Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Five years of realized returns for Blue Llama Mining Inc. (Blue Llama) are given in the following table: 2016 2017 2018 2019 2020 Stock return 20.00% 13.60% 24.00% 33.60% 10.40% LAlso note that: 1. While Blue Llama was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on Blue Llama's equity are calculated as arithmetic returns. Given this return data, the average realized return on Blue Llama Mining Inc.'s stock is The preceding data series represents a sample of Blue Llama's historical returns. Based on this conclusion, the standard deviation of Blue Llama's historical returns is If investors expect the average realized return on Blue Llama Mining Inc.'s stock from 2016 to 2020 to continue into the future, its expected coefficient of variation (CV) is expected to equal

Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Five years of realized returns for Blue Llama Mining Inc. (Blue Llama) are given in the following table: 2016 2017 2018 2019 2020 Stock return 20.00% 13.60% 24.00% 33.60% 10.40% LAlso note that: 1. While Blue Llama was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on Blue Llama's equity are calculated as arithmetic returns. Given this return data, the average realized return on Blue Llama Mining Inc.'s stock is The preceding data series represents a sample of Blue Llama's historical returns. Based on this conclusion, the standard deviation of Blue Llama's historical returns is If investors expect the average realized return on Blue Llama Mining Inc.'s stock from 2016 to 2020 to continue into the future, its expected coefficient of variation (CV) is expected to equal

Essentials Of Business Analytics

1st Edition

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Camm, Jeff.

Chapter11: Monte Carlo Simulation

Section: Chapter Questions

Problem 9P

Related questions

Question

1.) Given this return data, the average realized return on Blue Llama Mining Inc.’s stock is _______ .

2.) The preceding data series represents a sample of Blue Llama’s historical returns. Based on this conclusion, the standard deviation of Blue Llama’s historical returns is _______ .

3.)

If investors expect the average realized return on Blue Llama Mining Inc.’s stock from 2016 to 2020 to continue into the future, its expected coefficient of variation (CV) is expected to equal _______ .

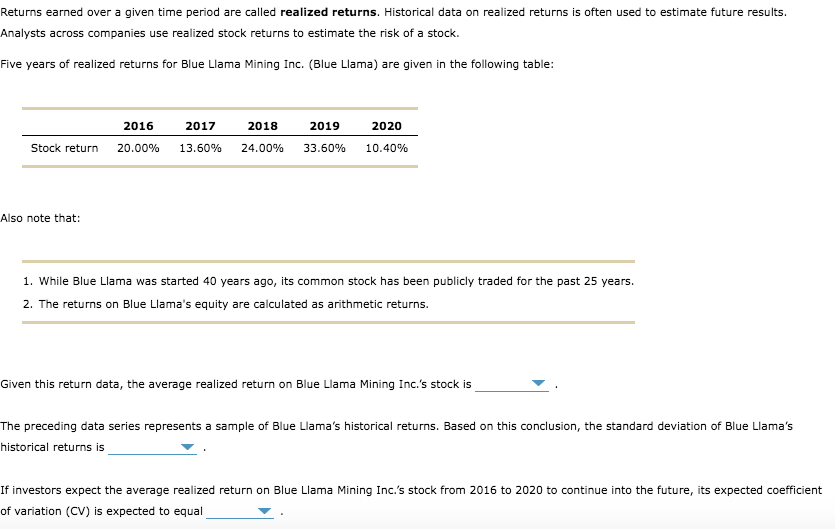

Transcribed Image Text:Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results.

Analysts across companies use realized stock returns to estimate the risk of a stock.

Five years of realized returns for Blue Llama Mining Inc. (Blue Llama) are given in the following table:

2016

2017

2018

2019

2020

Stock return

20.00%

13.60%

24.00%

33.60%

10.40%

Also note that:

1. While Blue Llama was started 40 years ago, its common stock has been publicly traded for the past 25 years.

2. The returns on Blue Llama's equity are calculated as arithmetic returns.

Given this return data, the average realized return on Blue Llama Mining Inc.'s stock is

The preceding data series represents a sample of Blue Llama's historical returns. Based on this conclusion, the standard deviation of Blue Llama's

historical returns is

If investors expect the average realized return on Blue Llama Mining Inc.'s stock from 2016 to 2020 to continue into the future, its expected coefficient

of variation (CV) is expected to equal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning