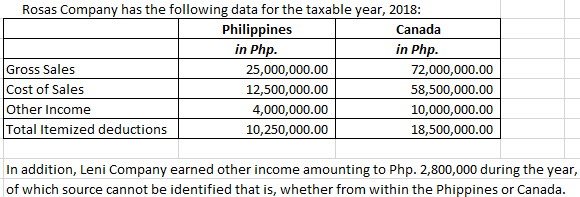

Rosas Company has the following data for the taxable year, 2018: Gross Sales Cost of Sales Philippines in Php. 25,000,000.00 12,500,000.00 Other Income Total Itemized deductions 4,000,000.00 10,250,000.00 Canada in Php. 72,000,000.00 58,500,000.00 10,000,000.00 18,500,000.00 In addition, Leni Company earned other income amounting to Php. 2,800,000 during the year, of which source cannot be identified that is, whether from within the Phippines or Canada.

Rosas Company has the following data for the taxable year, 2018: Gross Sales Cost of Sales Philippines in Php. 25,000,000.00 12,500,000.00 Other Income Total Itemized deductions 4,000,000.00 10,250,000.00 Canada in Php. 72,000,000.00 58,500,000.00 10,000,000.00 18,500,000.00 In addition, Leni Company earned other income amounting to Php. 2,800,000 during the year, of which source cannot be identified that is, whether from within the Phippines or Canada.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

5. Assume Rosas Company is a resident foreign corporation using OSD, determine the amount of OSD to be used to arrive at Net Income before tax.

Transcribed Image Text:Rosas Company has the following data for the taxable year, 2018:

Canada

Philippines

in Php.

in Php.

Gross Sales

Cost of Sales

other Income

Total Itemized deductions

25,000,000.00

72,000,000.00

12,500,000.00

58,500,000.00

4,000,000.00

10,000,000.00

10,250,000.00

18,500,000.00

In addition, Leni Company earned other income amounting to Php. 2,800,000 during the year,

of which source cannot be identified that is, whether from within the Phippines or Canada.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning