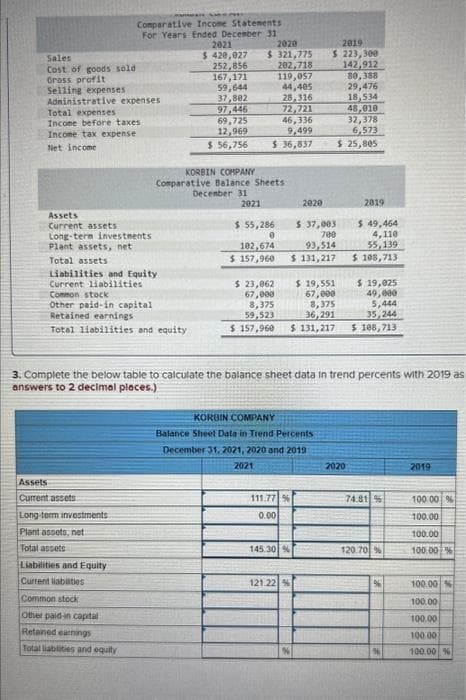

Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes i Income tax expense Net income Comparative Income Statements For Years Ended December 31 Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity ssets Current assets ong-term investments "lant assets, net otal assets iabilities and Equity Current liabaties Common stock 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 KORBIN COMPANY Comparative Balance Sheets December 31 2020 $ 321,775 202,718 119,057 44,405 2021 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 111.77 % 0.00 145.30% 2019 $ 223,300 142,912 121.22 % $ 37,003 700 93,514 $ 131,217 KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 48,010 32,378 6,573 $ 25,805 $ 19,551 67,000 8,375 36,291 $ 23,062 67,000 8,375 59,523 $ 157,960 $ 131,217 $ 108,713 Complete the below table to calculate the balance sheet data in trend percents with 2 swers to 2 decimal places.) 80,388 29,476 18,534 2019 2020 $ 49,464 4,110 55,139 $ 108,713 $ 19,025 49,000 5,444 35,244 74.81 % 120.70 % % 2019 100 100.0 100.0 100.0 100.0 100.C

Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes i Income tax expense Net income Comparative Income Statements For Years Ended December 31 Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity ssets Current assets ong-term investments "lant assets, net otal assets iabilities and Equity Current liabaties Common stock 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 KORBIN COMPANY Comparative Balance Sheets December 31 2020 $ 321,775 202,718 119,057 44,405 2021 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 111.77 % 0.00 145.30% 2019 $ 223,300 142,912 121.22 % $ 37,003 700 93,514 $ 131,217 KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 48,010 32,378 6,573 $ 25,805 $ 19,551 67,000 8,375 36,291 $ 23,062 67,000 8,375 59,523 $ 157,960 $ 131,217 $ 108,713 Complete the below table to calculate the balance sheet data in trend percents with 2 swers to 2 decimal places.) 80,388 29,476 18,534 2019 2020 $ 49,464 4,110 55,139 $ 108,713 $ 19,025 49,000 5,444 35,244 74.81 % 120.70 % % 2019 100 100.0 100.0 100.0 100.0 100.C

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.13MCE

Related questions

Question

Transcribed Image Text:Sales

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

Income before taxes.

Income tax expense

Net income

Assets

Current assets

Long-term investments

Plant assets, net

Total assets

Sin

Comparative Income Statements

For Years Ended December 31

2021

$ 420,027

252,856

167,171

59,644

37,802

97,446

69,725

12,969

$ 56,756

Liabilities and Equity

Current liabilities

Common stock

Other paid-in capital

Retained earnings

Total liabilities and equity

Assets

Current assets

Long-term investments

Plant assets, net.

Total assets

Liabilities and Equity

Current liabaties

Common stock

Other paid-in capital

Retained earnings

Total liabilities and equity

2020

$ 321,775

202,718

KORBIN COMPANY

Comparative Balance Sheets

December 31

2021

119,057

44,405

28,316

72,721

46,336

9,499

$ 36,837

$ 55,286

0

102,674

$ 157,960

2020

3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as

answers to 2 decimal places.)

111.77 %

0.00

$ 37,003

700

93,514

$ 131,217

KORBIN COMPANY

Balance Sheet Data in Trend Percents

December 31, 2021, 2020 and 2019

2021

2019

$ 223,300

142,912

145.30%

121.22 %

$ 19,551

$ 23,062

67,000

8,375

67,000

8,375

36,291

5,444

59,523

35,244

$ 157,960 $ 131,217 $ 108,713

80,388

29,476

18,534

48,010

32,378

6,573

$ 25,805

2819

$ 49,464

4,110

55,139

$ 108,713

$ 19,025

49,000

2020

74.81 %

120.70 %

%

2019

100.00 %

100.00

100.00

100.00 %

100.00

100.00

100.00

100.00

100.00 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning