Select one: O a. decrease, and the quantity sold in the market will decrease. O b. increase, and the quantity sold in the market will decrease. O c. increase, and the quantity sold in the market will increase. O d. decrease, and the quantity sold in the market will increase.

Select one: O a. decrease, and the quantity sold in the market will decrease. O b. increase, and the quantity sold in the market will decrease. O c. increase, and the quantity sold in the market will increase. O d. decrease, and the quantity sold in the market will increase.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 6CQQ

Related questions

Question

Answer please

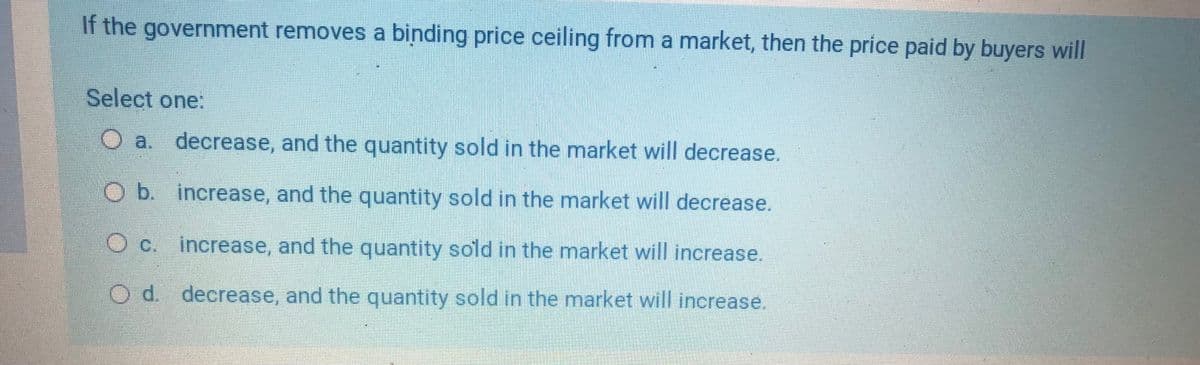

Transcribed Image Text:If the government removes a binding price ceiling from a market, then the price paid by buyers will

Select one:

O a. decrease, and the quantity sold in the market will decrease.

b.

increase, and the quantity sold in the market will decrease.

Oc.

increase, and the quantity sold in the market will increase.

d. decrease, and the quantity sold in the market will increase.

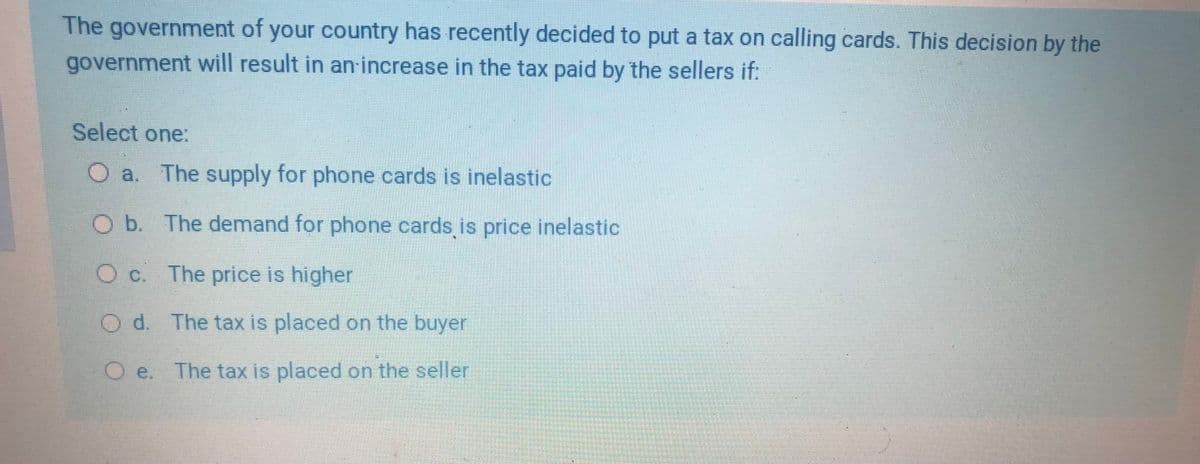

Transcribed Image Text:The government of your country has recently decided to put a tax on calling cards. This decision by the

government will result in an-increase in the tax paid by the sellers if:

Select one:

O a. The supply for phone cards is inelastic

Ob. The demand for phone cards is price inelastic

O c. The price is higher

O d. The tax is placed on the buyer

O e. The tax is placed on the seller

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning