→ required: Fill in the following two tables: Percent of completion Year 2022 2023 2024 Total revenues Total cost Gross profit Account receivable balance Zero profit method Year 2022 2023 2024 Total revenues Total cost

→ required: Fill in the following two tables: Percent of completion Year 2022 2023 2024 Total revenues Total cost Gross profit Account receivable balance Zero profit method Year 2022 2023 2024 Total revenues Total cost

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 61P

Related questions

Question

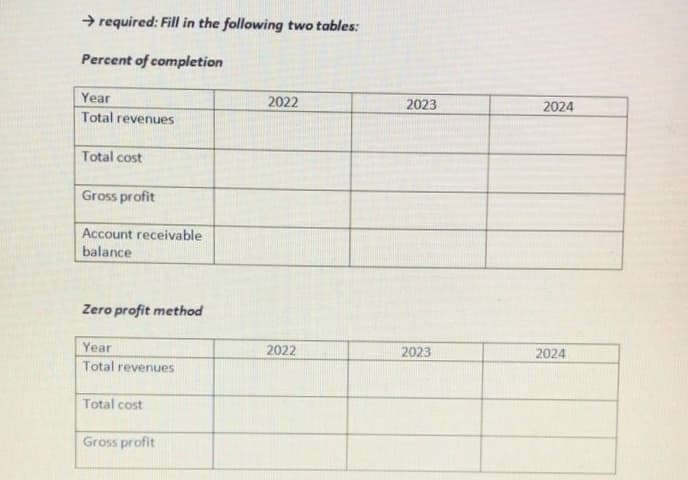

Transcribed Image Text:→ required: Fill in the following two tables:

Percent of completion

Year

2022

2023

2024

Total revenues

Total cost

Gross profit

Account receivable

balance

Zero profit method

Year

2022

2023

2024

Total revenues

Total cost

Gross profit

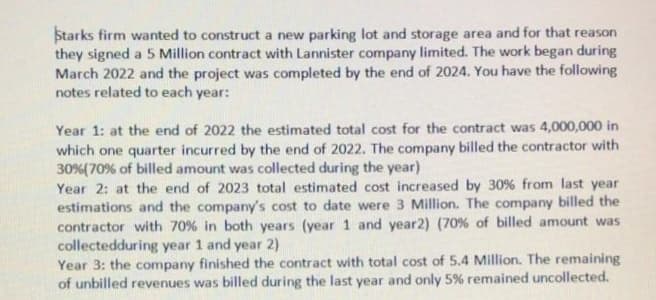

Transcribed Image Text:Starks firm wanted to construct a new parking lot and storage area and for that reason

they signed a 5 Million contract with Lannister company limited. The work began during

March 2022 and the project was completed by the end of 2024. You have the following

notes related to each year:

Year 1: at the end of 2022 the estimated total cost for the contract was 4,000,000 in

which one quarter incurred by the end of 2022. The company billed the contractor with

30%(70% of billed amount was collected during the year)

Year 2: at the end of 2023 total estimated cost increased by 30 % from last year

estimations and the company's cost to date were 3 Million. The company billed the

contractor with 70% in both years (year 1 and year2) (70% of billed amount was

collectedduring year 1 and year 2)

Year 3: the company finished the contract with total cost of 5.4 Million. The remaining

of unbilled revenues was billed during the last year and only 5% remained uncollected.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT