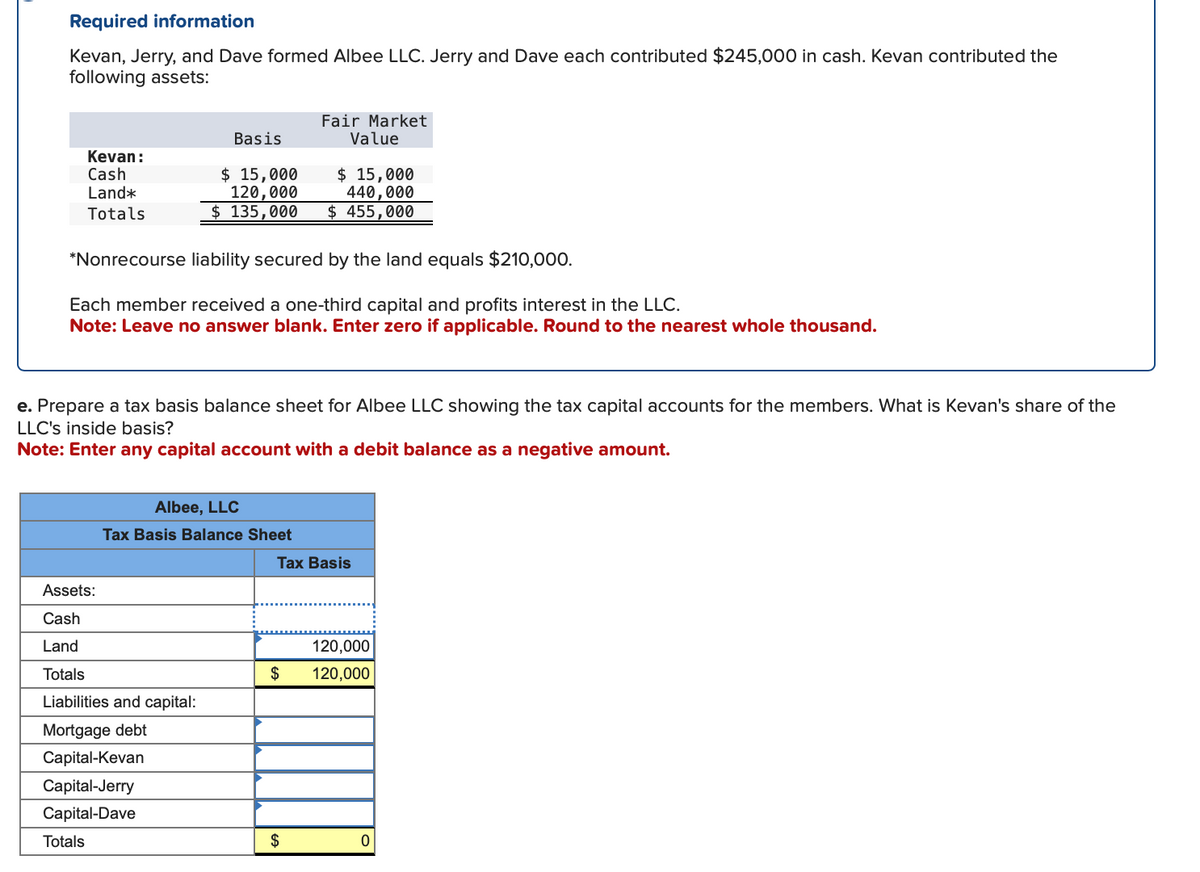

Required information Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan contributed the following assets: Kevan: Cash Land* Totals Basis Fair Market Value $ 15,000 120,000 $ 15,000 440,000 135,000 $ 455,000 *Nonrecourse liability secured by the land equals $210,000. Each member received a one-third capital and profits interest in the LLC. Note: Leave no answer blank. Enter zero if applicable. Round to the nearest whole thousand. e. Prepare a tax basis balance sheet for Albee LLC showing the tax capital accounts for the members. What is Kevan's share of the LLC's inside basis? Note: Enter any capital account with a debit balance as a negative amount.

Required information Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan contributed the following assets: Kevan: Cash Land* Totals Basis Fair Market Value $ 15,000 120,000 $ 15,000 440,000 135,000 $ 455,000 *Nonrecourse liability secured by the land equals $210,000. Each member received a one-third capital and profits interest in the LLC. Note: Leave no answer blank. Enter zero if applicable. Round to the nearest whole thousand. e. Prepare a tax basis balance sheet for Albee LLC showing the tax capital accounts for the members. What is Kevan's share of the LLC's inside basis? Note: Enter any capital account with a debit balance as a negative amount.

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 21CE

Related questions

Question

Transcribed Image Text:Required information

Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan contributed the

following assets:

Kevan:

Cash

Land*

Totals

Basis

$ 15,000

120,000

Assets:

Cash

Land

Totals

Liabilities and capital:

Mortgage debt

$ 15,000

440,000

$ 135,000 $ 455,000

*Nonrecourse liability secured by the land equals $210,000.

Each member received a one-third capital and profits interest in the LLC.

Note: Leave no answer blank. Enter zero if applicable. Round to the nearest whole thousand.

Capital-Kevan

Capital-Jerry

Capital-Dave

Totals

e. Prepare a tax basis balance sheet for Albee LLC showing the tax capital accounts for the members. What is Kevan's share of the

LLC's inside basis?

Note: Enter any capital account with a debit balance as a negative amount.

Albee, LLC

Tax Basis Balance Sheet

Fair Market

Value

Tax Basis

$

$

120,000

120,000

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub