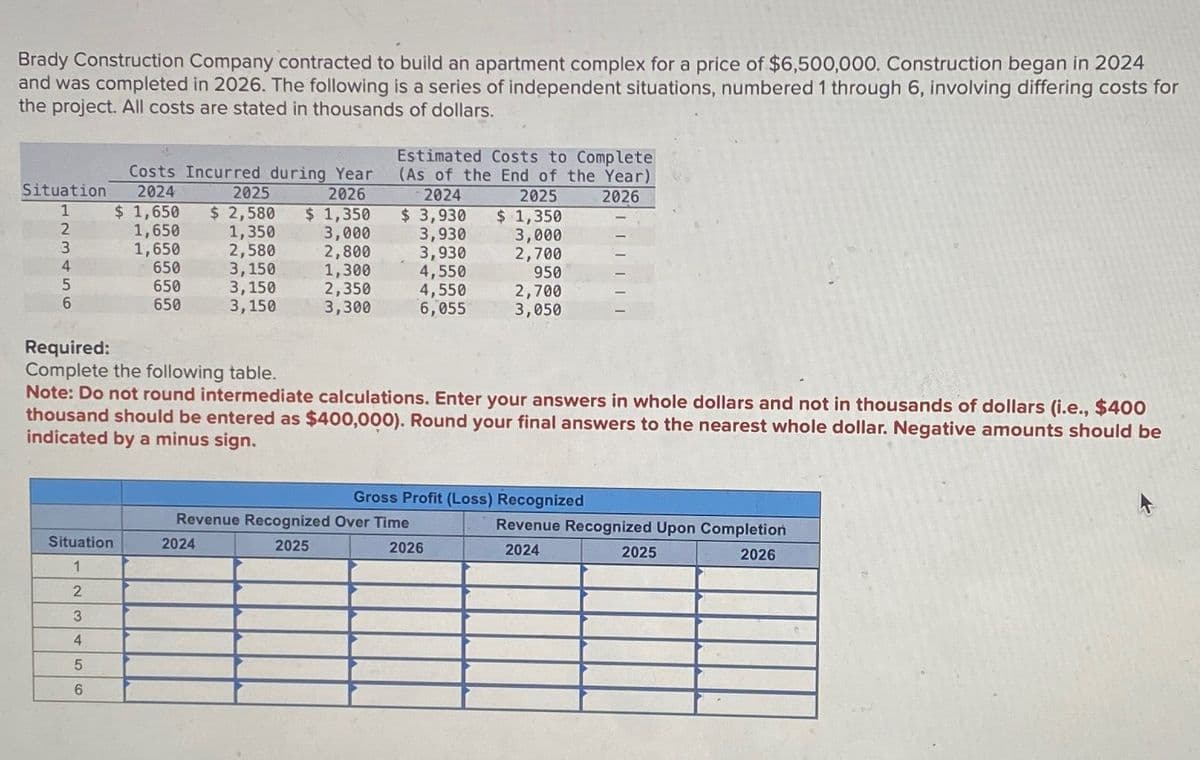

Required: Complete the following table. Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars (i.e., $400 thousand should be entered as $400,000). Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign. Gross Profit (Loss) Recognized Revenue Recognized Over Time Revenue Recognized Upon Completion Situation 2024 2025 2026 2024 2025 2026 1 2 3 4 5 6

Required: Complete the following table. Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars (i.e., $400 thousand should be entered as $400,000). Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign. Gross Profit (Loss) Recognized Revenue Recognized Over Time Revenue Recognized Upon Completion Situation 2024 2025 2026 2024 2025 2026 1 2 3 4 5 6

Chapter3: Income Sources

Section: Chapter Questions

Problem 88P

Related questions

Question

Sodlno

Transcribed Image Text:Brady Construction Company contracted to build an apartment complex for a price of $6,500,000. Construction began in 2024

and was completed in 2026. The following is a series of independent situations, numbered 1 through 6, involving differing costs for

the project. All costs are stated in thousands of dollars.

Costs Incurred during Year

Situation

1

2024

$ 1,650

2025

$ 2,580

2026

$ 1,350

2024

$ 3,930

Estimated Costs to Complete

(As of the End of the Year)

2026

2025

$ 1,350

123455

1,650

1,350

3,000

3,930

3,000

1,650

2,580

2,800

3,930

2,700

650

3,150

1,300

4,550

950

650

3,150

2,350

4,550

2,700

6

650

3,150

3,300

6,055

3,050

Required:

Complete the following table.

Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars (i.e., $400

thousand should be entered as $400,000). Round your final answers to the nearest whole dollar. Negative amounts should be

indicated by a minus sign.

Gross Profit (Loss) Recognized

Situation

1

2024

Revenue Recognized Over Time

2025

2026

2024

Revenue Recognized Upon Completion

2026

2025

2

3

4

5

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College