ANDY LIM TRADING Statement of Financial Position As of Decenber 31 Assets 2017 2016 Increase (Decrease) Current Assets Amount Percent Cash Php 158,000 Php 84,000 192,000 200,000 530,000 1,006,000 Short Term Investmert 130,000 240,000 500,000 1,028,000 Php Accourts Receivable, Net Merchandse Invertory Total Current Assets Php Non Current Assets Property, Plart, and Equipmert 2,340,000 3,368,000 2,350,000 3,356,000 Total Assets Php Php Liabilities & Owaner'sEquity Curent Liabilties 530,000 584,000 Non-Currert Liabilities 800,000 1,330,000 2,038,000 3,368,000 Php 840,000 1,424,000 1,932,000 3,356,000 Total Liabilities Ower's Equity Total Liabilities & Owner's Equity Php ANDY LIM TRADING Income Statement As of Decenber 31 2017 2016 Increase (Decrease) Amount Percent Net Sales Cost of Goods Sold Gross Proft Php 4,972.00 3,046.00 1,926.00 1,556.00 Php 4,150.00 Seling and Admin Expenses Operatinh Income Interest Expense Income Before Income Taxes (IBIT) Income Tax E xpense 2,444.00 1,706.00 1,500.00 206 92 370 88 282 114 94 42 Na Income Php 188 Php 72

ANDY LIM TRADING Statement of Financial Position As of Decenber 31 Assets 2017 2016 Increase (Decrease) Current Assets Amount Percent Cash Php 158,000 Php 84,000 192,000 200,000 530,000 1,006,000 Short Term Investmert 130,000 240,000 500,000 1,028,000 Php Accourts Receivable, Net Merchandse Invertory Total Current Assets Php Non Current Assets Property, Plart, and Equipmert 2,340,000 3,368,000 2,350,000 3,356,000 Total Assets Php Php Liabilities & Owaner'sEquity Curent Liabilties 530,000 584,000 Non-Currert Liabilities 800,000 1,330,000 2,038,000 3,368,000 Php 840,000 1,424,000 1,932,000 3,356,000 Total Liabilities Ower's Equity Total Liabilities & Owner's Equity Php ANDY LIM TRADING Income Statement As of Decenber 31 2017 2016 Increase (Decrease) Amount Percent Net Sales Cost of Goods Sold Gross Proft Php 4,972.00 3,046.00 1,926.00 1,556.00 Php 4,150.00 Seling and Admin Expenses Operatinh Income Interest Expense Income Before Income Taxes (IBIT) Income Tax E xpense 2,444.00 1,706.00 1,500.00 206 92 370 88 282 114 94 42 Na Income Php 188 Php 72

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.7BPE

Related questions

Question

100%

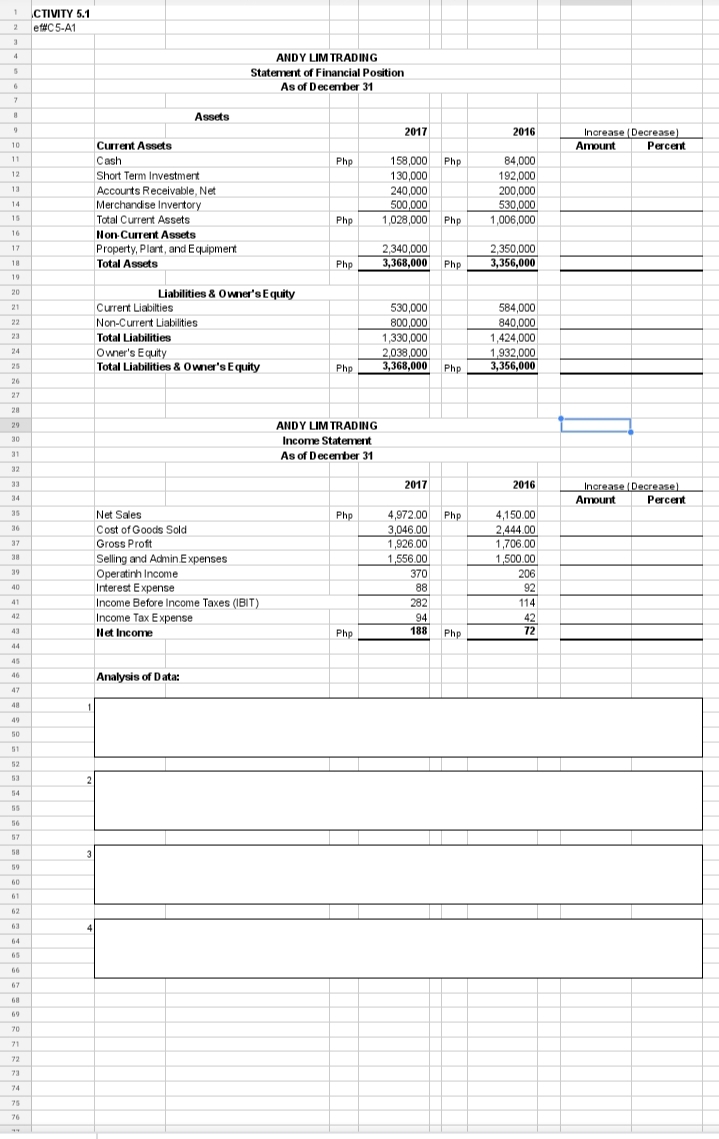

Horizontal Analysis

Presented below are the Comprehensive statement of Financial Position and comparative income statement of Andy Lim Trading . Perform a Horizontal analysis showing the increase of decrease for the year 2017 in comparison to the year 2016.

Transcribed Image Text:CTIVITY 5.1

2 et#C5-A1

4

ANDY LIM TRADING

Statement of Financial Position

As of December 31

Assets

2017

2016

Increase (Decrease)

Amount

10

Current Assets

Percent

Cash

84,000

192,000

200,000

530,000

1,006,000

11

158,000 Php

130,000

240,000

500,000

1,028,000

Php

12

Short Term Investment

13

Accounts Receivable, Net

Merchandise Invertory

Total Current Assets

Non-Current Assets

Property, Plant, and Equipment

14

15

Php

Php

16

17

2,340,000

2,350,000

3,356,000

18

Total Assets

Php

3,368,000

Php

19

20

Liabilities & Owner's Equity

530,000

800,000

Curent Liabilties

584,000

840,000

1,424,000

1,932,000

3,356,000

21

22

Non-Current Liabilities

23

Total Liabilities

1,330.000

24

Owner's Equity

Total Liabilities & Owner's Equity

2,038,000

3,368,000

25

Php

Php

26

27

28

29

ANDY LIM TRADING

30

Income Statement

31

As of December 31

32

2017

2016

Increase (Decrease)

Amount

33

34

Percent

4,150.00

2,444.00

1,706.00

1,500.00

Net Sales

Cost of Goods Sold

4,972.00

3,046.00

1,926.00

1,556.00

370

35

Php

Php

36

37

Gross Proft

38

Selling and Admin Expenses

Operatinh Income

Interest Expense

39

206

40

88

92

Income Before Income Taxes (IBIT)

Income Tax Expense

41

282

114

42

94

188

42

72

43

Net Income

Php

Php

44

45

Analysis of Data:

46

47

48

49

50

51

52

53

54

55

56

57

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning