Sam bought a house that costs $1,000,000. Sam got a 97% LTV loan. The lender demanded that Sam buy private mortgage insurance to insure the portion of the loan over 80% LTV. Suppose 5 years later, Sam's mortgage balance is $900,000. However Sam defaults and his house sells for $750,000 in a foreclosure auction. How much will the mortgage insurance company pay Sam's lender? OA. $170,000.00 O B. $250,000.00 OC. $150,000.00 O D. $220,000.00

Sam bought a house that costs $1,000,000. Sam got a 97% LTV loan. The lender demanded that Sam buy private mortgage insurance to insure the portion of the loan over 80% LTV. Suppose 5 years later, Sam's mortgage balance is $900,000. However Sam defaults and his house sells for $750,000 in a foreclosure auction. How much will the mortgage insurance company pay Sam's lender? OA. $170,000.00 O B. $250,000.00 OC. $150,000.00 O D. $220,000.00

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.58TI: What is the total effect on the economy of a government tax rebate of $500 to each household in...

Related questions

Question

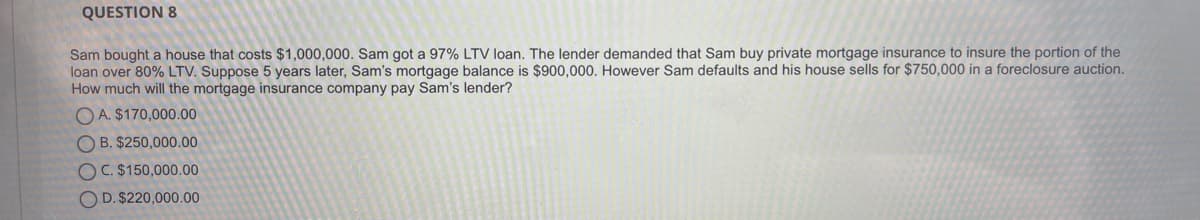

Transcribed Image Text:QUESTION 8

Sam bought a house that costs $1,000,000. Sam got a 97% LTV loan. The lender demanded that Sam buy private mortgage insurance to insure the portion of the

loan over 80% LTV. Suppose 5 years later, Sam's mortgage balance is $900,000. However Sam defaults and his house sells for $750,000 in a foreclosure auction.

How much will the mortgage insurance company pay Sam's lender?

O A. $170,000.00

O B. $250,000.00

OC. $150,000.00

O D. $220,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you