Excellent Corporation Income Statement for the year Dec. 31 ended 2018 Jan. 1 Cash $ 34,000 Accounts receivable 94,000 $ 34,000 $524,000 Sales Inventory Equipment (net) (328,000) $ 196,000 (118,700) $ 77,300 78,000 Cost of goods sold 68,000 74,000 Gross profit on sales 114.000 132,000 $310,000.00 $318,000.00 Operating expenses Operating income Total Assets Accounts payable Interest expense and income taxes (28,750) 54,000 60,000 Dividends payable 20,000 $48,550 12,000 Net income Long-term note payable Capital stock, $10 par (14,000 shs) Retained earnings 32,000 32,000 140,000 140,000 64,000 74,000 Total Liabilities+ $310,000 $318,000 Equity ow calculations below

Excellent Corporation Income Statement for the year Dec. 31 ended 2018 Jan. 1 Cash $ 34,000 Accounts receivable 94,000 $ 34,000 $524,000 Sales Inventory Equipment (net) (328,000) $ 196,000 (118,700) $ 77,300 78,000 Cost of goods sold 68,000 74,000 Gross profit on sales 114.000 132,000 $310,000.00 $318,000.00 Operating expenses Operating income Total Assets Accounts payable Interest expense and income taxes (28,750) 54,000 60,000 Dividends payable 20,000 $48,550 12,000 Net income Long-term note payable Capital stock, $10 par (14,000 shs) Retained earnings 32,000 32,000 140,000 140,000 64,000 74,000 Total Liabilities+ $310,000 $318,000 Equity ow calculations below

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3MC

Related questions

Question

Practice Pack

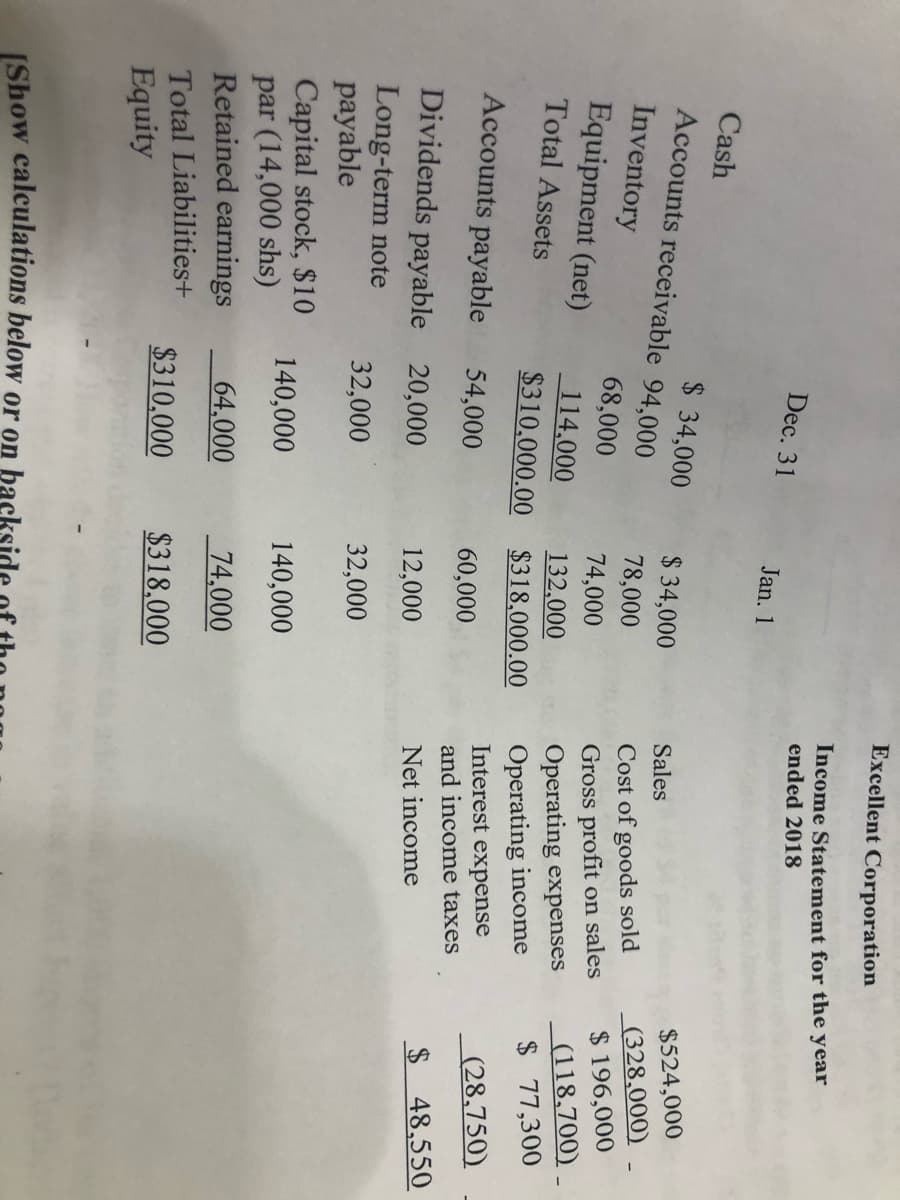

Given below are the comparative balance sheets and an income statement for the excellent corporation.

calculate the current ratio at year end and the quick ratio at the beginning of the year

Transcribed Image Text:Excellent Corporation

Income Statement for the year

ended 2018

Dec. 31

Jan. 1

Cash

$ 34,000

Accounts receivable 94,000

$ 34,000

$524,000

Sales

Inventory

Equipment (net)

(328,000)

$ 196,000

78,000

Cost of goods sold

68,000

Gross profit on sales

Operating expenses

Operating income

74,000

(118,700)

$77,300

114,000

132,000

Total Assets

$310,000.00 $318,000.00

Accounts payable

(28,750)

Interest expense

54,000

60,000

and income taxes

Dividends payable 20,000

$48,550

12,000

Net income

Long-term note

payable

32,000

32,000

Capital stock, $10

par (14,000 shs)

Retained earnings

140,000

140,000

64,000

74,000

Total Liabilities+

$310,000

$318,000

Equity

(Show calculations below or on back

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning