Required a) Calculate the borrowing costs that can be capitalized for the piece of machinery. b) Compute the cost of the machinery that will be reported in the statement of financial position as at December, 2019

Required a) Calculate the borrowing costs that can be capitalized for the piece of machinery. b) Compute the cost of the machinery that will be reported in the statement of financial position as at December, 2019

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 18E

Related questions

Question

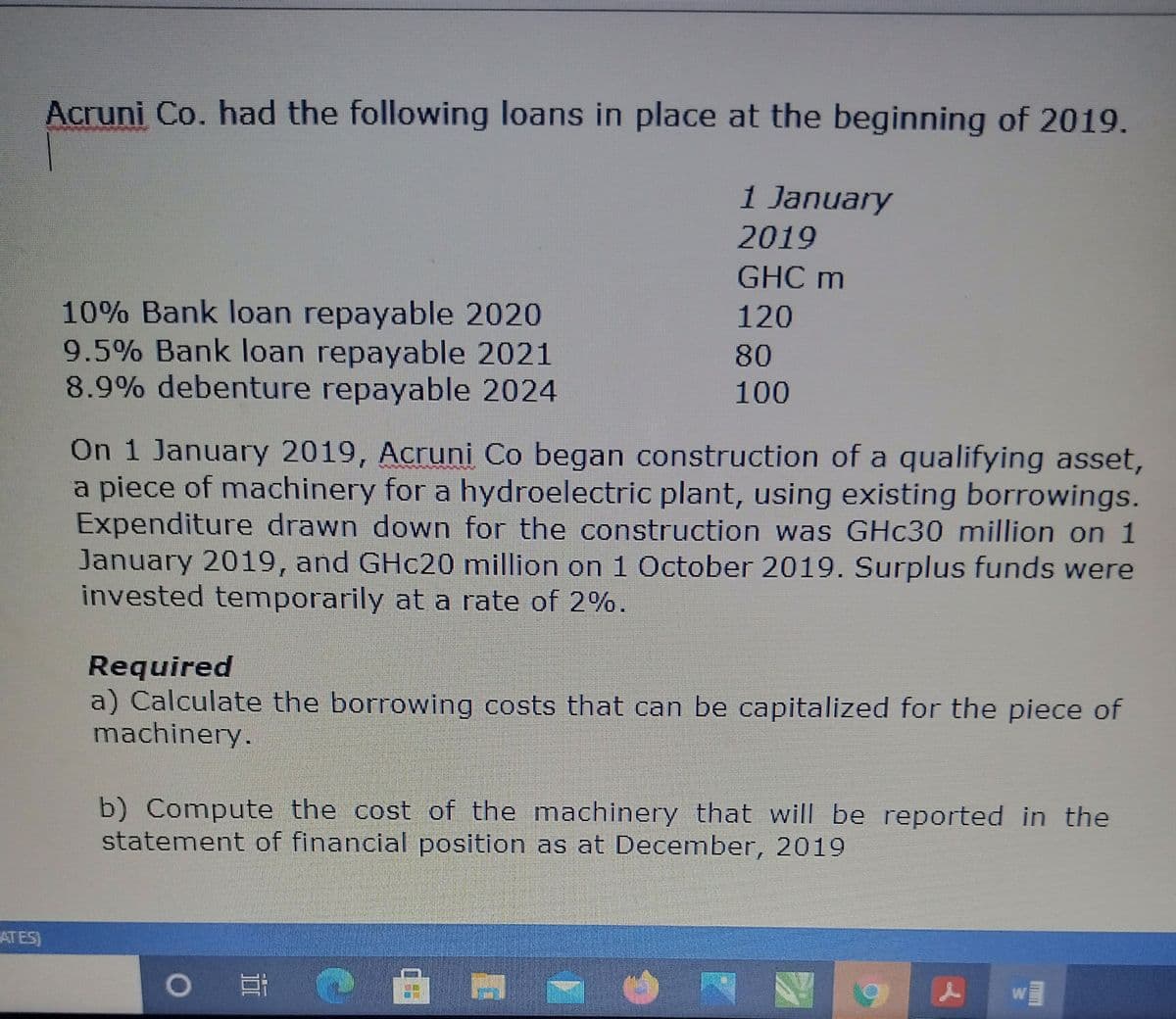

Transcribed Image Text:Acruni Co. had the following loans in place at the beginning of 2019.

1 January

2019

GHC m

10% Bank loan repayable 2020

9.5% Bank loan repayable 2021

8.9% debenture repayable 2024

120

80

100

On 1 January 2019, Acruni Co began construction of a qualifying asset,

a piece of machinery for a hydroelectric plant, using existing borrowings.

Expenditure drawn down for the construction was GHC30 million on 1

January 2019, and GHC20 million on 1 October 2019. Surplus funds were

invested temporarily at a rate of 2%.

Required

a) Calculate the borrowing costs that can be capitalized for the piece of

machinery.

b) Compute the cost of the machinery that will be reported in the

statement of financial position as at December, 2019

ATES)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College