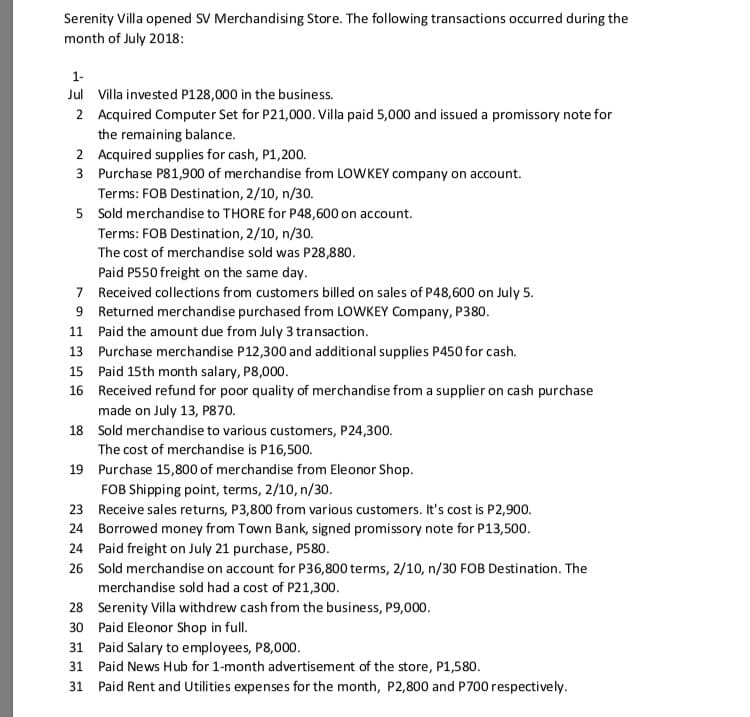

Serenity Villa opened SvV Merchandising Store. The following transactions occurred during the month of July 2018: 1- Jul Villa invested P128,000 in the business. 2 Acquired Computer Set for P21,000. Villa paid 5,000 and issued a promissory note for the remaining balance. 2 Acquired supplies for cash, P1,200. 3 Purchase P81,900 of merchandise from LOWKEY company on account. Terms: FOB Destination, 2/10, n/30. 5 Sold merchandise to THORE for P48,600 on account. Terms: FOB Destination, 2/10, n/30. The cost of merchandise sold was P28,880. Paid P550 freight on the same day. 7 Received collections from customers billed on sales of P48,600 on July 5. 9 Returned merchandise purchased from LOWKEY Company, P380. 11 Paid the amount due from July 3 transaction. 13 Purchase merchandise P12,300 and additional supplies P450 for cash. 15 Paid 15th month salary, P8,000. 16 Received refund for poor quality of merchandise from a supplier on cash purchase made on July 13, P870. 18 Sold merchandise to various customers, P24,300. The cost of merchandise is P16,500. 19 Purchase 15,800 of merchandise from Eleonor Shop. FOB Shipping point, terms, 2/10, n/30. 23 Receive sales returns, P3,800 from various customers. It's cost is P2,900. 24 Borrowed money from Town Bank, signed promissory note for P13,500. 24 Paid freight on July 21 purchase, P580. 26 Sold merchandise on account for P36,800 terms, 2/10, n/30 FOB Destination. The merchandise sold had a cost of P21,300. 28 Serenity Villa withdrew cash from the business, P9,000. 30 Paid Eleonor Shop in full. 31 Paid Salary to employees, P8,000. 31 Paid News Hub for 1-month advertisement of the store, P1,580. 31 Paid Rent and Utilities expenses for the month, P2,800 and P700 respectively.

Serenity Villa opened SvV Merchandising Store. The following transactions occurred during the month of July 2018: 1- Jul Villa invested P128,000 in the business. 2 Acquired Computer Set for P21,000. Villa paid 5,000 and issued a promissory note for the remaining balance. 2 Acquired supplies for cash, P1,200. 3 Purchase P81,900 of merchandise from LOWKEY company on account. Terms: FOB Destination, 2/10, n/30. 5 Sold merchandise to THORE for P48,600 on account. Terms: FOB Destination, 2/10, n/30. The cost of merchandise sold was P28,880. Paid P550 freight on the same day. 7 Received collections from customers billed on sales of P48,600 on July 5. 9 Returned merchandise purchased from LOWKEY Company, P380. 11 Paid the amount due from July 3 transaction. 13 Purchase merchandise P12,300 and additional supplies P450 for cash. 15 Paid 15th month salary, P8,000. 16 Received refund for poor quality of merchandise from a supplier on cash purchase made on July 13, P870. 18 Sold merchandise to various customers, P24,300. The cost of merchandise is P16,500. 19 Purchase 15,800 of merchandise from Eleonor Shop. FOB Shipping point, terms, 2/10, n/30. 23 Receive sales returns, P3,800 from various customers. It's cost is P2,900. 24 Borrowed money from Town Bank, signed promissory note for P13,500. 24 Paid freight on July 21 purchase, P580. 26 Sold merchandise on account for P36,800 terms, 2/10, n/30 FOB Destination. The merchandise sold had a cost of P21,300. 28 Serenity Villa withdrew cash from the business, P9,000. 30 Paid Eleonor Shop in full. 31 Paid Salary to employees, P8,000. 31 Paid News Hub for 1-month advertisement of the store, P1,580. 31 Paid Rent and Utilities expenses for the month, P2,800 and P700 respectively.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PB: Hajun Company started its business on May 1, 2019. The following transactions occurred during the...

Related questions

Question

100%

Prepare a Statement of financial performance

Transcribed Image Text:Serenity Villa opened SV Merchandising Store. The following transactions occurred during the

month of July 2018:

1-

Jul Villa invested P128,000 in the business.

2 Acquired Computer Set for P21,000. Villa paid 5,000 and issued a promissory note for

the remaining balance.

2 Acquired supplies for cash, P1,200.

3 Purchase P81,900 of merchandise from LOWKEY company on account.

Terms: FOB Destination, 2/10, n/30.

5 Sold merchandise to THORE for P48,600 on account.

Terms: FOB Destination, 2/10, n/30.

The cost of merchandise sold was P28,880.

Paid P550 freight on the same day.

7 Received collections from customers billed on sales of P48,600 on July 5.

9 Returned merchandise purchased from LOWKEY Company, P380.

11 Paid the amount due from July 3 transaction.

13 Purcha se merchandise P12,300 and additional supplies P450 for cash.

15 Paid 15th month salary, P8,000.

16 Received refund for poor quality of merchandise from a supplier on cash purchase

made on July 13, P870.

18 Sold merchandise to various customers, P24,300.

The cost of merchandise is P16,500.

19 Purchase 15,800 of merchandise from Eleonor Shop.

FOB Shipping point, terms, 2/10, n/30.

23 Receive sales returns, P3,800 from various customers. It's cost is P2,900.

24 Borrowed money from Town Bank, signed promissory note for P13,500.

24 Paid freight on July 21 purchase, P580.

26 Sold merchandise on account for P36,800 terms, 2/10, n/30 FOB Destination. The

merchandise sold had a cost of P21,300.

28 Serenity Villa withdrew cash from the business, P9,000.

30 Paid Eleonor Shop in full.

31 Paid Salary to employees, P8,000.

31 Paid News Hub for 1-month advertisement of the store, P1,580.

31 Paid Rent and Utilities expenses for the month, P2,800 and P700 respectively.

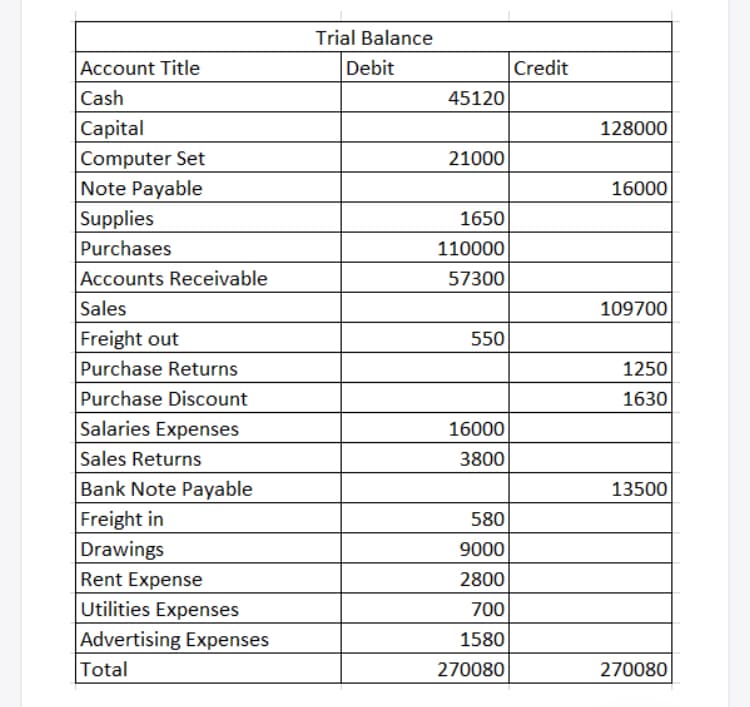

Transcribed Image Text:Trial Balance

Account Title

Debit

Credit

Cash

45120

Capital

|Computer Set

Note Payable

Supplies

128000

21000

16000

1650

Purchases

110000

Accounts Receivable

57300

Sales

109700

Freight out

Purchase Returns

Purchase Discount

Salaries Expenses

Sales Returns

Bank Note Payable

Freight in

Drawings

Rent Expense

Utilities Expenses

Advertising Expenses

Total

550

1250

1630

16000

3800

13500

580

9000

2800

700

1580

270080

270080

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning