Sales and marketing cost $150,000/year Operating and maintenance cost S25/operating hour Production time/1,000 units 100 hours Packaging and shipping cost s0.50/unit Planning horizon 5 years Minimum attractive rate of return 15% The managers would like to know the viability of this product and how it would roll out in sales. (a) To give them basis and insight what is the break-even value of units that must be sold annually to keep the product viable? (b) If the target revenue is from 30,000 units sold, what is the expected profit? (c) If the profit drops by 13% due to equipment replacement, how much must have been the cost of the alternative equipment (d) Provide graph for (a)

Sales and marketing cost $150,000/year Operating and maintenance cost S25/operating hour Production time/1,000 units 100 hours Packaging and shipping cost s0.50/unit Planning horizon 5 years Minimum attractive rate of return 15% The managers would like to know the viability of this product and how it would roll out in sales. (a) To give them basis and insight what is the break-even value of units that must be sold annually to keep the product viable? (b) If the target revenue is from 30,000 units sold, what is the expected profit? (c) If the profit drops by 13% due to equipment replacement, how much must have been the cost of the alternative equipment (d) Provide graph for (a)

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

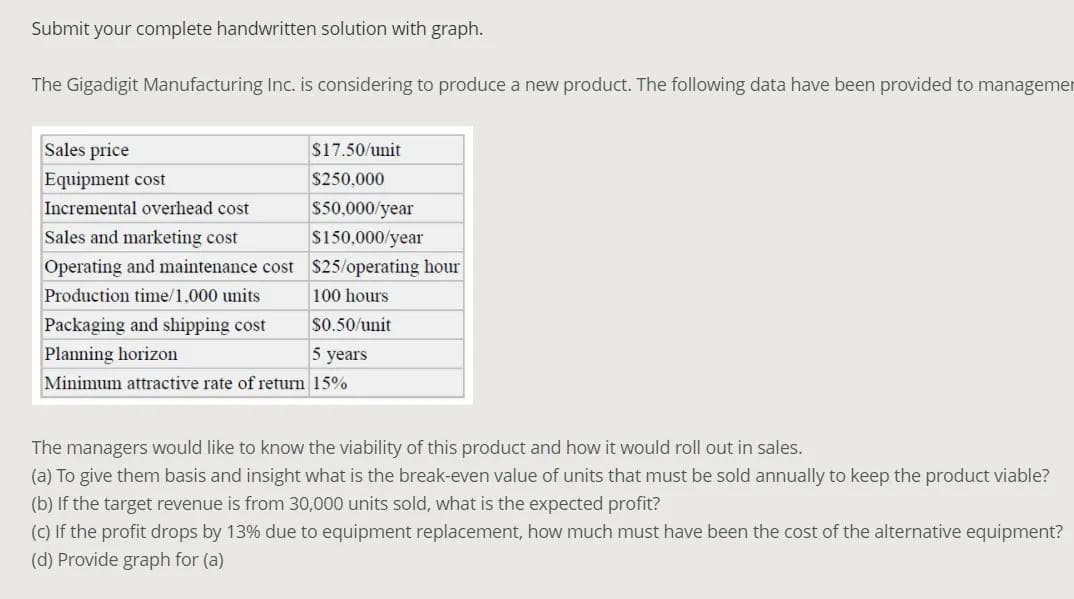

Transcribed Image Text:Submit your complete handwritten solution with graph.

The Gigadigit Manufacturing Inc. is considering to produce a new product. The following data have been provided to managemer

Sales price

$17.50/unit

Equipment cost

$250,000

Incremental overhead cost

$50,000/year

Sales and marketing cost

S150,000/year

Operating and maintenance cost $25/operating hour

Production time/1,000 units

100 hours

Packaging and shipping cost

S0.50/unit

Planning horizon

5 years

Minimum attractive rate of return 15%

The managers would like to know the viability of this product and how it would roll out in sales.

(a) To give them basis and insight what is the break-even value of units that must be sold annually to keep the product viable?

(b) If the target revenue is from 30,000 units sold, what is the expected profit?

(C) If the profit drops by 13% due to equipment replacement, how much must have been the cost of the alternative equipment?

(d) Provide graph for (a)

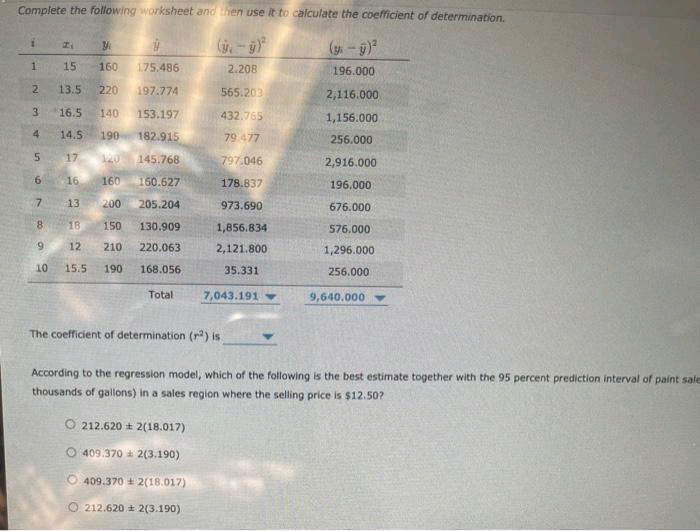

Transcribed Image Text:Complete the following worksheet and then use it to calculate the coefficient of determination.

1.

15

160

175.486

2.208

196.000

2.

13.5

220

197.774

565.203

2,116.000

3

16.5

140

153.197

432.765

1,156.000

4.

14.5

190

182.915

79.477

256.000

17

120

145.768

797.046

2,916.000

6.

16

160

160.627

178.837

196.000

13

200

205.204

973.690

676.000

8.

18

150

130.909

1,856.834

576.000

6.

12

210

220.063

2,121.800

1,296.000

10

15.5

190

168.056

35.331

256.000

Total

7,043.191

9,640.000

The coefficient of determination (r) is

According to the regression model, which of the following is the best estimate together with the 95 percent prediction interval of paint sale

thousands of gallons) in a sales region where the selling price is $12.50?

O 212.620 + 2(18.017)

409.370 a 2(3.190)

409.370 + 2(18.017)

O 212.620 + 2(3.190)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education