Shining Star LLC come Statement for the year ending 31 December 2019 t Sales OMR 25000 st of Goods Sold 7000 Gross Profit 18000 erating Expenses 8000 Operating 10000 ome her Income: terest Income 4000 t Income OMR 14000 he company must pay an income z expense on its profit and the tax e is 30%, determine the Net come after-tax ect one: а. OMR 10000 b. OMR 9800 с. OMR 18200

Shining Star LLC come Statement for the year ending 31 December 2019 t Sales OMR 25000 st of Goods Sold 7000 Gross Profit 18000 erating Expenses 8000 Operating 10000 ome her Income: terest Income 4000 t Income OMR 14000 he company must pay an income z expense on its profit and the tax e is 30%, determine the Net come after-tax ect one: а. OMR 10000 b. OMR 9800 с. OMR 18200

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 15P: Use the following income statement of Elliott Game Theory Consulting to determine its net operating...

Related questions

Question

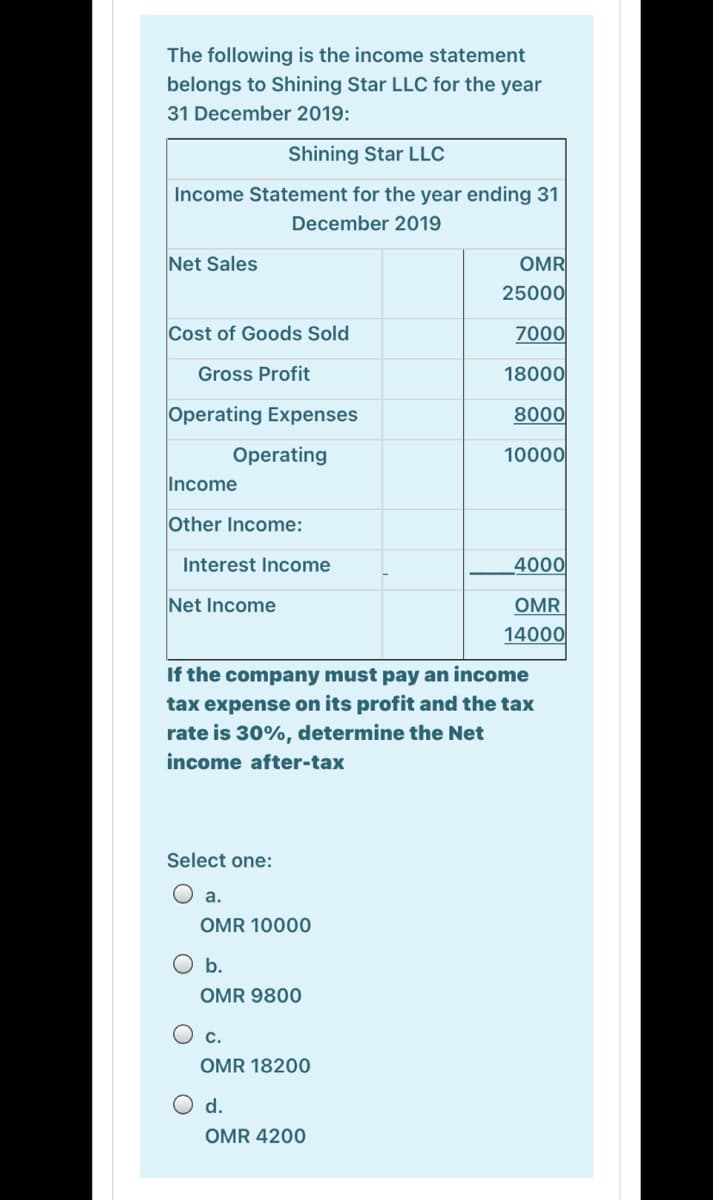

Transcribed Image Text:The following is the income statement

belongs to Shining Star LLC for the year

31 December 2019:

Shining Star LLC

Income Statement for the year ending 31

December 2019

Net Sales

OMR

25000

Cost of Goods Sold

7000

Gross Profit

18000

Operating Expenses

8000

Operating

10000

Income

Other Income:

Interest Income

4000

Net Income

OMR

14000

If the company must pay an income

tax expense on its profit and the tax

rate is 30%, determine the Net

income after-tax

Select one:

O a.

OMR 10000

O b.

OMR 9800

C.

OMR 18200

O d.

OMR 4200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning