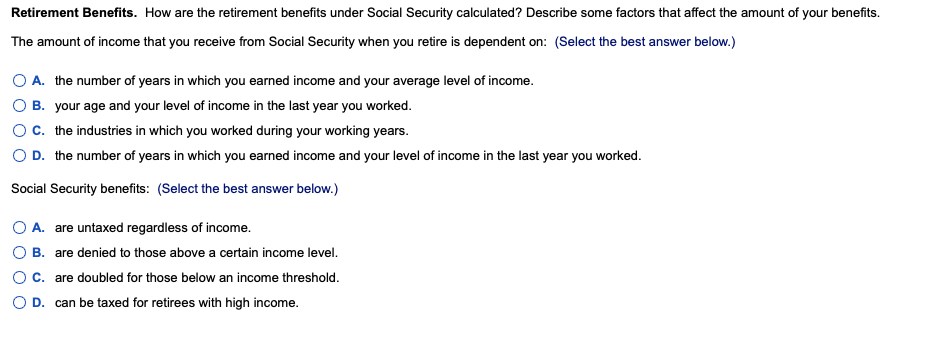

Retirement Benefits. How are the retirement benefits under Social Security calculated? Describe some factors that affect the amount of your benefits. The amount of income that you receive from Social Security when you retire is dependent on: (Select the best answer below.) O A. the number of years in which you earned income and your average level of income. OB. your age and your level of income in the last year you worked. OC. the industries in which you worked during your working years. O D. the number of years in which you earned income and your level of income in the last year you worked. Social Security benefits: (Select the best answer below.) O A. are untaxed regardless of income. B. are denied to those above a certain income level. O C. are doubled for those below an income threshold. O D. can be taxed for retirees with high income.

Retirement Benefits. How are the retirement benefits under Social Security calculated? Describe some factors that affect the amount of your benefits. The amount of income that you receive from Social Security when you retire is dependent on: (Select the best answer below.) O A. the number of years in which you earned income and your average level of income. OB. your age and your level of income in the last year you worked. OC. the industries in which you worked during your working years. O D. the number of years in which you earned income and your level of income in the last year you worked. Social Security benefits: (Select the best answer below.) O A. are untaxed regardless of income. B. are denied to those above a certain income level. O C. are doubled for those below an income threshold. O D. can be taxed for retirees with high income.

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter1: Ten Principles Of Economics

Section: Chapter Questions

Problem 6PA

Related questions

Question

Transcribed Image Text:Retirement Benefits. How are the retirement benefits under Social Security calculated? Describe some factors that affect the amount of your benefits.

The amount of income that you receive from Social Security when you retire is dependent on: (Select the best answer below.)

A. the number of years in which you earned income and your average level of income.

B. your age and your level of income in the last year you worked.

OC. the industries in which you worked during your working years.

O D. the number of years in which you earned income and your level of income in the last year you worked.

Social Security benefits: (Select the best answer below.)

O A. are untaxed regardless of income.

B. are denied to those above a certain income level.

C. are doubled for those below an income threshold.

O D. can be taxed for retirees with high income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co