Seaport Corp. had the follow February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31, 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2025. Required: 1. Please carefully record each transaction in general journal form. 2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded during the year for any item.)

Seaport Corp. had the follow February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31, 2025. April 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650 remained on hand. November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2025. Required: 1. Please carefully record each transaction in general journal form. 2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded during the year for any item.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section3.4: Starting A New Journal

Problem 1WT

Related questions

Question

Transcribed Image Text:View History Bookmarks Profiles Tab Window Help

1- Proctoring Enable X

tproctorio.com/secured#lockdown

ng Enabled: Chapter 2 Required Homewor...

+

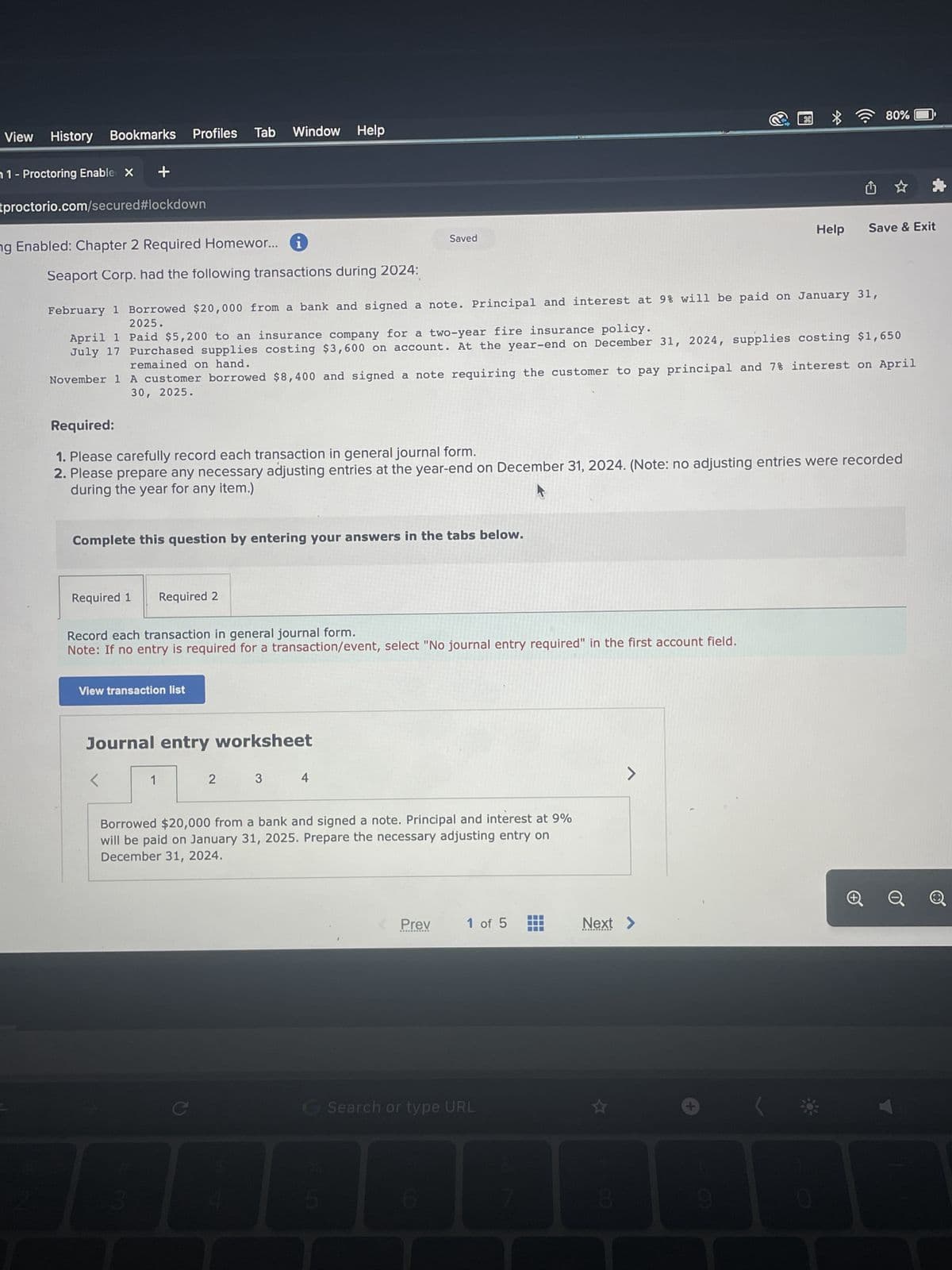

Seaport Corp. had the following transactions during 2024:

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,

2025.

April 1

Paid $5,200 to an insurance company for a two-year fire insurance policy.

July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650

remained on hand.

November 1

A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April

30, 2025.

Record each transaction in general journal form.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Required:

1. Please carefully record each transaction in general journal form.

2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded

during the year for any item.)

Journal entry worksheet

<

1

3

Saved

2

3

4

Borrowed $20,000 from a bank and signed a note. Principal and interest at 9%

will be paid on January 31, 2025. Prepare the necessary adjusting entry on

December 31, 2024.

Prev

1 of 5

G Search or type URL

III

=

>

Next >

8

26

+

9

Help

80%

0

Save & Exit

Transcribed Image Text:Edit View

View History Bookmarks Profiles Tab

Question 1 - Proctoring Enable X +

getproctorio.com/secured#lockdown

1

Proctoring Enabled: Chapter 2 Required Homewor... 1

Mc

Graw

Hill

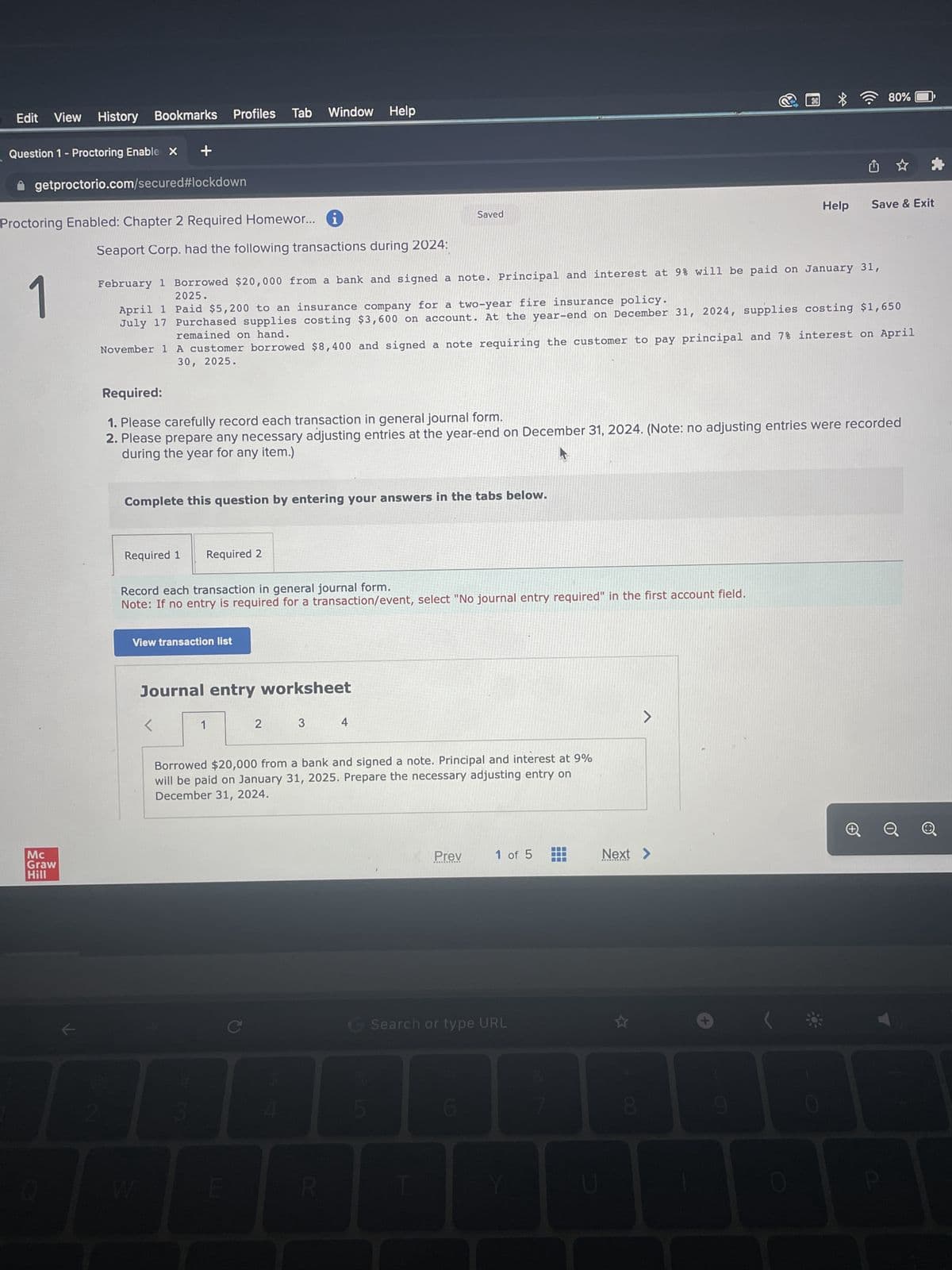

Seaport Corp. had the following transactions during 2024:

Required 1

February 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,

2025.

April 1

Paid $5,200 to an insurance company for a two-year fire insurance policy.

July 17 Purchased supplies costing $3,600 on account. At the year-end on December 31, 2024, supplies costing $1,650

remained on hand.

Complete this question by entering your answers in the tabs below.

Window Help

November 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April

30, 2025.

Required 2

Required:

1. Please carefully record each transaction in general journal form.

2. Please prepare any necessary adjusting entries at the year-end on December 31, 2024. (Note: no adjusting entries were recorded

during the year for any item.)

View transaction list

Record each transaction in general journal form.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

<

Journal entry worksheet

1

2

E

Saved

3 4

Borrowed $20,000 from a bank and signed a note. Principal and interest at 9%

will be paid on January 31, 2025. Prepare the necessary adjusting entry on

December 31, 2024.

R

5

Prev

1 of 5

Search or type URL

7

▬

J

Next >

8

Help

80%

+

Save & Exit

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning