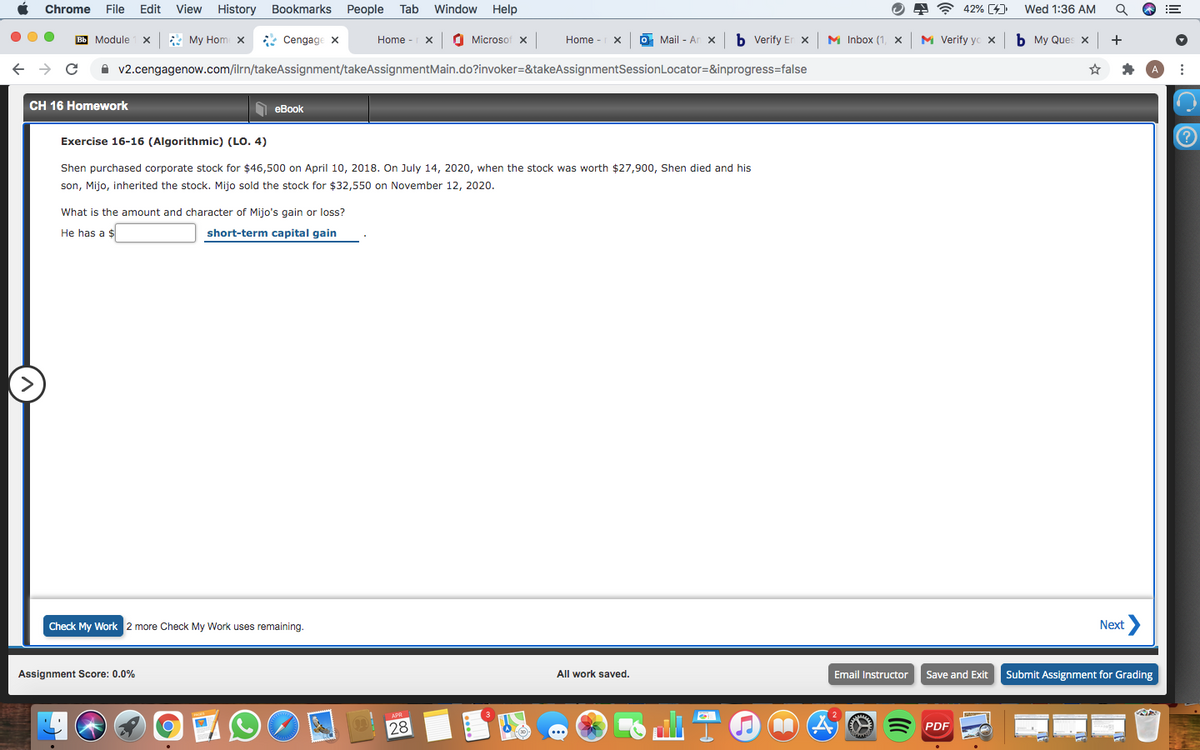

Shen purchased corporate stock for $46,500 on April 10, 2018. On July 14, 2020, when the stock was worth $27,900, Shen died and his son, Mijo, inherited the stock. Mijo sold the stock for $32,550 on November 12, 2020.

Shen purchased corporate stock for $46,500 on April 10, 2018. On July 14, 2020, when the stock was worth $27,900, Shen died and his son, Mijo, inherited the stock. Mijo sold the stock for $32,550 on November 12, 2020.

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

Shen purchased corporate stock for $46,500 on April 10, 2018. On July 14, 2020, when the stock was worth $27,900, Shen died and his son, Mijo, inherited the stock. Mijo sold the stock for $32,550 on November 12, 2020.

Transcribed Image Text:Chrome

File

Edit

View History

Bookmarks

Реople

Tab

Window

Help

學令 42% [幻

Wed 1:36 AM

Вы Мodule

* My Hom x

* Cengage x

Home - X

O Microsof x

O Mail - Ar

b Verify Er x

M Inbox (1, x

M Verify yo x

b My Ques x

Home -

A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

CH 16 Homework

O eBook

Exercise 16-16 (Algorithmic) (LO. 4)

Shen purchased corporate stock for $46,500 on April 10, 2018. On July 14, 2020, when the stock was worth $27,900, Shen died and his

son, Mijo, inherited the stock. Mijo sold the stock for $32,550 on November 12, 2020.

What is the amount and character of Mijo's gain or loss?

He has a $

short-term capital gain

Check My Work 2 more Check My Work uses remaining.

Next>

Assignment Score: 0.0%

All work saved.

Email Instructor

Save and Exit

Submit Assignment for Grading

28

PDF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you