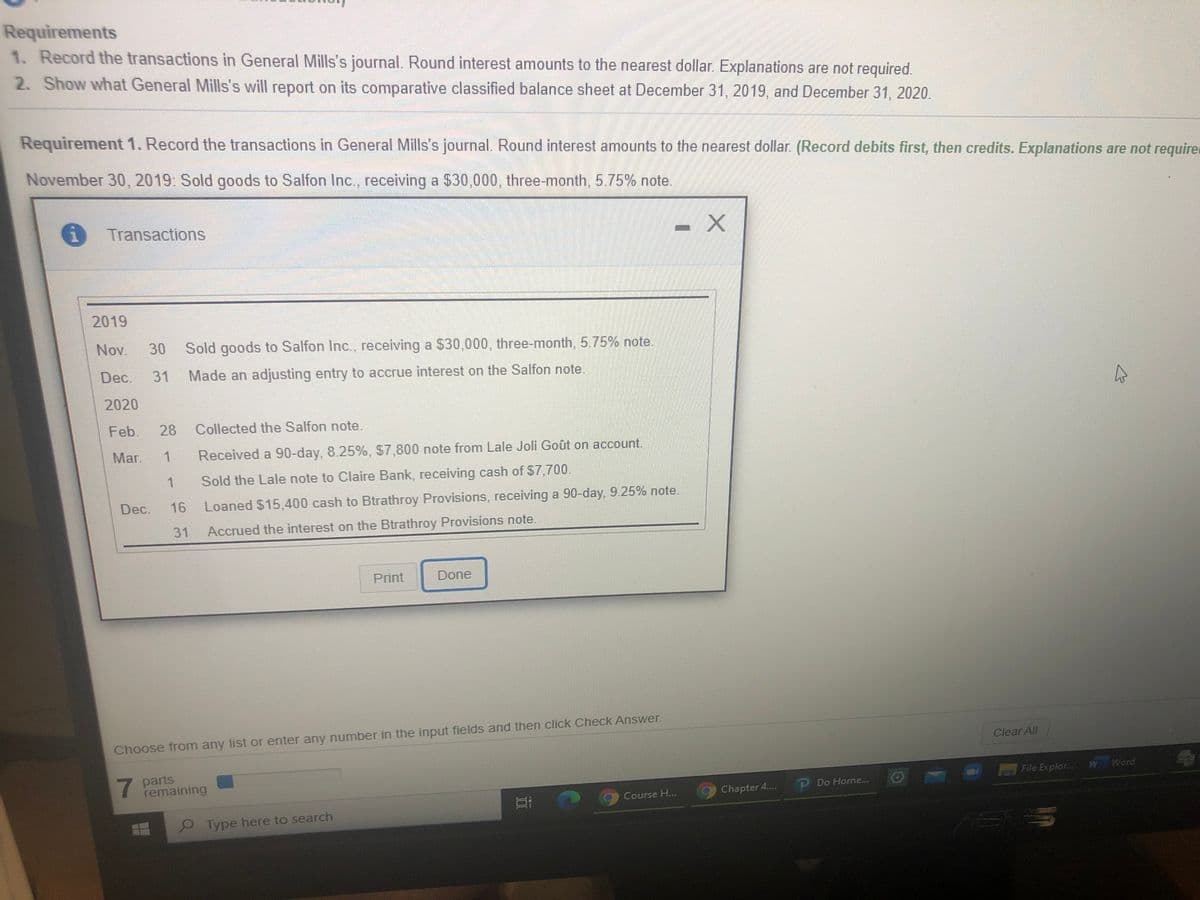

Requirements 1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. Explanations are not required. 2. Show what General Mills's will report on its comparative classified balance sheet at December 31, 2019, and December 31, 2020. Requirement 1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. (Record debits first, then credits. Explanations are not require November 30, 2019: Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note. Transactions 2019 Nov. 30 Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note. 31 Made an adjusting entry to accrue interest on the Salfon note. Dec 2020 Feb 28 Collected the Salfon note. Mar Received a 90-day, 8.25%, $7.800 note from Lale Joli Goût on account. Sold the Lale note to Claire Bank, receiving cash of $7,700. Dec. 16 Loaned $15,400 cash to Btrathroy Provisions, receiving a 90-day, 9.25% note. 31 Accrued the interest on the Btrathroy Provisions note. Print Done

Requirements 1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. Explanations are not required. 2. Show what General Mills's will report on its comparative classified balance sheet at December 31, 2019, and December 31, 2020. Requirement 1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. (Record debits first, then credits. Explanations are not require November 30, 2019: Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note. Transactions 2019 Nov. 30 Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note. 31 Made an adjusting entry to accrue interest on the Salfon note. Dec 2020 Feb 28 Collected the Salfon note. Mar Received a 90-day, 8.25%, $7.800 note from Lale Joli Goût on account. Sold the Lale note to Claire Bank, receiving cash of $7,700. Dec. 16 Loaned $15,400 cash to Btrathroy Provisions, receiving a 90-day, 9.25% note. 31 Accrued the interest on the Btrathroy Provisions note. Print Done

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 14P: Analyzing Accounts Receivable Upham Companys June 30, 2019, balance sheet included the following...

Related questions

Question

Complete requirement 2

Transcribed Image Text:Requirements

1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. Explanations are not required.

2. Show what General Mills's will report on its comparative classified balance sheet at December 31, 2019, and December 31, 2020.

Requirement 1. Record the transactions in General Mills's journal. Round interest amounts to the nearest dollar. (Record debits first, then credits. Explanations are not require

November 30, 2019: Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note.

Transactions

2019

Nov.

Sold goods to Salfon Inc., receiving a $30,000, three-month, 5.75% note.

30

Dec.

31

Made an adjusting entry to accrue interest on the Salfon note.

2020

Feb.

28

Collected the Salfon note.

Mar.

Received a 90-day, 8.25%, $7,800 note from Lale Joli Goût on account.

1

Sold the Lale note to Claire Bank, receiving cash of $7,700.

Dec.

16

Loaned $15.400 cash to Btrathroy Provisions, receiving a 90-day, 9.25% note.

31

Accrued the interest on the Btrathroy Provisions note.

Print

Done

Choose from any list or enter any number in the input fields and then click Check Answer.

Clear All

7 parts

remaining

File Explor... W Word

Chapter 4...

PDo Home...

Course H...

Type here to search

ASU

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning