Suppose the Fed decided to purchase $100 billion worth of government securities in the open market. Assume all payments a directly deposited into or withdrawn from the banking system. What impact would this action have on the economy? Specifica answer the following questions. Instructions: Enter your responses as a whole number. a. How will M1 be affected initially? No initial change to M1 Increase by $100 billion Decrease by $100 billion Not enough information to answer b. By how much will the banking system's lending capacity increase if the reserve requirement is 20 percent? 20 billion

Suppose the Fed decided to purchase $100 billion worth of government securities in the open market. Assume all payments a directly deposited into or withdrawn from the banking system. What impact would this action have on the economy? Specifica answer the following questions. Instructions: Enter your responses as a whole number. a. How will M1 be affected initially? No initial change to M1 Increase by $100 billion Decrease by $100 billion Not enough information to answer b. By how much will the banking system's lending capacity increase if the reserve requirement is 20 percent? 20 billion

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 18CQ

Related questions

Question

b, c and d help needed

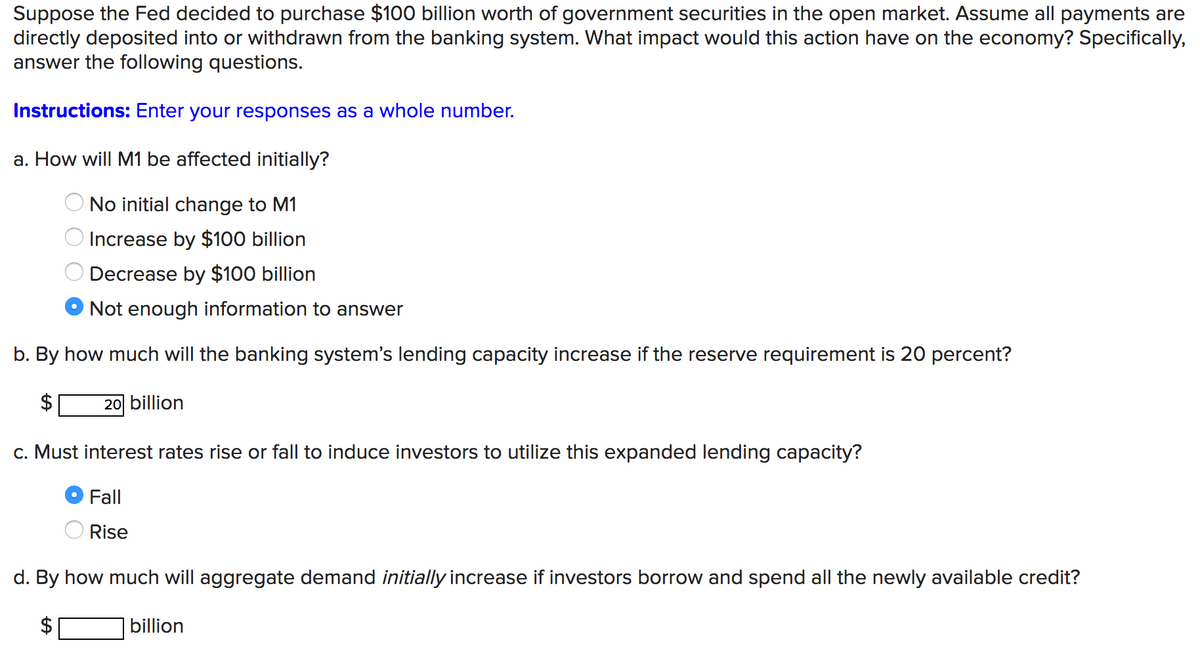

Transcribed Image Text:Suppose the Fed decided to purchase $100 billion worth of government securities in the open market. Assume all payments are

directly deposited into or withdrawn from the banking system. What impact would this action have on the economy? Specifically,

answer the following questions.

Instructions: Enter your responses as a whole number.

a. How will M1 be affected initially?

No initial change to M1

Increase by $100 billion

Decrease by $100 billion

Not enough information to answer

b. By how much will the banking system's lending capacity increase if the reserve requirement is 20 percent?

20 billion

c. Must interest rates rise or fall to induce investors to utilize this expanded lending capacity?

Fall

Rise

d. By how much will aggregate demand initially increase if investors borrow and spend all the newly available credit?

billion

0 0 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning