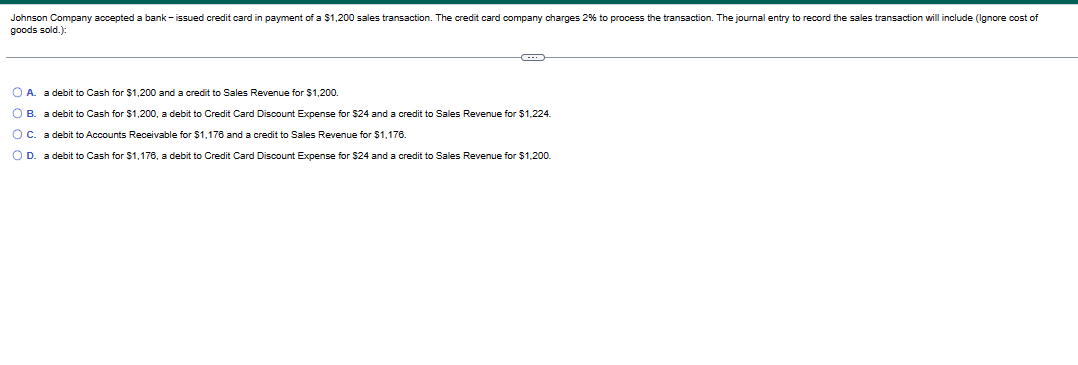

Johnson Company accepted a bank-issued credit card in payment of a $1,200 sales transaction. The credit card company charges 2% to process the transaction. The journal entry to record the sales transaction will include (Ignore cost of goods sold.): OA a debit to Cash for $1,200 and a credit to Sales Revenue for $1,200. OB. a debit to Cash for $1,200, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,224. O C. a debit to Accounts Receivable for $1,176 and a credit to Sales Revenue for $1,176. O D. a debit to Cash for $1,176, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,200

Johnson Company accepted a bank-issued credit card in payment of a $1,200 sales transaction. The credit card company charges 2% to process the transaction. The journal entry to record the sales transaction will include (Ignore cost of goods sold.): OA a debit to Cash for $1,200 and a credit to Sales Revenue for $1,200. OB. a debit to Cash for $1,200, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,224. O C. a debit to Accounts Receivable for $1,176 and a credit to Sales Revenue for $1,176. O D. a debit to Cash for $1,176, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,200

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4Q: American Signs allows customers to pay with their Jones credit card and cash. Jones charges American...

Related questions

Question

Quesiotn attached thanks for the help

1l3pt13pg13lpg41lhp2oth2tpoh2

arg

leol

Transcribed Image Text:Johnson Company accepted a bank-issued credit card in payment of a $1,200 sales transaction. The credit card company charges 2% to process the transaction. The journal entry to record the sales transaction will include (Ignore cost of

goods sold.):

O A. a debit to Cash for $1,200 and a credit Sales Revenue for $1,200.

O B. a debit to Cash for $1,200, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,224.

O C. a debit to Accounts Receivable for $1,176 and a credit to Sales Revenue for $1,176.

O D. a debit to Cash for $1,176, a debit to Credit Card Discount Expense for $24 and a credit to Sales Revenue for $1,200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub