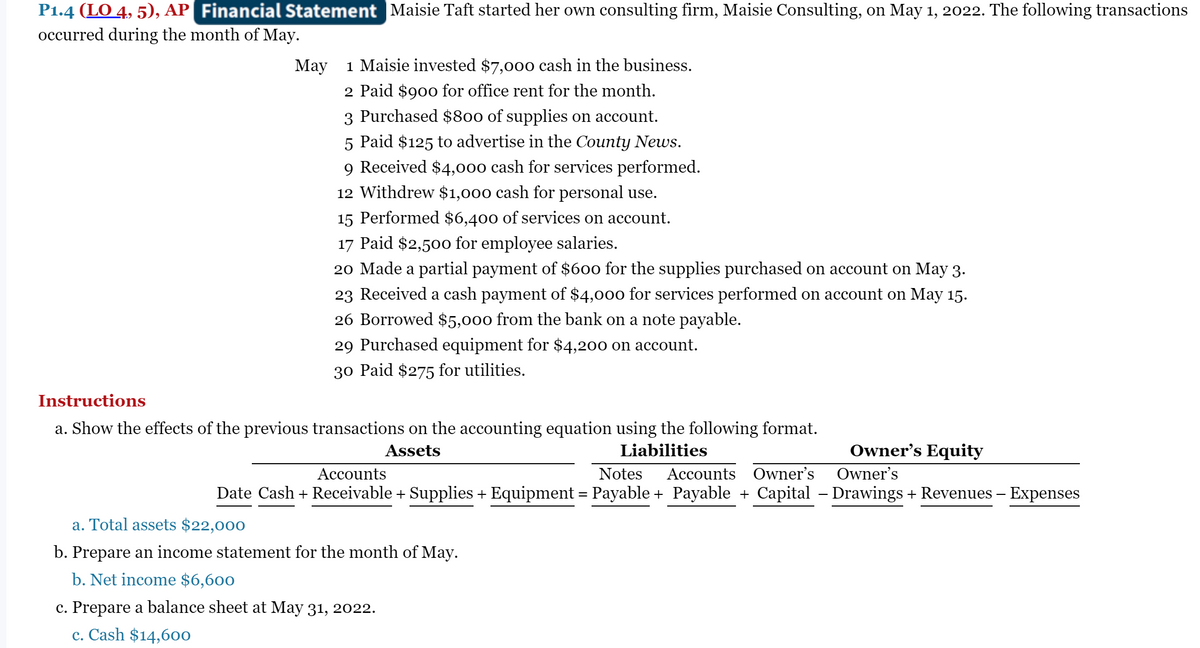

y 1 Maisie invested $7,000 cash in the business. 2 Paid $900 for office rent for the month. 3 Purchased $80o of supplies on account. 5 Paid $125 to advertise in the County News. 9 Received $4,00o cash for services performed. 12 Withdrew $1,000 cash for personal use. 15 Performed $6,400 of services on account. 17 Paid $2,500 for employee salaries. 20 Made a partial payment of $600 for the supplies purchased on account on May 3. 23 Received a cash payment of $4,000 for services performed on account on May 15. 26 Borrowed SE 000 from the bank on a note pavable

Q: 1. Deposited $50,000 in a bank account in the name of Shannon Realty 2. Purchased a lot for $10,000…

A: Accounting can be defined as the process of identifying, recording, analyzing, interpreting, and…

Q: Dec 1 Miranda invested P150,000 in the firm. 2 Paid rent for December to Recoletos Realty,…

A: Cash flow statements include: Cash flow from operating activities Cash flow from investing…

Q: Jimmy Flores completed this transactions during the first half of December Dec 2 Invested P120,000…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. Journal…

Q: Jan. 1 Bernick invested cash in the business, $12,000. 2 Paid office rent, $750. 3 Purchased office…

A: Journal entry is the primary step to record transaction in the books of account. After preparation…

Q: All-Stor Autonative Company exxperienced the following accounting events during Year 3: 1 Performed…

A: Statement of cash flows is one of financial statement which is used by stakeholders like investors…

Q: Linda Williams started her own consulting firm, Linda Consulting, on May 1, 2022. The following…

A: As per Accounting Equation,Assets =Liabilities +Shareholder's equity

Q: Sep. 1 Received $42,000 cash and gave capital to Steven. 4 Purchased office supplies, $500, and…

A: The primary book in which the financial transactions of the business are initially recorded is known…

Q: Dec 1 Miranda invested P150,000 in the firm. 2 Paid rent for December to Recoletos Realty,…

A: Journal entries: Journal entries are the accounting treatment done in the books of accounts for all…

Q: Prepare general journal entries for the following transactions of Valdez Services.

A: Journal entry: It can be defined as the recording of financial events and transactions that have…

Q: Jan 2 Received $11,000 cash from Ruiz, and issued common stock to him. 2 Paid monthly office rent,…

A: Following are the requisite financial statement

Q: Chin consulting service engaged in the following transactions during march 19x3 March 1 Rudy Chin…

A: Recording of the journal Entries::: March 1 Rudy Chin invest 59,000 of cash to start the…

Q: Date Transactions June 1 Mr. Vincent invested P 500,000 in a car repair shop. 2 Paid for rent P…

A: Journal is the recording of transactions of the business according to the date immediately when a…

Q: The business transactions for January, 2020 follow: Jan. 1 Wilson invested P500,000 cash and…

A: A trial balance's main function is to confirm that the entries in a firm's accounting system are…

Q: More info а. Missy Mansion contributed $8,000 cash in exchange for capital. b. Performed service for…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: 5. The following transactions occurred in the first month of operation of the "At-Your-Service…

A: General ledgers are the T accounts in which the balances are identified for the journal…

Q: Wernan Peralta, Attorney-at-Law, opened his office on September 1, 2018. The following transactions…

A: Accounting equation of the business says that total assets in the business must be always equal to…

Q: Werman Peralta, Attorney at Law, opened his office on Sept. 1, 2018. the following transactions were…

A: As per accounting equation, total assets in the business should be equal to total liabilities and…

Q: March 1. Jamili deposited P200,000 in a bank account in the name of the business. 2. Jamili invested…

A: Journal entries are used to record the transactions of the business in a chronological order.

Q: The king are transactions of Ms. Dianna Fe D. Eranista courrer ng the month of July, her first month…

A: Journal Entries DATE PARTICULAR DEBIT CREDIT July 1 Cash 750,000 Capital…

Q: Emerita Modesto established a. Deposited P120,000 in a bank account in the name of the business.…

A: Accounting equation of the business says that total assets always must be equal to total liabilities…

Q: August 1 August 2 August 3 August 7 August 8 August 15 August 17 Mr. Min Jimin invested P50,000 to…

A: The journal entries are prepared to keep the record of daily transactions of the business.

Q: 5. The following transactions occurred in the first month of operation of the "At-Your-Service…

A: As posted multiple sub parts we are answering only first question kindly repost the unanswered…

Q: More info Jul. 2 Received $12,000 contribution from Brett London, owner, in exchange for capital. 4…

A: For passing the Journal entry : Debit the expenses and credit the income Debit the receiver and…

Q: Dec. 1 Treyson contributed $16,000 cash in exchange for capital. Dec. 2 Received $2,400 cash from…

A: The transactions of the company will be recorded first in the company's books which is called as…

Q: 1. Christine invested $8,000 cash in the business 2. Paid $1,400 cash for the truck lease for the…

A: T Account A T-account is a common term for a set of double-entry financial records. The statement…

Q: Received $12,000 from Katie Long, owner. (a) Purchased equipment for $25,000, paying $10,000 in cash…

A: A trial balance is prepared at the end of the accounting year. It is prepared to check the accuracy…

Q: hristine opened a tour and travel business, “Tine Travels” on June 01, 2021. 1 Christine…

A: Income statements show the performance of the entity during the year. It indicates how the resources…

Q: Sep. 1 Received $42,000 cash and gave capital to Stewart. 4 Purchased office supplies, $700, and…

A: T-accounts preparation is the second step after recording transactions to the journals. All the…

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: SOLUTION- JOURNAL ENTRY IS USED TO RECORD A BUSINESS TRANSACTION IN THE ACCOUNTING RECORDS OF A…

Q: Oct 1: Owner contributes 80,000 cash. 5: Buy machine for 15,000…

A: Net Income = Service Revenue - Total ExpensesEnding Owner's Capital = Beginning Owner's Capital +…

Q: 1. Paid $50 for advertising in the local newspaper. 2. Received S1,000 as payment for preparing a…

A: Definition: Accounting equation: Accounting equation is an accounting tool expressed in the form of…

Q: March 2021 1 The owner, Gina, invested the following: filing cabinets and fixtures- 15,000; cash,…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Sample: Ms. RCM invested cash of P100,000 and fumiture and fixtures amounting to P250,000, Sept. 5:…

A: There are some type of accounts used in accounting. These are Assets, Liabilities, Revenues,…

Q: Bayoud has started a computer servicing center on May 1, 2021. Following are some events and…

A: Journal entries are defined as recording of business transactions into the books of accounts of…

Q: The business transactions for January, 2020 follow: Jan. 1 Wilson invested P500,000 cash and…

A: A T-Account ledger is a log or list of accounts that keeps track of account transfers.

Q: Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions…

A: As per accounting equation of the business, total assets must be equal to total liabilities and…

Q: Jul. 1 Yang contributed $60,000 cash to the business in exchange for capital. 5 Paid monthly rent on…

A: Introduction: Accounting is the process of identifying, measuring and recording the accounting…

Q: May1, Business owner Bill Doors invested $200,000 in cash and office equipment worth $48,000 in the…

A: In the givens problems, the financial statements refer to the statement of profit & loss and…

Q: Lisa Anderson started her own consulting firm, Lisa Consulting, on May 1, 2022. The following…

A: Lets understand the basics. Income statement is a statement which shows revenue, expense and net…

Q: M-planet begins business as a real estate agent with a cash investment of $25,000 in exchange for…

A: Revenue earned on account = total fees - cash received = 360000 - 60000 = $300,000

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Mr. Mak Dy opened his laundry shop. During the month of March, Dy completed the following…

A: The journal entries are prepared to record day to day transactions of the business.

Q: . Adriana Diaz invested $50,000 cash to start an appliance repair business. 2. Hired an employee to…

A: Journal entries are passed following the golden rules of accounting. Debit all assets and expenses…

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: As posted multiple questions we are answering only first question kindly repost the unanswered…

Q: Bayoud has started a computer servicing center on May 1, 2021. Following are some events and…

A: Following is the requisite cash account.

Q: p. On April 5, Timothy established an interior decorating business, Tim's Design, with a cash…

A: Journal entries recording is the very first step in accounting cycle process. Under this process,…

Q: Prepare general journal entries for the following transactions of Valdez Services.

A: Journal entry: It can be defined as the recording of financial events and transactions that have…

Q: 7. Joshua Owen commenced business on 1 September, and had several special transactions during the…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: James operates a business supplying treadmill. During the month of August, the following…

A: The journal entries are prepared to record daily transactions of the business.

Hello, please help me with the followingm your help is appreciated. Thank you

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Effects of transactions on Accounting equation On Time Delivery Service had the following selected transactions during November: 1. Received cash from issuance of common stock, $75,000. 2. Paid rent for November, $5000. 3. Paid advertising expense, $3,000. 4. Received cash for providing delivery services, $34,500. 5. Borrowed $10,000 from Second National Bank to finance its operations. 6. Purchased a delivery van for cash, $25,000. 7. Paid interest on note from Second National Bank, $75. 8. Paid salaries and wages for November, $10,000. 9. Paid dividends, $2,000. Indicate the effect of each transaction on the accounting equation by listing the numbers identifying the transactions, (1) through (9), in a vertical column, and inserting at the right of each number the appropriate letter from he following list: a. Increase in an asset, decrease in another asset. h. Increase in an asset, increase in a liability. c. Increase in an asset, increase in stockholders’ equity. d. Decrease in an asset, decrease in a liability. e. Decrease in an asset, decrease in stockholders equity.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?RR Claro, a public relation man, opened his business on May 1, 2020. Below are the transactions completed by the RC Communication Company during the month of May. May 1 RR Claro invested cash, P80,000 to start the business. 7 Paid taxes and licenses to the City Treasurer, P1,500. 8 Purchased office furniture from Acme Furniture, P15,000 paying P5,000 down, balance in 10 days. 15 Received P25,000 for services rendered from various clients. 19 Billed National Enterprises for services rendered, P28,000. 31 Withdrew 30,000 for personal useCarla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following transactions occurred during the month of May. May 1 Carla invested Tk. 7,000 cash in the business. 2 Paid Tk. 900 for office rent for the month. 3 Purchased Tk. 600 of supplies on account. 5 Paid Tk. 125 to advertise in the County News. 9 Received Tk. 4,000 cash for services provided. 12 Withdrew Tk. 1,000 cash for personal use. 15 Performed Tk. 5,400 of services on account. 17 Paid Tk. 2,500 for employee salaries. 20 Paid for the supplies purchased on account on May 3. 23 Received a cash payment of Tk. 4,000 for services provided on account on May 15. 26 Borrowed Tk. 5,000 from the bank on a note payable. 29 Purchased office equipment for Tk. 4,200 on account. 30 Paid Tk. 275 for utilities. Instruction: a) Journalize the transactions. b) Post to the ledger accounts. c) Prepare a trial balance.

- On August 1, 20Y9, Brooke Kline established Western Realty. Brooke completed the following transactions during the month of August: a. Opened a business bank account with a deposit of $28,000 in exchange for common stock. b. Paid rent on office and equipment for the month, $3,600. c. Paid automobile expenses for month, $1,300, and miscellaneous expenses, $700. d. Purchased office supplies on account, $1,250. e. Earned sales commissions, receiving cash, $18,400. f. Paid creditor on account, $750. g. Paid office salaries, $3,000. h. Paid dividends, $3,300. i. Determined that the cost of supplies on hand was $500; therefore, the cost of supplies used was $750. Required: 1. Indicate the effect of each transaction and the balances after each transaction, using the tabular headings in the exhibit below. In each transaction row (rows indicated by a letter), you must indicate the math sign (+ or -) in columns affected by the transaction. You will not need to…Ruth Lewis opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,700, Supplies $500, Equipment $5,700, Accounts Payable $3,600, and Owner’s Capital $9,300. During August, the following transactions occurred. 1. Collected $1,400 of accounts receivable. 2. Paid $2,800 cash on accounts payable. 3. Recognized revenue of $7,700, of which $2,500 is collected in cash and the balance is due in September. 4. Purchased additional equipment for $2,100, paying $500 in cash and the balance on account. 5. Paid salaries $1,700, rent for August $1,100, and advertising expenses $350. 6. Withdrew $700 in cash for personal use. 7. Received $1,600 from Standard Federal Bank—money borrowed on a note payable. 8. Incurred utility expenses for month on account $180. Prepare an income statement for August. RUTH LEWIS, ATTORNEY AT LAWIncome Statement For the Year Ended August 31, 2020August 31, 2020For…Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions were completed during the month:a. Deposited P210,000 in the bank in the name of the business.b. Bought office equipment on account from Daraga Corp., P147,000.c. Invested his personal law library into the business, P57,000.d. Paid office rent for the month, P7,600.e. Bought office supplies for cash, P8,850.f. Paid the premium for a one-year fire insurance policy on the equipment and the library, P1,860.g. Received professional fees for services rendered, P24,600.h. Received and paid bill for the use of a landline, P2,280.i. Paid salaries of two part-time legal researchers, P9,600.j. Paid car rental expense, P2,880.k. Received professional fees for services rendered, P21,200.l. Paid Daraga Corp. a portion of the amount owed for the acquisition of the office equipment recorded earlier, P15,000.m. Lagomo withdrew cash for personal use, P20,750.Required: Record the transactions for the month…

- On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $31,000. 2 Paid rent on office and equipment for the month, $3,050. 3 Purchased supplies on account, $2,250. 4 Paid creditor on account, $850. 5 Earned fees, receiving cash, $14,660. 6 Paid automobile expenses (including rental charge) for month, $1,540, and miscellaneous expenses, $670. 7 Paid office salaries, $2,600. 8 Determined that the cost of supplies used was $1,050. 9 Withdrew cash for personal use, $2,200. Required: 1. Journalize entries for transactions Jan. 1 through 9. Refer to the chart of accounts for the exact wording of the account titles. . Every line on a journal page is used for debit or credit entries. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left…On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: Oct. 1 Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $30,000. 2 Paid rent on office and equipment for the month, $3,050. 3 Purchased supplies on account, $2,250. 4 Paid creditor on account, $880. 5 Earned sales commissions, receiving cash, $15,210. 6 Paid automobile expenses (including rental charge) for month, $1,600, and miscellaneous expenses, $510. 7 Paid office salaries, $2,300. 8 Determined that the cost of supplies used was $1,050. 9 Paid dividends, $2,900. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance.On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: Oct. 1 Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $30,000. 2 Paid rent on office and equipment for the month, $3,050. 3 Purchased supplies on account, $2,250. 4 Paid creditor on account, $880. 5 Earned sales commissions, receiving cash, $15,210. 6 Paid automobile expenses (including rental charge) for month, $1,600, and miscellaneous expenses, $510. 7 Paid office salaries, $2,300. 8 Determined that the cost of supplies used was $1,050. 9 Paid dividends, $2,900. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.