Required: For each of the above independent and unrelated errors, determ the effect on the 2020 accounts. Prepare the journal entries ea company should record in 2021 to correct the errors. Assets Liabilities R/E Revenue Expense NI Error 1 Error 2 Error 3 Error #1 Correcting Entry: Error #2 Correcting Entry: Error #3 Correcting Entry:

Required: For each of the above independent and unrelated errors, determ the effect on the 2020 accounts. Prepare the journal entries ea company should record in 2021 to correct the errors. Assets Liabilities R/E Revenue Expense NI Error 1 Error 2 Error 3 Error #1 Correcting Entry: Error #2 Correcting Entry: Error #3 Correcting Entry:

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.4E: Accruals and Deferrals For the following situations, indicate whether each involves a deferred...

Related questions

Question

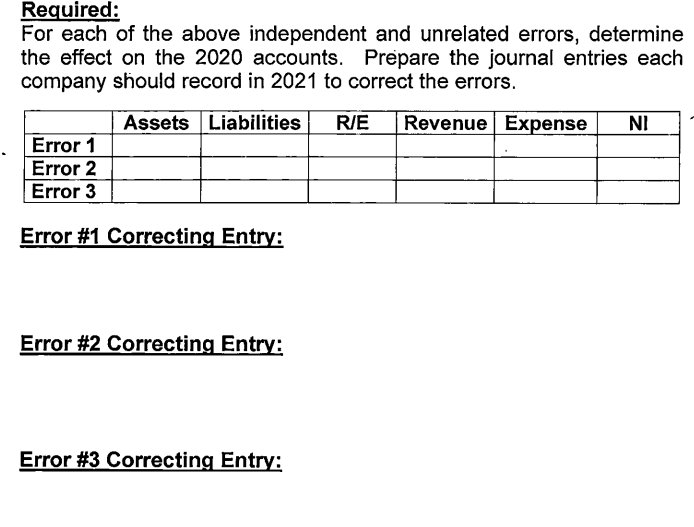

Transcribed Image Text:Required:

For each of the above independent and unrelated errors, determine

the effect on the 2020 accounts. Prepare the journal entries each

company should record in 2021 to correct the errors.

Assets Liabilities

R/E

Revenue Expense

NI

Error 1

Error 2

Error 3

Error #1 Correcting Entry:

Error #2 Correcting Entry:

Error #3 Correcting Entry:

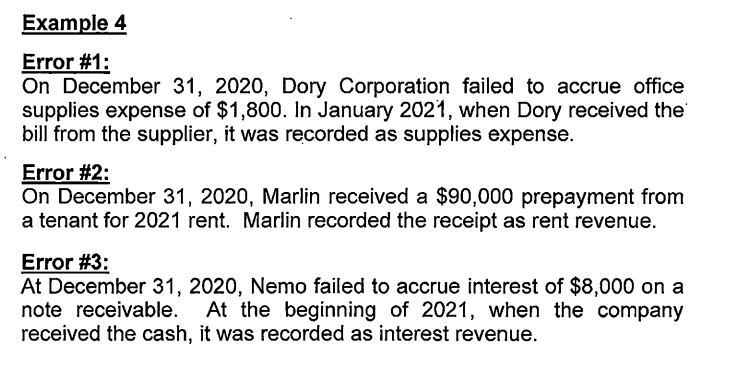

Transcribed Image Text:Example 4

Error #1:

On December 31, 2020, Dory Corporation failed to accrue office

supplies expense of $1,800. In January 2021, when Dory received the

bill from the supplier, it was recorded as supplies expense.

Error #2:

On December 31, 2020, Marlin received a $90,000 prepayment from

a tenant for 2021 rent. Marlin recorded the receipt as rent revenue.

Error #3:

At December 31, 2020, Nemo failed to accrue interest of $8,000 on a

note receivable. At the beginning of 2021, when the company

received the cash, it was recorded as interest revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage