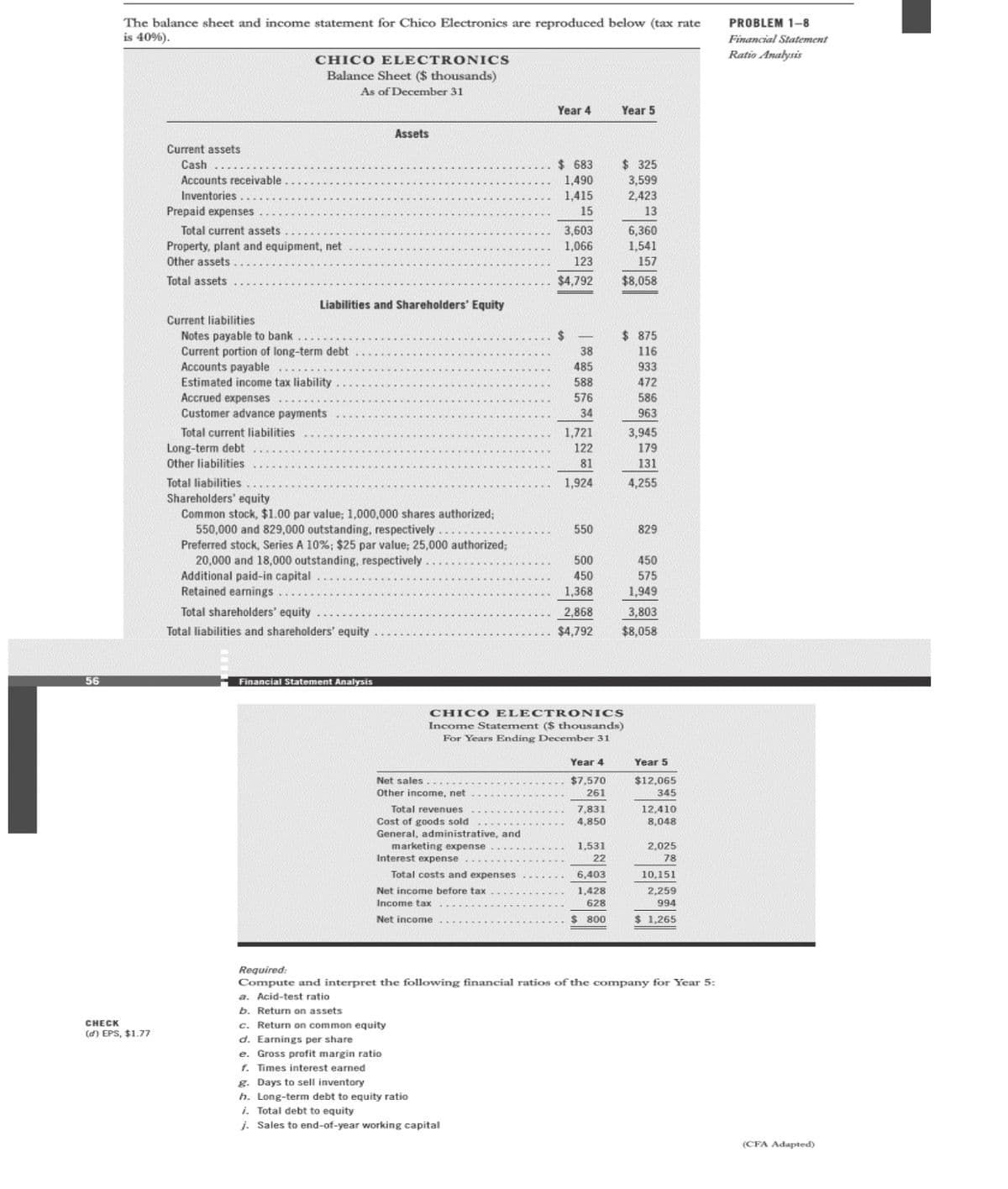

Required: Compute and interpret the following financial ratios of the company for Year 5: a. Acid-test ratio b. Return on assets c. Return on common equity d. Earnings per share e. Gross profit margin ratio f. Times interest earned g. Days to sell inventory h. Long-term debt to equity ratio i. Total debt to equity j. Sales to end-of-year working capital

Required: Compute and interpret the following financial ratios of the company for Year 5: a. Acid-test ratio b. Return on assets c. Return on common equity d. Earnings per share e. Gross profit margin ratio f. Times interest earned g. Days to sell inventory h. Long-term debt to equity ratio i. Total debt to equity j. Sales to end-of-year working capital

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

Transcribed Image Text:The balance sheet and income statement for Chico Electronics are reproduced below (tax rate

is 40%).

PROBLEM 1-8

Financial Statement

Ratio Analysis

CHICO ELECTRONICS

Balance Sheet ($ thousands)

As of December 31

Year 4

Year 5

Assets

Current assets

$ 683

$ 325

3,599

2,423

Cash

1,490

1,415

Accounts receivable

Inventories

Prepaid expenses

15

13

3,603

1,066

6,360

1,541

157

Total current assets

Property, plant and equipment, net

Other assets

123

Total assets

$4,792

$8,058

Liabilities and Shareholders' Equity

Current liabilities

2$

$ 875

Notes payable to bank

Current portion of long-term debt

Accounts payable

Estimated income tax liability

Accrued expenses ..

Customer advance payments

38

116

485

933

588

472

576

586

34

963

Total current liabilities

1,721

3,945

Long-term debt

Other liabilities

122

179

81

131

Total liabilities

1,924

4,255

Shareholders' equity

Common stock, $1.00 par value; 1,000,000 shares authorized;

550,000 and 829,000 outstanding, respectively

Preferred stock, Series A 10%; $25 par value; 25,000 authorized;

20,000 and 18,000 outstanding, respectively

Additional paid-in capital

Retained earnings

550

829

500

450

450

575

1,368

1,949

Total shareholders' equity

2,868

3,803

Total liabilities and shareholders' equity

$4,792

$8,058

56

Financial Statement Analysis

CHICO ELECTR ONICS

Income Statement ($ thousands)

For Years Ending December 31

Year 4

Year 5

Net sales

$7,570

$12,065

Other income, net

261

345

7,831

12,410

8,048

Total revenues

Cost of goods sold

4,850

General, administrative, and

marketing expense

Interest expense

1,531

2,025

22

78

Total costs and expenses

6,403

10,151

Net income before tax

1,428

2.259

Income tax

628

994

Net income

800

$ 1.265

Required:

Compute and interpret the following financial ratios of the company for Year 5:

a. Acid-test ratio

b. Return on assets

c. Return on common equity

d. Earnings per share

e. Gross profit margin ratio

f. Times interest earned

g. Days to sell inventory

h. Long-term debt to equity ratio

i. Total debt to equity

j. Sales to end-of-year working capital

CHECK

(d) EPS, $1.77

(CFA Adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning