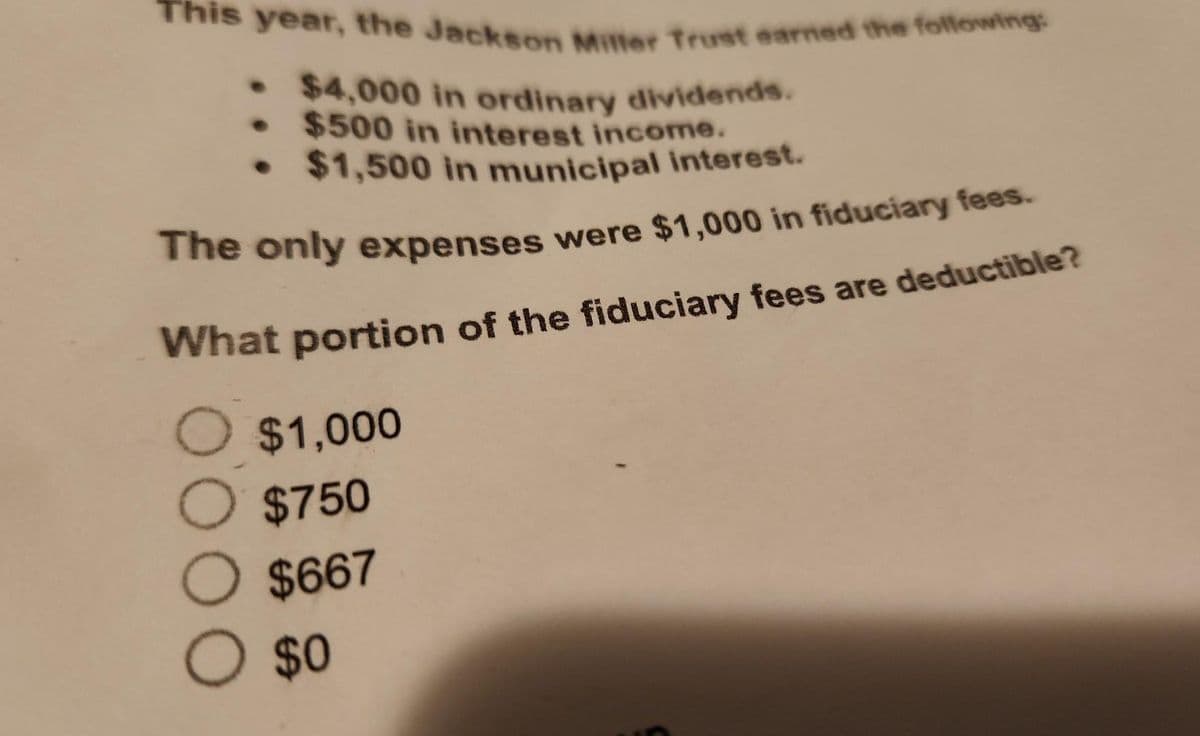

This year, the Jackson Miller Trust earned the following: . $4,000 in ordinary dividends. • $500 in interest income. • $1,500 in municipal interest. The only expenses were $1,000 in fiduciary fees. What portion of the fiduciary fees are deductible? $1,000 O $750 O $667 O $0

This year, the Jackson Miller Trust earned the following: . $4,000 in ordinary dividends. • $500 in interest income. • $1,500 in municipal interest. The only expenses were $1,000 in fiduciary fees. What portion of the fiduciary fees are deductible? $1,000 O $750 O $667 O $0

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 12CE

Related questions

Question

Transcribed Image Text:This year, the Jackson Miller Trust earned the following:

$4,000 in ordinary dividends.

• $500 in interest income.

• $1,500 in municipal interest.

The only expenses were $1,000 in fiduciary fees.

What portion of the fiduciary fees are deductible?

O $1,000

O $750

O $667

O $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you