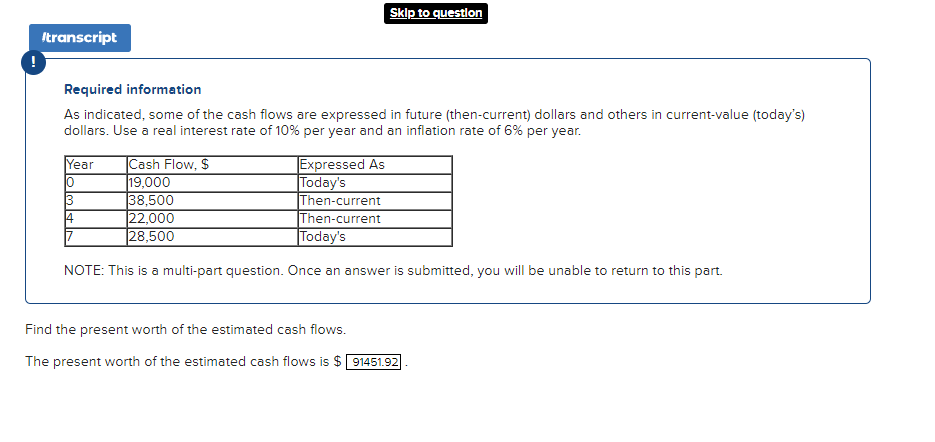

Required information As indicated, some of the cash flows are expressed in future (then-current) dollars and others in current-value (today's) dollars. Use a real interest rate of 10% per year and an inflation rate of 6% per year. Year 0 3 Cash Flow, $ 19,000 38,500 14 Then-current 22,000 Then-current Today's 28,500 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Expressed As Today's the present worth of the estimated cash flows.

Required information As indicated, some of the cash flows are expressed in future (then-current) dollars and others in current-value (today's) dollars. Use a real interest rate of 10% per year and an inflation rate of 6% per year. Year 0 3 Cash Flow, $ 19,000 38,500 14 Then-current 22,000 Then-current Today's 28,500 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Expressed As Today's the present worth of the estimated cash flows.

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

Transcribed Image Text:/transcript

Required information

As indicated, some of the cash flows are expressed in future (then-current) dollars and others in current-value (today's)

dollars. Use a real interest rate of 10% per year and an inflation rate of 6% per year.

Year

10

3

14

Cash Flow, $

19,000

38,500

22,000

28,500

7

Skip to question

Expressed As

Today's

Then-current

Then-current

Today's

NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part.

Find the present worth of the estimated cash flows.

The present worth of the estimated cash flows is $91451.92

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub