rformed services for $15,000 rchased land for $8,000 cash. red an accountant to keep the eceived $40,000 cash from the prrowed $10,000 cash from St. aid $5,000 cash for salary exp old land for $10,000 cash. aid $4,000 cash on the loan fr aid $5,200 cash for utilities ex "aid a cash dividend of $2,000 uired

rformed services for $15,000 rchased land for $8,000 cash. red an accountant to keep the eceived $40,000 cash from the prrowed $10,000 cash from St. aid $5,000 cash for salary exp old land for $10,000 cash. aid $4,000 cash on the loan fr aid $5,200 cash for utilities ex "aid a cash dividend of $2,000 uired

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.10E: Effects of transactions on Accounting equation On Time Delivery Service had the following selected...

Related questions

Question

Answers only I don't need work.

Please answer all parts of question B.

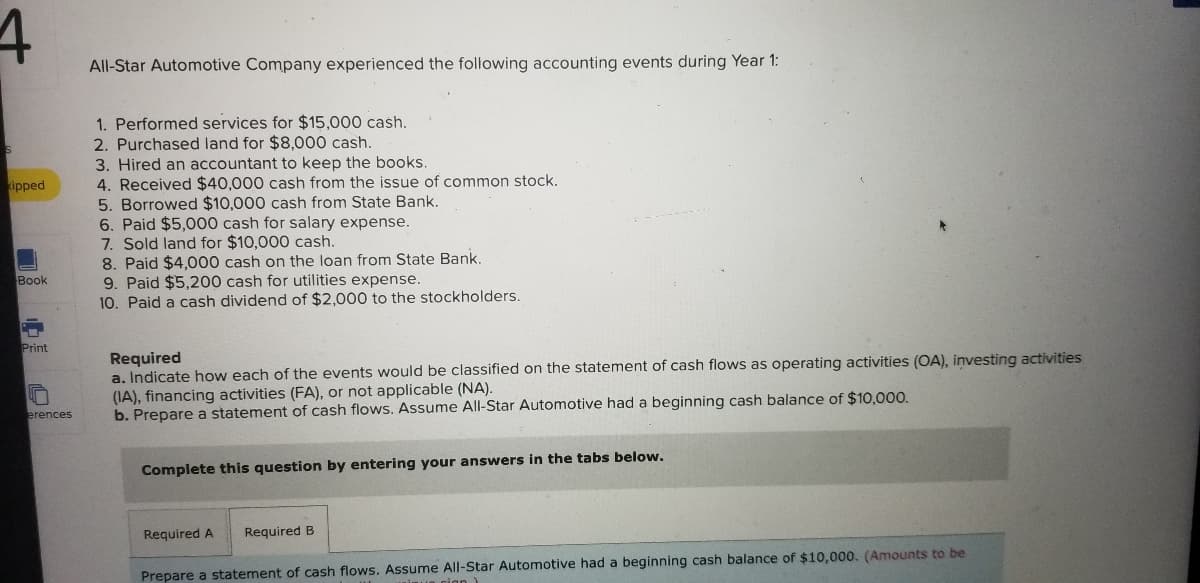

Transcribed Image Text:4.

All-Star Automotive Company experienced the following accounting events during Year 1:

1. Performed services for $15,000 cash.

2. Purchased land for $8,000 cash.

3. Hired an accountant to keep the books.

4. Received $40,000 cash from the issue of common stock.

5. Borrowed $10,000 cash from State Bank.

6. Paid $5,000 cash for salary expense.

7. Sold land for $10,000 cash.

8. Paid $4,000 cash on the loan from State Bank.

9. Paid $5,200 cash for utilities expense.

10. Paid a cash dividend of $2,000 to the stockholders.

ipped

Book

Print

Required

a. Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities

(IA), financing activities (FA), or not applicable (NA).

b. Prepare a statement of cash flows. Assume All-Star Automotive had a beginning cash balance of $10,00o.

erences

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a statement of cash flows, Assume All-Star Automotive had a beginning cash balance of $10,000. (Amounts to be

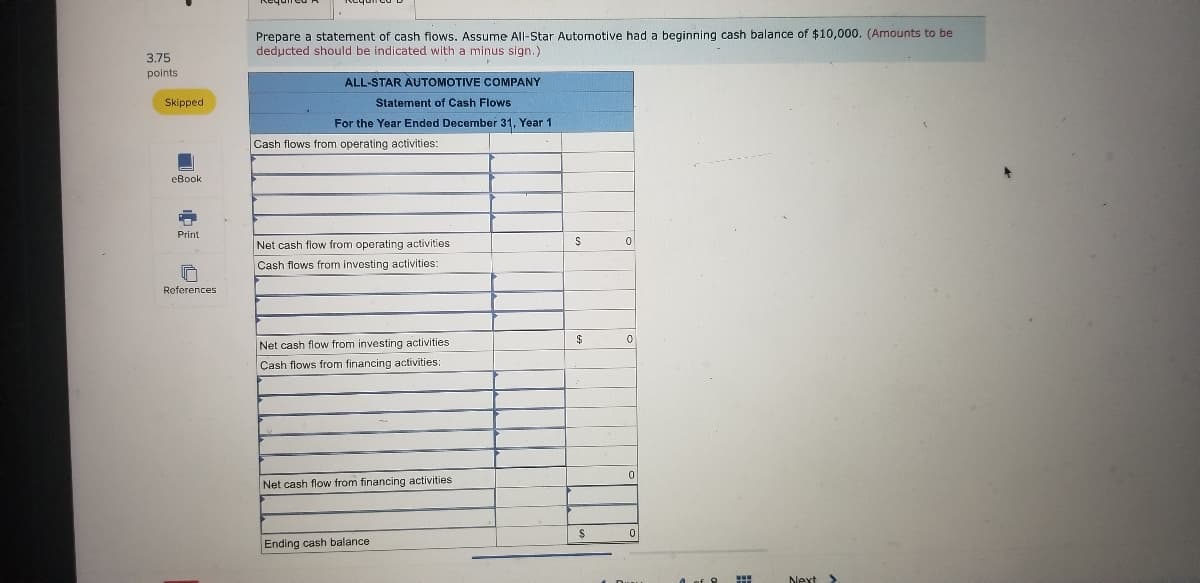

Transcribed Image Text:Prepare a statement of cash flows. Assume All-Star Automotive had a beginning cash balance of $10,000. (Amounts to be

deducted should be indicated with a minus sign.)

3.75

points

ALL-STAR AUTOMOTIVE COMPANY

Skipped

Statement of Cash Flows

For the Year Ended December 31, Year 1

Cash flows from operating activities:

eBook

Print

Net cash flow from operating activities

Cash flows from investing activities:

References

$4

Net cash flow from investing activities

Cash flows from financing activities:

Net cash flow from financing activities

Ending cash balance

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning