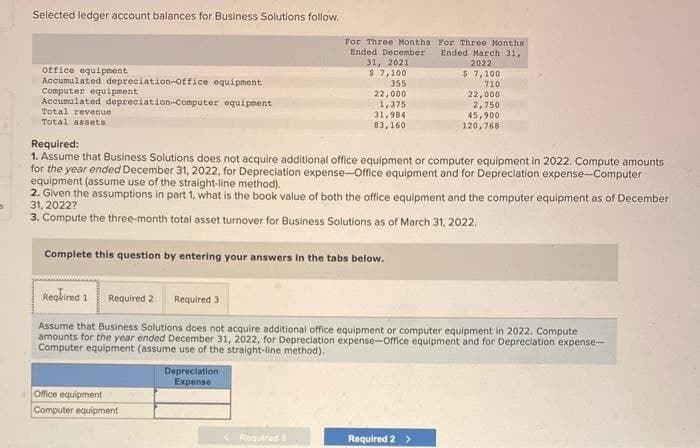

Selected ledger account balances for Business Solutions follow. office equipment Accumulated depreciation-office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets Office equipment Computer equipment For Three Months For Three Months Ended December Ended March 31, 2022 $ 7,100 710 22,000 2,750 45,900 120,768 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. Complete this question by entering your answers in the tabs below. Depreciation Expense 31, 2021 $ 7,100 355 Required 1 Required 2 Required 3 Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense- Computer equipment (assume use of the straight-line method). Required 22,000 1,375 31,9841 83,160 Required 2 >

Selected ledger account balances for Business Solutions follow. office equipment Accumulated depreciation-office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets Office equipment Computer equipment For Three Months For Three Months Ended December Ended March 31, 2022 $ 7,100 710 22,000 2,750 45,900 120,768 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. Complete this question by entering your answers in the tabs below. Depreciation Expense 31, 2021 $ 7,100 355 Required 1 Required 2 Required 3 Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense- Computer equipment (assume use of the straight-line method). Required 22,000 1,375 31,9841 83,160 Required 2 >

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter14: Adjustments And The Work Sheet For A Merchandising Business

Section: Chapter Questions

Problem 10SPA: COMPLETION OF A WORK SHEET SHOWING A NET LOSS The trial balance for Cascade Bicycle Shop, a business...

Related questions

Question

Transcribed Image Text:5

Selected ledger account balances for Business Solutions follow.

office equipment

Accumulated depreciation-office equipment

Computer equipment

Accumulated depreciation-Computer equipment

Total revenue

Total assets

For Three Months For Three Months

Ended December Ended March 31,

31, 2021

2022

$ 7,100

$ 7,100

355

710

Required:

1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts

for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense-Computer

equipment (assume use of the straight-line method).

22,000

1,375

31,984

83,160

2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December

31, 2022?

3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022.

Complete this question by entering your answers in the tabs below.

Office equipment

Computer equipment

Depreciation

Expense

Required 1

Required 2 Required 3

Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute

amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense-

Computer equipment (assume use of the straight-line method).

Required t

22,000

2,750

45,900

120,768

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning