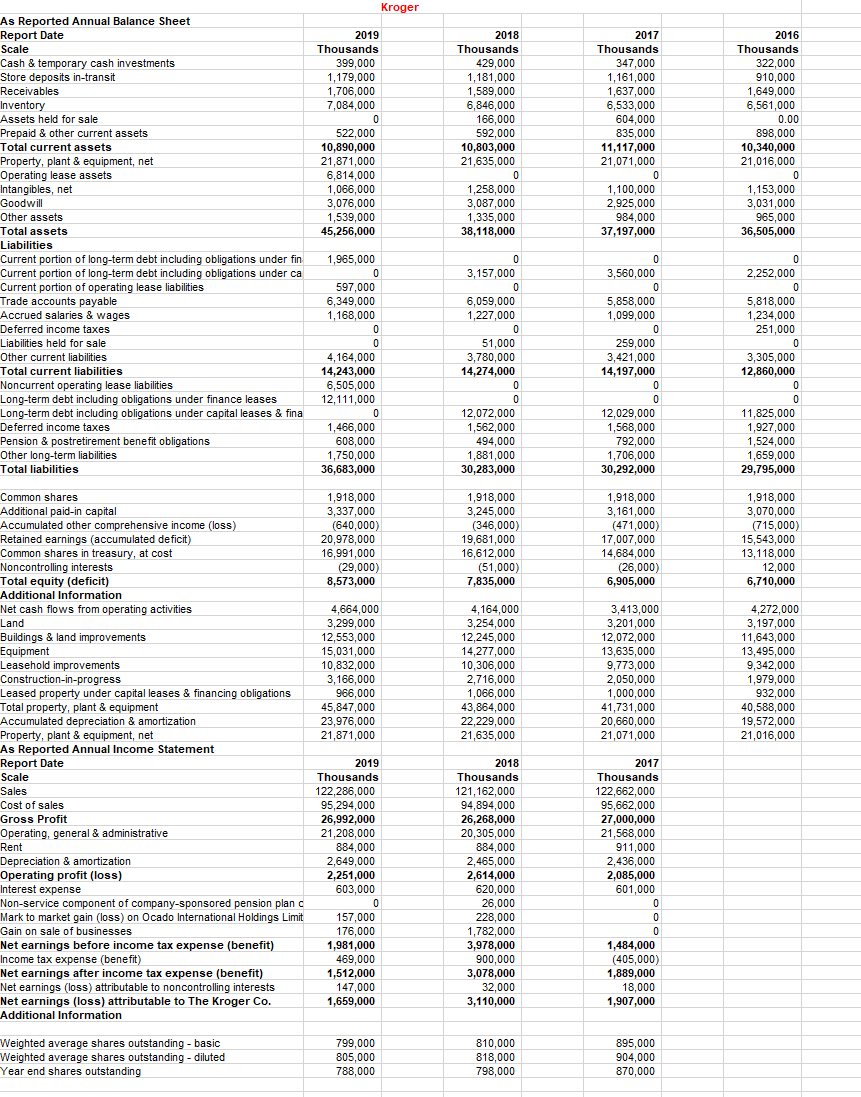

s Reported Annual Balance Sheet Ceport Date cale ash & temporary cash investments tore deposits in-transit Ceceivables ventory ssets held for sale repaid & other current assets otal current assets 2019 2018 2017 2016 Thousands 399,000 1,179,000 1,706,000 7,084,000 Thousands 322,000 910,000 1,649,000 6,561,000 0.00 Thousands Thousands 429,000 1,181,000 1,589,000 6,846,000 166,000 592,000 10,803,000 21,635,000 347,000 1,161,000 1,637,000 6,533,000 604,000 835,000 11,117,000 21,071,000 522,000 10,890,000 21,871,000 6,814,000 1,066,000 3,076,000 1,539,000 45,256,000 898,000 10,340,000 21,016,000 roperty, plant & equipment, net perating lease assets atangibles, net Foodwill ther assets otal assets iabilities urrent portion of long-term debt including obligations under fin urrent portion of long-term debt including obligations under ca current portion of operating lease liabilities rade accounts payable ccrued salaries & wages eferred income taxes 1,258,000 3,087,000 1,335,000 38,118,000 1,153,000 3,031,000 965,000 36,505,000 1,100,000 2.925.000 984,000 37,197,000 1,965,000 3,157,000 3,560,000 2,252,000 597,000 6,349,000 1.168.000 6,059,000 1,227,000 5,858,000 1,099,000 5,818,000 1,234,000 251,000 iabilities held for sale ather current liabilities 51,000 3,780,000 14,274,000 259,000 3,421,000 14,197,000 4,164,000 14,243,000 6,505,000 12,111,000 3,305,000 12,860,000 otal current liabilities oncurrent operating lease liabilities ong-term debt including obligations under finance leases ong-term debt including obligations under capital leases & fina eferred income taxes ension & postretirement benefit obligations ther long-term liabilities otal liabilities 12,072,000 1,562,000 494,000 1,881,000 30,283,000 12,029,000 1,568,000 792,000 1,706,000 30,292,000 11,825,000 1,927,000 1,524,000 1,659,000 29,795,000 1,466,000 608.000 1,750,000 36,683,000 Common shares dditional paid-in capital Accumulated other comprehensive income (loss) Cetained earnings (accumulated deficit) Common shares in treasury, at cost loncontrolling interests otal equity (deficit) dditional Information let cash flows from operating activities 1,918,000 3,337,000 (640,000) 20,978,000 16,991,000 (29,000) 8,573,000 1,918,000 3,245,000 (346,000) 19,681,000 16,612,000 (51,000) 7,835,000 1,918,000 3,161,000 (471,000) 17,007,000 14,684,000 (26,000) 6,905,000 1,918,000 3,070,000 (715,000) 15,543,000 13,118,000 12,000 6,710,000 4,664,000 3,299,000 12,553,000 3,413,000 3,201,000 12.072.000 4,164,000 3,254,000 12,245,000 14,277,000 10,306,000 2,716,000 1,066,000 43,864.000 4,272,000 3,197,000 11,643,000 13,495,000 9,342,000 1,979,000 932,000 40,588.000 and uildings & land improvements quipment easehold improvements Construction-in-progress eased property under capital leases & financing obligations otal property, plant & equipment Accumulated depreciation & amortization roperty, plant & equipment, net as Reported Annual Income Statement Ceport Date cale ales ost of sales 15.031.000 13,635,000 9,773,000 2,050,000 1,000,000 41,731,000 20,660,000 21,071,000 10,832,000 3,166,000 966.000 45,847,000 23,976,000 21,871,000 22,229,000 21,635,000 19,572,000 21,016,000 2019 2018 2017 Thousands Thousands 122,662,000 95,662,000 27,000,000 21,568,000 911,000 2,436,000 2,085,000 601,000 Thousands 122,286,000 Gross Profit perating, general & administrative Cent epreciation & amortization perating profit (loss) aterest expense lon-service component of company-sponsored pension plan c lark to market gain (loss) on Ocado International Holdings Limit Sain on sale of businesses let earnings before income tax expense (benefit) acome tax expense (benefit) et earnings after income tax expense (benefit) et earnings (loss) attributable to noncontrolling interests et earnings (loss) attributable to The Kroger Co. dditional Information 95,294,000 26,992,000 21,208,000 884,000 2,649,000 2,251,000 603,000 121,162,000 94,894,000 26,268,000 20,305,000 884,000 2,465,000 2,614,000 620,000 26,000 228,000 1,782,000 3,978,000 900,000 157,000 176,000 1,981,000 469,000 1,512,000 147,000 1,659,000 1,484,000 (405,000) 1,889,000 18,000 1,907,000 3,078,000 32,000 3,110,000 Veighted average shares outstanding - basic Veighted average shares outstanding - diluted ear end shares outstanding 799,000 805,000 788,000 810,000 818,000 798,000 895,000 904,000 870,000

Find the asset turnover for years 2017, 2018, and 2019.

Assets turnover ratio is used to determine the company efficiency to use its total assets to generate the sale income during a year.

Assets turnover ratio is calculated as dividing net sales during year by average total assets.

Assets turnover ratio = Net sales / Average total assets

Average total assets = (Beginning Total assets + Ending total assets) / 2

Calculation of assets turnover for year 2017, 2018, 2019

Year 2017

Net sales= 122,662,000 thousands

Beginning total assets = 36,505,000 thousands

Ending total assets = 37,197,000 thousands

Average total assets = (36,505,000 + 37,197,000) / 2 =36,851,000 thousands

Assets turnover ratio = 122,662,000 / 36,851,000 = 3.33

Year 2018

Net sales= 121,162,000 thousands

Beginning total assets = 37,197,000 thousands

Ending total assets =38,118,000 thousands

Average total assets = (37,197,000 + 38,118,000) / 2 =37,657,500 thousands

Assets turnover ratio = 121,162,000 / 37,657,500 = 3.22

Year 2019

Net sales= 122,286,000 thousands

Beginning total assets = 38,118,000 thousands

Ending total assets = 45,256,000 thousands

Average total assets = (38,118,000 + 45,256,000) / 2 =83,374,000 thousands

Assets turnover ratio = 122,286,000 / 83,374,000 = 1.47

Step by step

Solved in 3 steps