Required: Compute the following for Year 2: Earnings per share of common stock Price-earnings ratio Dividend payout ratio Dividend yield ratio Return on total assets Return on common stockholders' equity Book value per share Working capital Current ratio Acid-test (quick) ratio Accounts receivable turnover Average collection period (age of receivables) Inventory turnover Average sale period (turnover in days) Times interest earned Debt-to-equity ratio

Required: Compute the following for Year 2: Earnings per share of common stock Price-earnings ratio Dividend payout ratio Dividend yield ratio Return on total assets Return on common stockholders' equity Book value per share Working capital Current ratio Acid-test (quick) ratio Accounts receivable turnover Average collection period (age of receivables) Inventory turnover Average sale period (turnover in days) Times interest earned Debt-to-equity ratio

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 53CE: Profitability Ratios The following data came from the financial statements of Israel Company:...

Related questions

Question

Required: Compute the following for Year 2:

- Earnings per share of common stock

- Price-earnings ratio

- Dividend payout ratio

- Dividend yield ratio

- Return on total assets

- Return on common

stockholders' equity - Book value per share

Working capital Current ratio - Acid-test (quick) ratio

Accounts receivable turnover- Average collection period (age of receivables)

- Inventory turnover

- Average sale period (turnover in days)

- Times interest earned

- Debt-to-equity ratio

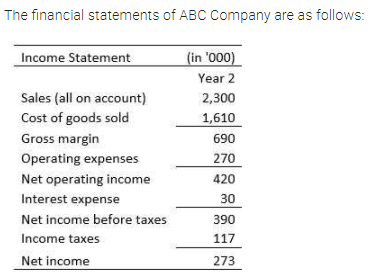

Transcribed Image Text:The financial statements of ABC Company are as follows:

Income Statement

(in '000)

Year 2

Sales (all on account)

2,300

Cost of goods sold

1,610

Gross margin

690

Operating expenses

270

Net operating income

420

Interest expense

30

Net income before taxes

390

Income taxes

117

Net income

273

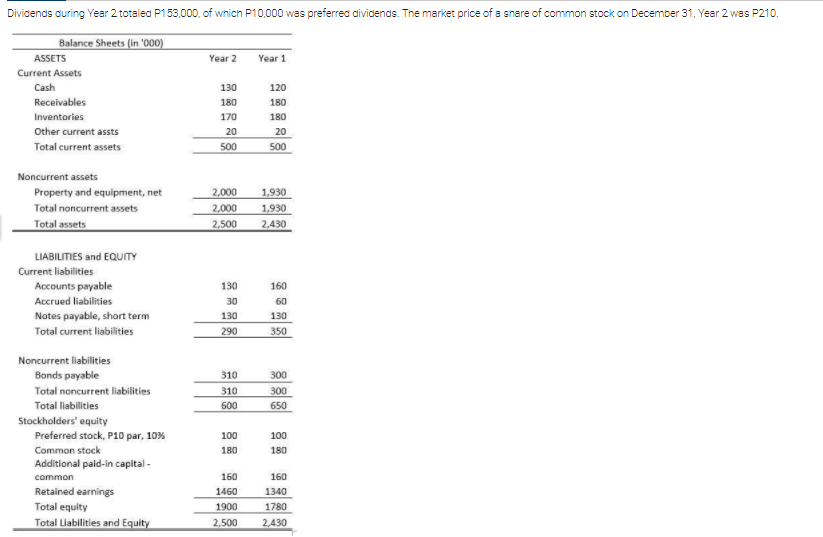

Transcribed Image Text:Dividends during Year 2 totaled P153,000, of wnich P10,000 was preferred dividends. The market price of a snare of common stock on December 31, Year 2 was P210.

Balance Sheets (in '000)

ASSETS

Year 2

Year 1

Current Assets

Cash

130

120

Receivables

180

180

Inventories

170

180

Other current assts

20

500

20

Total current assets

500

Noncurrent assets

Property and equipment, net

2,000

1,930

Total noncurrent assets

2,000

1,930

Total assets

2,500

2,430

LIABILITIES and EQUITY

Current liabilities

Accounts payable

130

160

Accrued liabilities

30

60

Notes payable, short term

130

130

Total current liabilities

290

350

Noncurrent liabilities

Bonds payable

Total noncurrent liabilities

310

300

310

300

Total liabilities

600

650

Stockholders' equity

Preferred stock, P10 par, 10%

100

100

Common stock

180

180

Additional paid-in capital -

common

160

160

Retained earnings

1460

1340

Total equity

1900

1780

Total Liabilities and Equity

2,500

2,430

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning