Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows (direct method). (Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities: Cash received from customers 2$ 155.30 Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income taxes Net cash flows from operating activities 2$ 155.30 < Required 1 Required 2 >

Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows (direct method). (Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities: Cash received from customers 2$ 155.30 Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income taxes Net cash flows from operating activities 2$ 155.30 < Required 1 Required 2 >

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 15E

Related questions

Question

100%

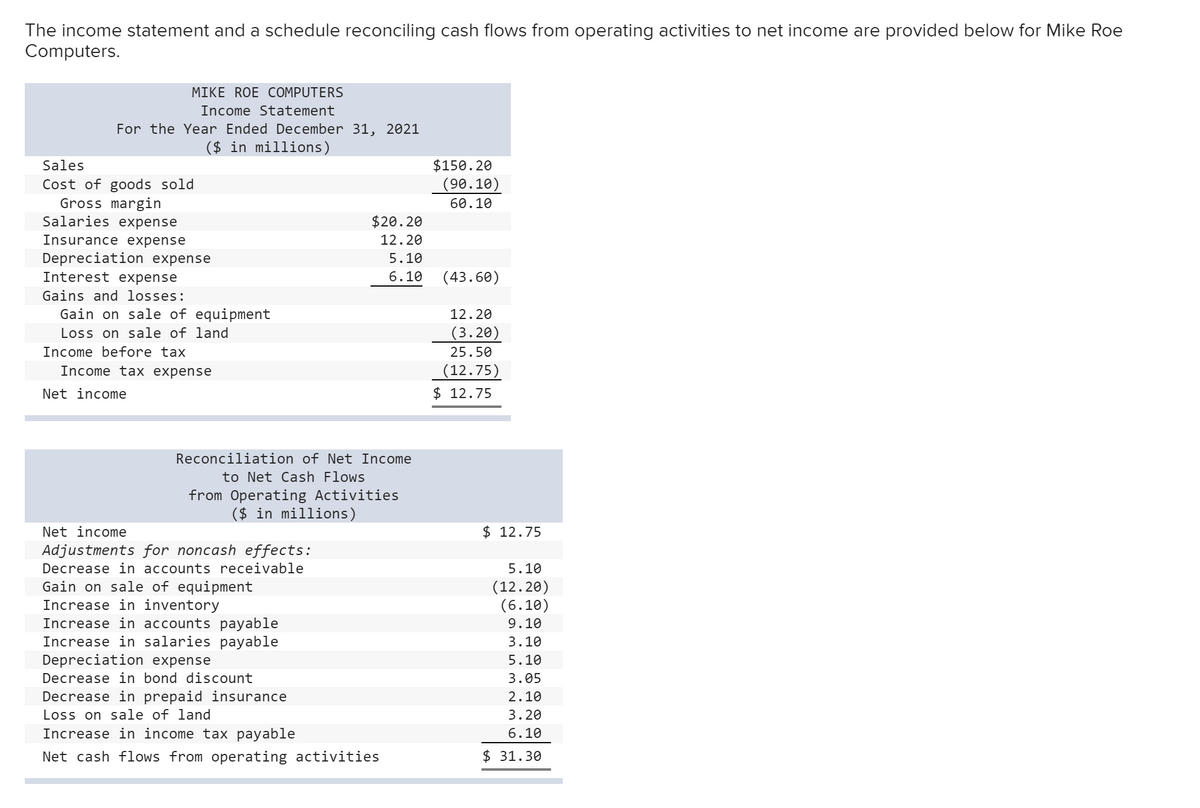

Transcribed Image Text:The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Mike Roe

Computers.

MIKE ROE COMPUTERS

Income Statement

For the Year Ended December 31, 2021

($ in millions)

Sales

$150.20

(90.10)

Cost of goods sold

Gross margin

Salaries expense

60.10

$20.20

Insurance expense

12.20

Depreciation expense

Interest expense

5.10

6.10

(43.60)

Gains and losses:

Gain on sale of equipment

12.20

Loss on sale of land

(3.20)

Income before tax

25.50

Income tax expense

(12.75)

Net income

$ 12.75

Reconciliation of Net Income

to Net Cash Flows

from Operating Activities

($ in millions)

Net income

$ 12.75

Adjustments for noncash effects:

Decrease in accounts receivable

5.10

Gain on sale of equipment

Increase in inventory

Increase in accounts payable

Increase in salaries payable

Depreciation expense

(12.20)

(6.10)

9.10

3.10

5.10

Decrease in bond discount

3.05

Decrease in prepaid insurance

2.10

Loss on sale of land

3.20

Increase in income tax payable

6.10

Net cash flows from operating activities

$ 31.30

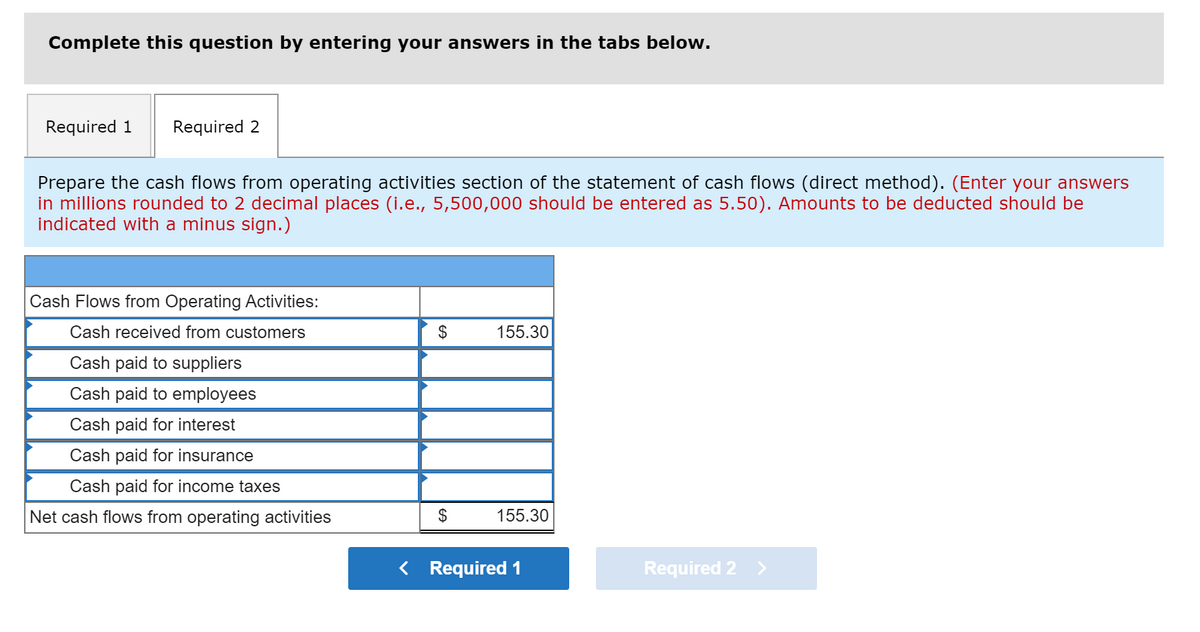

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare the cash flows from operating activities section of the statement of cash flows (direct method). (Enter your answers

in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). Amounts to be deducted should be

indicated with a minus sign.)

Cash Flows from Operating Activities:

Cash received from customers

$

155.30

Cash paid to suppliers

Cash paid to employees

Cash paid for interest

Cash paid for insurance

Cash paid for income taxes

Net cash flows from operating activities

$

155.30

< Required 1

Required 2 >

|%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning