rthern Ontario. The default (readily available) option is to connect the site to the regular Iroelectric grid and pay an estimated S11,000 in annual energy cost. The company identif alternative energy sources: solar and wind. The solar energy alternative has a useful life rs, will require procurement and installation cost of $22,000 and annual maintenance cos 500. The solar system will have a salvage value after 6 years of S1,000. The wind system seful life of 8 years, with an initial cost of $15,500 and annual operation and maintenance $1,600, and a decommissioning cost (negative salvage value) after 8 years of $2,000. Bot tems will generate enough power such that the electric system will be self-sufficient and: irely without the need of connecting to regular hydroelectric grid. For economic analysis, the MARR is set to be 6%, and alternatives are replicable in ure with exact cost/salvage estimates; including initial and running costs. The forestry

rthern Ontario. The default (readily available) option is to connect the site to the regular Iroelectric grid and pay an estimated S11,000 in annual energy cost. The company identif alternative energy sources: solar and wind. The solar energy alternative has a useful life rs, will require procurement and installation cost of $22,000 and annual maintenance cos 500. The solar system will have a salvage value after 6 years of S1,000. The wind system seful life of 8 years, with an initial cost of $15,500 and annual operation and maintenance $1,600, and a decommissioning cost (negative salvage value) after 8 years of $2,000. Bot tems will generate enough power such that the electric system will be self-sufficient and: irely without the need of connecting to regular hydroelectric grid. For economic analysis, the MARR is set to be 6%, and alternatives are replicable in ure with exact cost/salvage estimates; including initial and running costs. The forestry

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

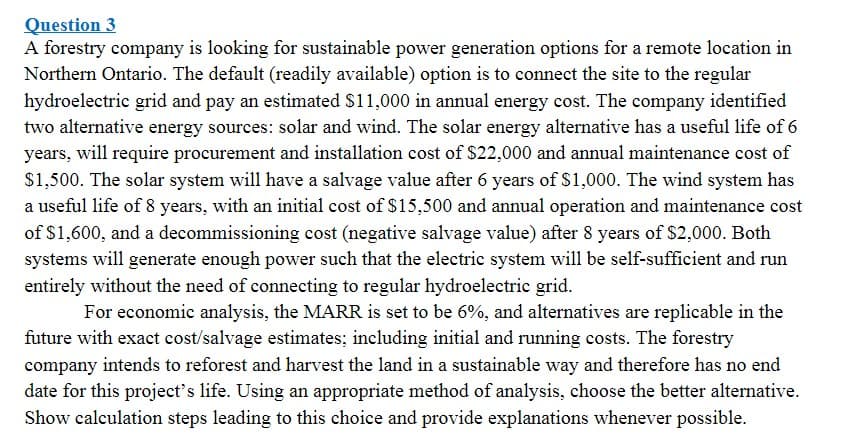

Transcribed Image Text:Question 3

A forestry company is looking for sustainable power generation options for a remote location in

Northern Ontario. The default (readily available) option is to connect the site to the regular

hydroelectric grid and pay an estimated S11,000 in annual energy cost. The company identified

two alternative energy sources: solar and wind. The solar energy alternative has a useful life of 6

years, will require procurement and installation cost of $22,000 and annual maintenance cost of

$1,500. The solar system will have a salvage value after 6 years of $1,000. The wind system has

a useful life of 8 years, with an initial cost of $15,500 and annual operation and maintenance cost

of $1,600, and a decommissioning cost (negative salvage value) after 8 years of S2,000. Both

systems will generate enough power such that the electric system will be self-sufficient and run

entirely without the need of connecting to regular hydroelectric grid.

For economic analysis, the MARR is set to be 6%, and alternatives are replicable in the

future with exact cost/salvage estimates; including initial and running costs. The forestry

company intends to reforest and harvest the land in a sustainable way and therefore has no end

date for this project's life. Using an appropriate method of analysis, choose the better alternative.

Show calculation steps leading to this choice and provide explanations whenever possible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning