Review Crane's cash receipts summary and determine the amount of any deposits not recorded by the bank. These will be deposits in transit. (Hint: It can be useful to check off or cross out the deposits that appear on both the bank statement and the cash receipts summary because these will not be deposits in transit.) Deposit in transit of May 31

Review Crane's cash receipts summary and determine the amount of any deposits not recorded by the bank. These will be deposits in transit. (Hint: It can be useful to check off or cross out the deposits that appear on both the bank statement and the cash receipts summary because these will not be deposits in transit.) Deposit in transit of May 31

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 16P

Related questions

Question

Hello,

How do I solve this?

Thanks

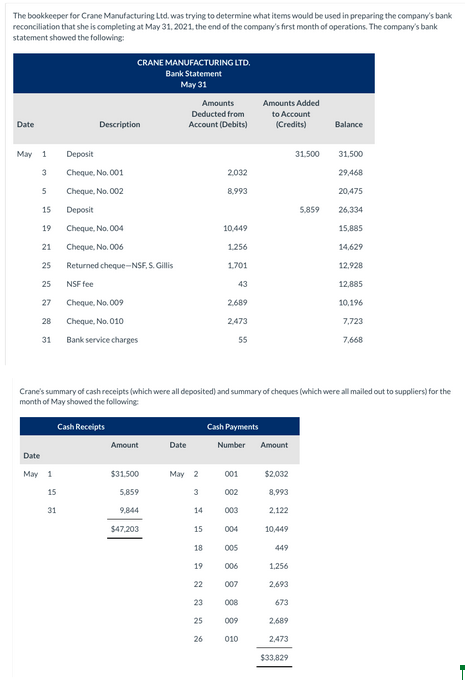

Transcribed Image Text:The bookkeeper for Crane Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank

reconciliation that she is completing at May 31, 2021, the end of the company's first month of operations. The company's bank

statement showed the following:

Date

May 1

3

5

Deposit

Cheque, No. 001

Cheque, No. 002

Deposit

Cheque, No. 004

21 Cheque, No. 006

15

19

2 2 2

25

25 Returned cheque-NSF. S. Gillis

NSF fee

27 Cheque, No. 009

28 Cheque, No. 010

31

Description

Date

May 1

CRANE MANUFACTURING LTD.

Bank Statement

May 31

15

31

Bank service charges

Cash Receipts

Amount

$31.500

5,859

$47,203

Amounts

Deducted from

Account (Debits)

Date

May 2

3

14

15

Crane's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the

month of May showed the following:

18

19

22

23

25

2,032

8,993

26

10,449

1,256

1,701

2,689

2,473

55

43

Cash Payments

Number

001

002

003

004

005

006

007

008

009

Amounts Added

to Account

(Credits)

010

Amount

$2,032

8,993

2,122

31.500

10,449

449

1,256

2,693

673

2,689

2,473

$33,829

5.859

Balance

31,500

29,468

20,475

26,334

15,885

14,629

12,928

12,885

10.196

7,723

7,668

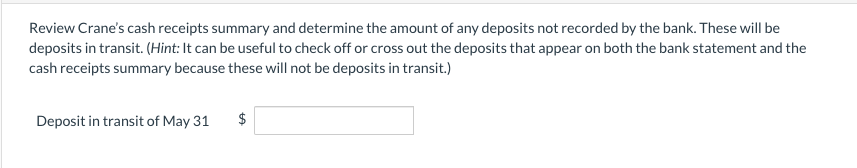

Transcribed Image Text:Review Crane's cash receipts summary and determine the amount of any deposits not recorded by the bank. These will be

deposits in transit. (Hint: It can be useful to check off or cross out the deposits that appear on both the bank statement and the

cash receipts summary because these will not be deposits in transit.)

Deposit in transit of May 31

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I'm also struggling with the follow up part of this question

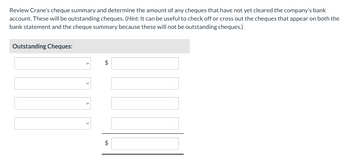

Transcribed Image Text:Review Crane's cheque summary and determine the amount of any cheques that have not yet cleared the company's bank

account. These will be outstanding cheques. (Hint: It can be useful to check off or cross out the cheques that appear on both the

bank statement and the cheque summary because these will not be outstanding cheques.)

Outstanding Cheques:

GA

tA

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub