lease help

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 39P

Related questions

Question

please help

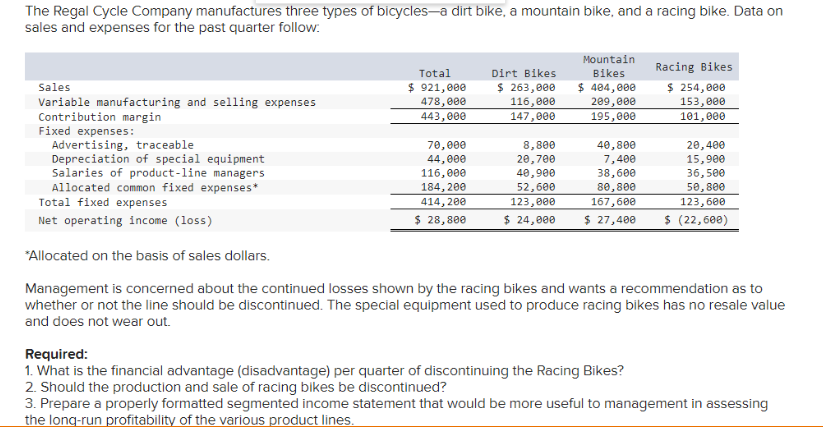

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on

sales and expenses for the past quarter follow.

Mountain

Racing Bikes

Total

Dirt Bikes

Bikes

$ 921, e00

478, 000

443,000

$ 263,000

116,000

147,000

$ 404,000

209,000

195,000

$ 254, 000

153,000

101, e00

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses

70,000

8,800

40,800

7,400

20,400

44,000

20,700

15,900

116, 00е

40,900

38,600

36,500

50, 800

123,600

184, 200

52,600

80,800

414, 200

$ 28,800

123,000

167,600

Net operating income (loss)

$ 24,000

$ 27,400

$ (22,600)

*Allocated on the basis of sales dollars.

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to

whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value

and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing

the long-run profitability of the various product lines.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning