Required: Compute Apex Company's free cash flow for the current year. (Negative amount should be indicated by a minus sign.) Free Cash Flow = ?

Required: Compute Apex Company's free cash flow for the current year. (Negative amount should be indicated by a minus sign.) Free Cash Flow = ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Statement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income,...

Related questions

Question

What is the

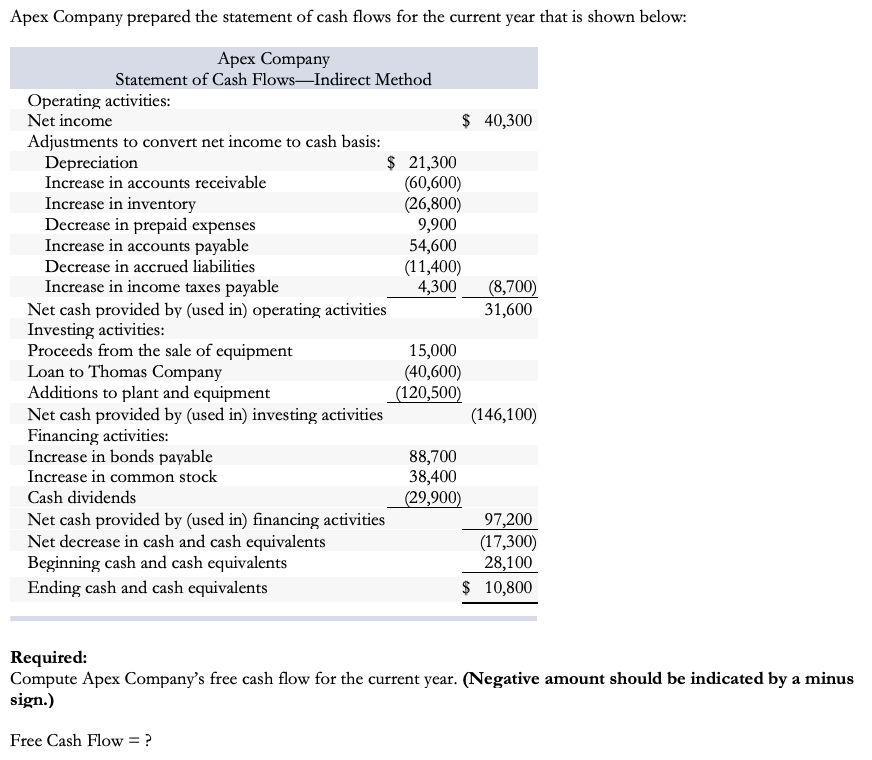

Transcribed Image Text:Apex Company prepared the statement of cash flows for the current year that is shown below:

Apex Company

Statement of Cash Flows–Indirect Method

Operating activities:

Net income

$ 40,300

Adjustments to convert net income to cash basis:

Depreciation

$ 21,300

(60,600)

(26,800)

9,900

54,600

(11,400)

4,300

Increase in accounts receivable

Increase in inventory

Decrease in prepaid expenses

Increase in accounts payable

Decrease in accrued liabilities

Increase in income taxes payable

(8,700)

31,600

Net cash provided by (used in) operating activities

Investing activities:

Proceeds from the sale of equipment

Loan to Thomas Company

Additions to plant and equipment

Net cash provided by (used in) investing activities

Financing activities:

Increase in bonds payable

15,000

(40,600)

(120,500)

(146,100)

88,700

38,400

(29,900)

Increase in common stock

Cash dividends

Net cash provided by (used in) financing activities

Net decrease in cash and cash equivalents

Beginning cash and cash equivalents

97,200

(17,300)

28,100

Ending cash and cash equivalents

$ 10,800

Required:

Compute Apex Company's free cash flow for the current year. (Negative amount should be indicated by a minus

sign.)

Free Cash Flow = ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning