Depreciation The purpose of providing the depreciation cost to know the actual values which are…

Q: Enter the amount (if any) of each year's carryover utilized in 2020. Amount of Carryover Year…

A: (a) The table below shows the each year carryover utilized:

Q: nd the Other Nonoperating Loss or Gain 2019:

A: Non-operating Gain or loss: Nonoperating income or gain / Losses are non recuring in nature . It is…

Q: What amount should be recognized as pretax revaluation surplus on January 1, 2019?

A:

Q: depletion expense should be recognized for 2021? 550,000

A:

Q: The total amount of depletion that Valley should record for 2021 is?

A: The depletion expense is the reduction in value of mines with the tons removed during the period.

Q: Compute the annual depreciation to be charged, beginning with 2019. Annual depreciation…

A: Depreciation is recorded on the cost of fixed assets to record a reduction in value. It can be…

Q: 6. What is the depreciation expense for the year ended December 31, 2021?

A: Depreciation refers to the reduction in the value of asset due to its normal use and tear and wear.…

Q: depreciation for machinery and equipment (SYD method) on Dec. 31, 2020 and its carrying value at the…

A:

Q: What is the loss on repossession for the year ended December 31, 2022?

A: Loss on repossession is the loss on the sale of goods that are taken back because of non-payment of…

Q: How much is the consolidated asset for 2022?

A: In a consolidated financial statement, the unrealized gains on intra-group transactions should be…

Q: r 2020, these are sections Asset Type Date of purchase Cost Useful life from the date of…

A: Assets: When a company expects to derive the benefits in the form of a cash stream over a long…

Q: Calculate the depreciation expense by straight-line for 2020. (.

A: Straight-line Depreciation: Under the straight-line method of depreciation, the same amount of…

Q: How much is the total carrying amount of the property as of June 30, 2021? Show the solutions…

A: Depreciation Cost The purpose of using the depreciation method to know the actual cost of the assets…

Q: Property, Plant, and Equipment

A: (Note: Since you have posted a multi-part question, we will solve the first three parts for you. For…

Q: a. Prepare journal entry to record the revaluation on January 1, 2020. b. Prepare journal entry to…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: What is the fair value of the biological assets on December 31, 2021?

A: Biological assets refer to those assets of an organization which are living. It is generally the…

Q: Required: Capitalized cost of right-of-use asset on January 1, 2020.

A: A person or a firm who gives asset on lease to another person or a firm is known as lessor. Lessee…

Q: How much is the total assets for 2021?

A: Total Assets = Net Book value of Non current assets or Plant and equipments + Total current assets

Q: For the next 3 questions.. What amount should be reported as pretax revaluation surplus on…

A: solution : What amount should be reported as pretax revaluation surplus on December 31, 2019?…

Q: 1. What amount should be recognized as depletion for 2020? a. 6,900,000 b. 9,600,000 c. 8,100,000 d.…

A: Summary of the information provided in the question : Purchase Cost of the resource…

Q: Show Depreciation entry for 2018 year

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: What are the Asset Management Ratios for the periods 2019,2020 and 2021?

A: Asset management ratios 1. Average sales per/day = Net sales / 365 2. Inventory turnover ratio =…

Q: Q1. What will be the value of accumulated depreciation in the year of 2021?

A: Depreciation refers to the loss in the value of a tangible asset over a period of time. There are…

Q: What amount should be recognized as depletion for 2021? a. 1,344,000 b. 1,920,000 1,200,000 d.…

A: calculation of depletion expenses for 2021 are as follows:

Q: REQUIRED: Complete the tables for depreciation for the Units of Production and Double Declining…

A: The question is based on the concept of Depreciation Accounitng.

Q: The depreciation expense pertaining to the mining equipment in 2021 amounted to?

A: Depreciation Expense is the Wear Tear Expense for the Usage of the Assets During the Year Formula…

Q: What should be the amount of Goodwill on December 31, 2020?

A: Shadow company acquired net assets of Recruit company on July 1, 2019 and recorded the value of…

Q: nly asset she acquires in 2019. Determine anelle's cost recovery depreciation in 2020 nd 2021.

A: Step 1 Cost recovery refers to the depreciation of a part of the cost of an asset used in a company…

Q: Assuming cost model was used for the Real Property B, what is the carrying value of the property as…

A: Under cost model, an asset is valued and carried at cost less depreciation in the subsequent years.…

Q: Unearned rent income was not recognized in year 2021. What is its effect liability at December 31,…

A: The net income is calculated as difference between revenue and expenses of the current period.

Q: Compute the carrying amount of wasting asset on december 31,2022

A: A wasting asset refers to that asset which holds a limited life and whose value keeps on decreasing…

Q: What amount shall Tom Company recognize in profit or loss for the year 2020 if it designated the…

A: Fair value through profit and loss is the method through which a business records its investments…

Q: Using the double-declining-balance method, depreciation for 2022 would be:

A: This is a method of Depreciation where Depreciation expense decreases with age of Asset. Higher…

Q: Compute the annual depreciation to be charged, beginning with 2022. (Round answer to O decimal…

A: Cost of building = $2,160,000 Salvage value = $65,600 Useful life = 40 years Depreciation per…

Q: Calculate the depreciation expense by sum-of-the-years'-digits for 2021.

A: Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset due to its…

Q: Use Newell Brands, Inc.'s financial statements to answer to the following questions. According…

A: Since we answer up to 3 sub parts, we will answer the first 3. Please resubmit the question and…

Q: how much is the non-controlling interest in net assets as of December 31, 2022?

A: P Company is the holding company of S company. P company holds 80% shares in S company. The shares…

Q: REQUIRED: choose the letter What is the interest expense for 2020? a. 200,000 b. 115,200 c.…

A: As the lease was capitalized in the books, hence an interest expense and depreciation expense will…

Q: e depreciation of the building for 2005? What is the revaluation surplus on December 31, 2005?

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: how much is the depreciation expense for 2024 using SYD depreciation method?

A: Depreciation means allocation of cost of asset over the useful life of the asset.

Q: what is the carrying value of the property at December 31, 2020?

A: In fair value method of investment property, the investment property would be valued at its fair…

Q: Compute the depreciation for this asset for 2022 and 2023 using the double-declining-balance method.…

A:

Q: How much are the depreciation expenses for the year 2019

A: The depreciation expense is calculated on right to use of assets. The Right to use of assets…

Q: need help answering part D on total assets for 2022

A: Total assets is the total amount of asset side of the balance sheet. It includes both current assets…

Q: Compute the capital allowance, balancing charges and balancing allowance (if any) for each asset for…

A: Computation of balance of Lorry for each the relevant years of assessment up to the year of…

Q: 9. How much impairment loss is to be recorded by Frozen relating to the non-current assets held for…

A: As per our protocol we provide solution to the only one question kindly resubmit the remaining…

Q: What is the total contributed capital as of December 31, 2020?

A: Contributed capital is total amount received by company from investors for acquiring their rights in…

Q: Required: Complete the following schedules to calculate the following for 2020: ) Actual interest…

A: Interest Capitalization: Capitalized interest is the borrowing cost for acquiring the long-term…

Q: Find the Fixed Asset 2018:

A: The fixed assets refer to the long-term assets owned by the entity. long-term assets like land,…

What is the impairment loss for 2021 and 2022?

What is the

Step by step

Solved in 3 steps

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.

- During 2019, White Company determined that machinery previously depreciated over a 7-year life had a total estimated useful life of only 5 years. An accounting change was made in 2019 to reflect the change in estimate. If the change had been made in 2018, accumulated depreciation at December 31, 2018, would have been 1,600,000 instead of 1,200,000. As a result of this change, the 2019 depreciation expense was 100,000 greater than it would have been if no change were made. Ignoring income tax considerations, what is the proper amount of the adjustment to Whites January 1, 2019, balance of retained earnings? a. 0 b. 100,000 c. 280,000 d. 400,000Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.