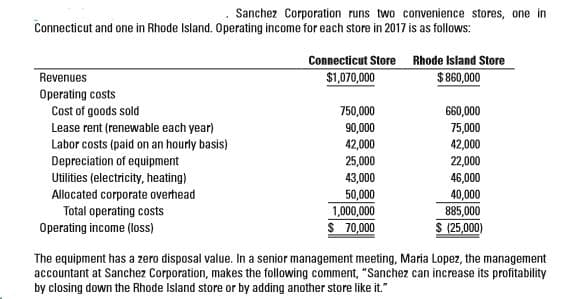

Sanchez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows: Connecticut Store Rhode Island Store Revenues $1,070,000 $ 860,000 Operating costs Cost of goods sold 750,000 660,000 Lease rent (renewable each year) Labor costs (paid on an hourly basis) 90,000 42,000 75,000 42,000 Depreciation of equipment 25,000 22,000 Utilities (electricity, heating) 43,000 46,000 40,000 Allocated corporate overhead Total operating costs 50,000 1,000,000 $ 70,000 885,000 Operating income (loss) S (25,000) The equipment has a zero disposal value. In a senior management meeting, Maria Lopez, the management accountant at Sanchez Corporation, makes the following comment, "Sanchez can increase its profitability by closing down the Rhode Island store or by adding another store like it."

Sanchez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows: Connecticut Store Rhode Island Store Revenues $1,070,000 $ 860,000 Operating costs Cost of goods sold 750,000 660,000 Lease rent (renewable each year) Labor costs (paid on an hourly basis) 90,000 42,000 75,000 42,000 Depreciation of equipment 25,000 22,000 Utilities (electricity, heating) 43,000 46,000 40,000 Allocated corporate overhead Total operating costs 50,000 1,000,000 $ 70,000 885,000 Operating income (loss) S (25,000) The equipment has a zero disposal value. In a senior management meeting, Maria Lopez, the management accountant at Sanchez Corporation, makes the following comment, "Sanchez can increase its profitability by closing down the Rhode Island store or by adding another store like it."

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

By closing down the Rhode Island store, Sanchez can reduce overall corporate overhead costs by $44,000. Calculate Sanchez’s operating income if it closes the Rhode Island store. Is Maria Lopez’s statement about the effect of closing the Rhode Island store correct? Explain.

Transcribed Image Text:Sanchez Corporation runs two convenience stores, one in

Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows:

Connecticut Store Rhode Island Store

Revenues

$1,070,000

$ 860,000

Operating costs

Cost of goods sold

750,000

660,000

Lease rent (renewable each year)

Labor costs (paid on an hourly basis)

90,000

42,000

75,000

42,000

Depreciation of equipment

25,000

22,000

Utilities (electricity, heating)

43,000

46,000

40,000

Allocated corporate overhead

Total operating costs

50,000

1,000,000

$ 70,000

885,000

Operating income (loss)

S (25,000)

The equipment has a zero disposal value. In a senior management meeting, Maria Lopez, the management

accountant at Sanchez Corporation, makes the following comment, "Sanchez can increase its profitability

by closing down the Rhode Island store or by adding another store like it."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College