a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown her Use a + to indicate increase, - for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column, Indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). b. What is the total amount of interest expense paid for the year? Complete this question by entering your answers in the tabs below. Required A Required B Required A Required B

a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown her Use a + to indicate increase, - for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column, Indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). b. What is the total amount of interest expense paid for the year? Complete this question by entering your answers in the tabs below. Required A Required B Required A Required B

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 9PB: Pickles R Us is a pickle farm located in the Northeast. The following transactions take place: A. On...

Related questions

Question

please answer all the parts of the question within 30 minutes. make sure all the parts of the question are answered else i will give negative ratings.

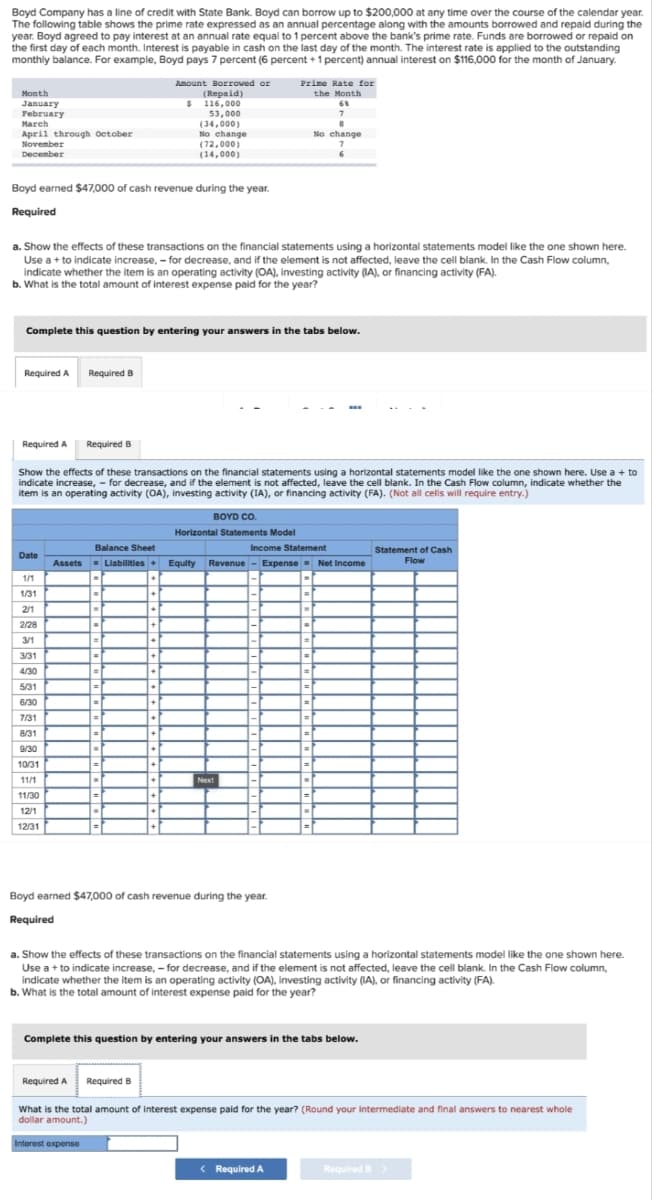

Transcribed Image Text:Boyd Company has a line of credit with State Bank. Boyd can borrow up to $200,000 at any time over the course of the calendar year.

The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the

year. Boyd agreed to pay interest at an annual rate equal to 1 percent above the bank's prime rate. Funds are borrowed or repaid on

the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding

monthly balance. For example, Boyd pays 7 percent (6 percent + 1 percent) annual interest on $116,000 for the month of January.

Amount Borrowed or

Prime Rate for

(Repaid)

$ 116,000

53,000

(34,000)

No change

(72,000)

(14,000)

Month

the Month

January

February

March

April through October

November

No change

December

Boyd earned $47,000 of cash revenue during the year.

Required

a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown here.

Use a+ to indicate increase, - for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column,

indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA).

b. What is the total amount of interest expense paid for the year?

Complete this question by entering your answers in the tabs below.

Required A Required B

Required A

Required B

Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown here. Use a + to

indicate increase, - for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column, indicate whether the

item is an operating activity (OA), investing activity (IA), or financing activity (FA). (Not all cells will require entry.)

BOYD CO.

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of Cash

Date

- Liabilities+

Equity Revenue - Expense- Net Income

Flow

Assets

1/1

1/31

2/1

%3D

2/28

3/1

3/31

|-r

4/30

5/31

6/30

1.

1.

1.

7/31

8/31

9/30

10/31

Next

11/1

11/30

12/1

12/31

Boyd earned $47,000 of cash revenue during the year.

Required

a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown here.

Use a + to indicate increase, - for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column,

indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA).

b. What is the total amount of interest expense paid for the year?

Complete this question by entering your answers in the tabs below.

Required A

Required B

What is the total amount of interest expense paid for the year? (Round your intermediate and final answers to nearest whole

dollar amount.)

Interest expense

< Required A

Required B>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning