SECTION A Answer ALL the questions in this section. QUESTION ONE INFORMATION: The following information was extracted from the accounting records of Leeds Limited for the month ended 30 April 2021: INFORMATION There is no inventory on hand at the beginning of the month of April for Leeds Limited. The total expected production and sales are 75 000 units and 70 000 units respectively. The selling price per unit is R12. The company's expenses can be broken down as follows: DO 4 F0O

SECTION A Answer ALL the questions in this section. QUESTION ONE INFORMATION: The following information was extracted from the accounting records of Leeds Limited for the month ended 30 April 2021: INFORMATION There is no inventory on hand at the beginning of the month of April for Leeds Limited. The total expected production and sales are 75 000 units and 70 000 units respectively. The selling price per unit is R12. The company's expenses can be broken down as follows: DO 4 F0O

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 3AP

Related questions

Question

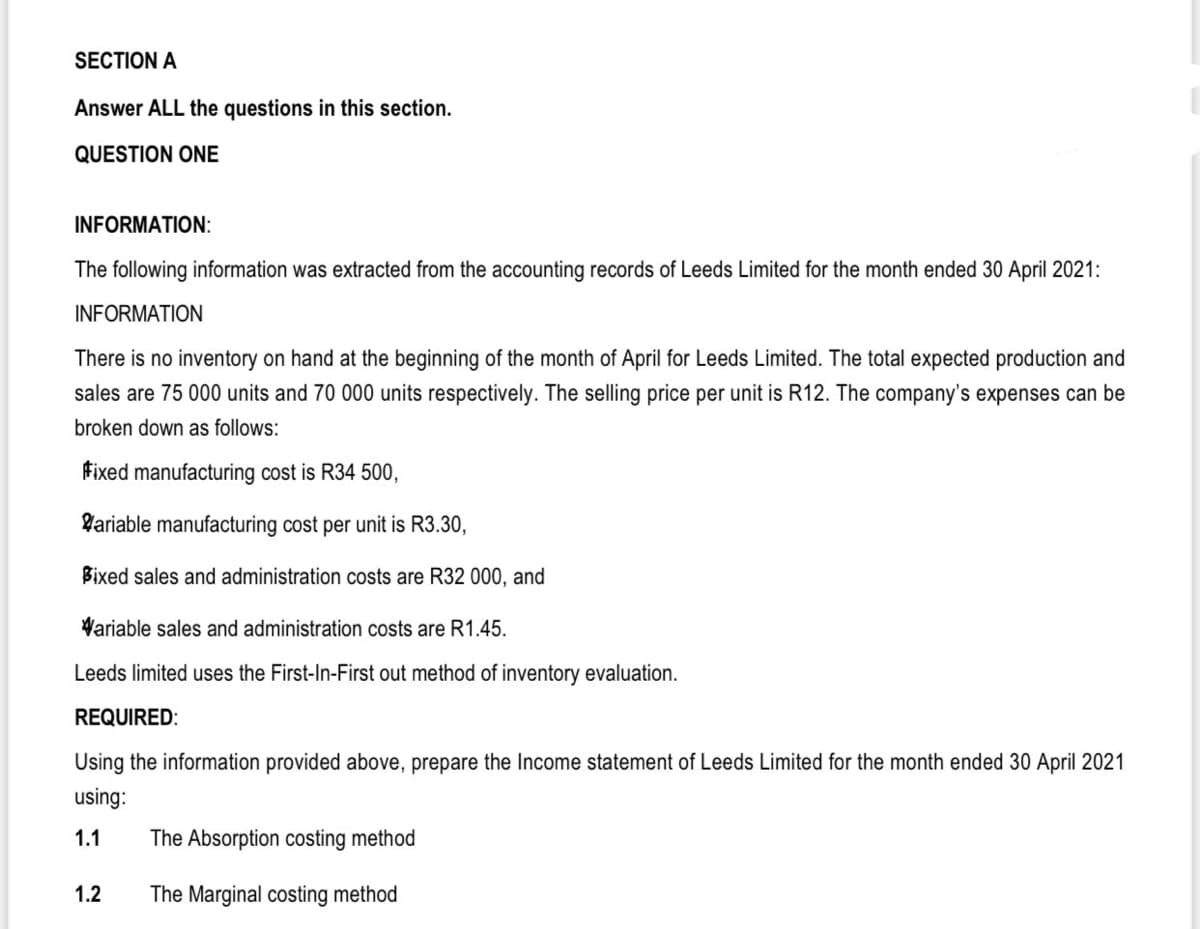

Transcribed Image Text:SECTION A

Answer ALL the questions in this section.

QUESTION ONE

INFORMATION:

The following information was extracted from the accounting records of Leeds Limited for the month ended 30 April 2021:

INFORMATION

There is no inventory on hand at the beginning of the month of April for Leeds Limited. The total expected production and

sales are 75 000 units and 70 000 units respectively. The selling price per unit is R12. The company's expenses can be

broken down as follows:

fixed manufacturing cost is R34 500,

Variable manufacturing cost per unit is R3.30,

Bixed sales and administration costs are R32 000, and

Variable sales and administration costs are R1.45.

Leeds limited uses the First-In-First out method of inventory evaluation.

REQUIRED:

Using the information provided above, prepare the Income statement of Leeds Limited for the month ended 30 April 2021

using:

1.1

The Absorption costing method

1.2

The Marginal costing method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning