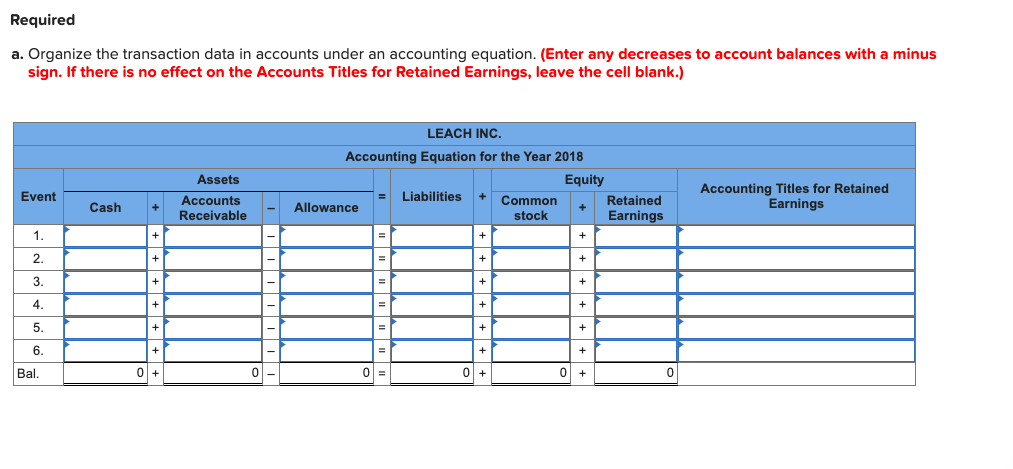

Required information [The following information applies to the questions displayed below.] Leach Inc. experienced the following events for the first two years of its operations: 2018: 1. Issued $10,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Provided $35,000 of services and received cash. 4. Collected $65,000 cash from accounts receivable. 5. Paid $14,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. 2019: 1. Wrote off an uncollectible account for $750. 2. Provided $120,000 of services on account. 3. Provided $30,000 of services and collected cash. 4. Collected $102,000 cash from accounts receivable. 5. Paid $20,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. Required a. Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank.) LEACH INC. Accounting Equation for the Year 2018 Assets Equity Accounting Titles for Retained Earnings Event Liabilities Accounts Receivable Common stock Retained Cash Allowance Earnings 1. 2. 3. 4. 5. 6. Bal.

Required information [The following information applies to the questions displayed below.] Leach Inc. experienced the following events for the first two years of its operations: 2018: 1. Issued $10,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Provided $35,000 of services and received cash. 4. Collected $65,000 cash from accounts receivable. 5. Paid $14,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. 2019: 1. Wrote off an uncollectible account for $750. 2. Provided $120,000 of services on account. 3. Provided $30,000 of services and collected cash. 4. Collected $102,000 cash from accounts receivable. 5. Paid $20,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. Required a. Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank.) LEACH INC. Accounting Equation for the Year 2018 Assets Equity Accounting Titles for Retained Earnings Event Liabilities Accounts Receivable Common stock Retained Cash Allowance Earnings 1. 2. 3. 4. 5. 6. Bal.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 20PC: Analyzing Transactions. Using the analytical framework, indicate the effect of the following related...

Related questions

Question

![Required information

[The following information applies to the questions displayed below.]

Leach Inc. experienced the following events for the first two years of its operations:

2018:

1. Issued $10,000 of common stock for cash.

2. Provided $100,000 of services on account.

3. Provided $35,000 of services and received cash.

4. Collected $65,000 cash from accounts receivable.

5. Paid $14,000 of salaries expense for the year.

6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent

of the ending accounts receivable balance will be uncollectible.

2019:

1. Wrote off an uncollectible account for $750.

2. Provided $120,000 of services on account.

3. Provided $30,000 of services and collected cash.

4. Collected $102,000 cash from accounts receivable.

5. Paid $20,000 of salaries expense for the year.

6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the

ending accounts receivable balance will be uncollectible.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd10f884b-6753-44fe-997f-af50a8e0d0d1%2F290da6a2-dcb6-474f-a80c-5200cbcc90c0%2Fl57eu0o.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Leach Inc. experienced the following events for the first two years of its operations:

2018:

1. Issued $10,000 of common stock for cash.

2. Provided $100,000 of services on account.

3. Provided $35,000 of services and received cash.

4. Collected $65,000 cash from accounts receivable.

5. Paid $14,000 of salaries expense for the year.

6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent

of the ending accounts receivable balance will be uncollectible.

2019:

1. Wrote off an uncollectible account for $750.

2. Provided $120,000 of services on account.

3. Provided $30,000 of services and collected cash.

4. Collected $102,000 cash from accounts receivable.

5. Paid $20,000 of salaries expense for the year.

6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the

ending accounts receivable balance will be uncollectible.

Transcribed Image Text:Required

a. Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus

sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank.)

LEACH INC.

Accounting Equation for the Year 2018

Assets

Equity

Accounting Titles for Retained

Earnings

Event

Liabilities

Accounts

Receivable

Common

stock

Retained

Cash

Allowance

Earnings

1.

2.

3.

4.

5.

6.

Bal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning