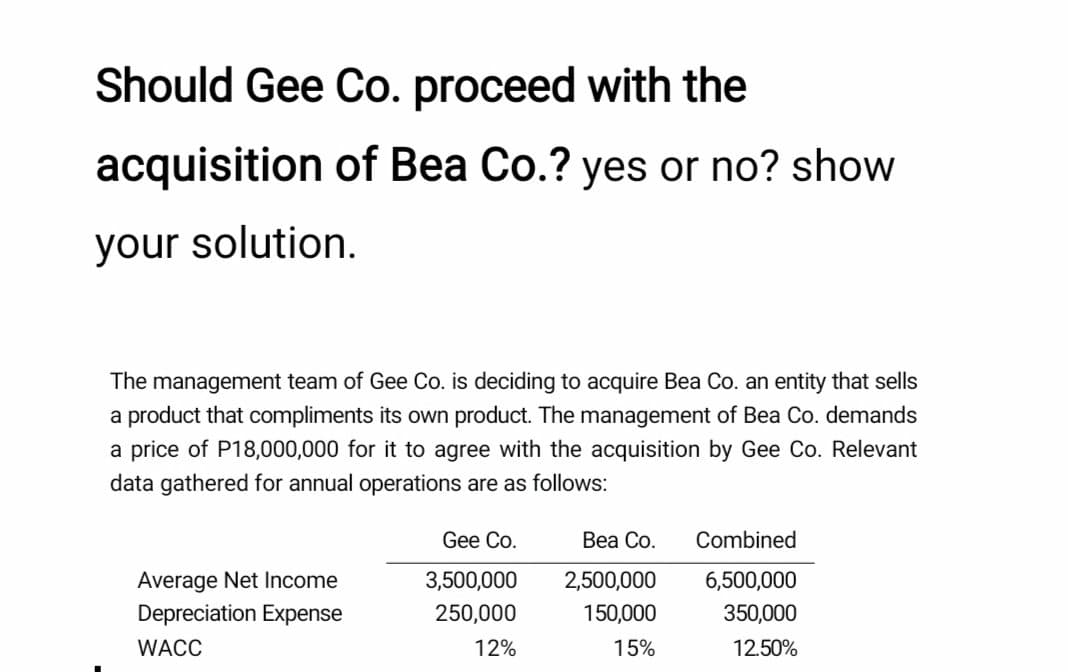

Should Gee Co. proceed with the acquisition of Bea Co.? yes or no? show your solution. The management team of Gee Co. is deciding to acquire Bea Co. an entity that sells a product that compliments its own product. The management of Bea Co. demands a price of P18,000,000 for it to agree with the acquisition by Gee Co. Relevant data gathered for annual operations are as follows: Gee Co. Вea Co. Combined Average Net Income 3,500,000 2,500,000 6,500,000 Depreciation Expense 250,000 150,000 350,000 WACC 12% 15% 12.50%

Q: What was consolidated cost of goods sold?

A: COGS = Opening Inventory + Purchases - Closing Inventory

Q: The financial manager of Company A is evaluating Company B as a possible acquisition. Company B is…

A: Acquisition of other company's business is known as business acquisition. Under acquisition, all…

Q: In which of the following situations would Martinez Indus-tries include goodwill in its balance…

A: Goodwill: Goodwill is an intangible asset. It is defined as the excess of cost of an acquired…

Q: From the data given, compute the goodwill or gain from bargain purchase for the different items.…

A: Goodwill is an intangible asset that is related to the takeover of one company by another. In fact,…

Q: Lion Company is considering the acquisition of Tiger Company, Inc. early in 2018. To assess the…

A: Goodwill is an intangible asset which is related with the purchase of one company by another.…

Q: BBB,Inc sells its unprofitable division A at a gain of $20,000. Before the sale, division A had a…

A: We know that continuing operations means the operating activities of the company which it undertakes…

Q: An entity is planning to sell the business to new interests. The cumulative net earnings for the…

A: At the time of purchase or acquisition of any business or empire, sometimes amount paid for…

Q: Choose the correct. Dosmann, Inc., bought all outstanding shares of Lizzi Corporation on January 1,…

A: The explanation for the given options: a) The additional $110,000 payment is a reduction in…

Q: Buyer Company purchased Target Company for $800,000 cash. Target Company had total liabilities of…

A: Goodwill means the reputation which a firm enjoy because any factor like good after sale service ,…

Q: The following are several figures reported for Allister and Barone as of December 31, 2021:…

A: To determine balances for the above-mentioned items that would appear on Allister's consolidated…

Q: If PROMDI Co., a new company would acquire the net assets of CARDO Co and SYANO Co. PROMDI Co will…

A: Goodwill is an intangible asset that is related to the takeover of one company by another. In fact,…

Q: Toni Skysong Inc. has the folowing amountS reported in its general ledger at the end or the current…

A: Intangible assets are those assets which can not be seen or touched but are related to business such…

Q: Mickey Inc. is considering purchasing the net assets of Minnie Corporation. Mickey has been given…

A: Answer) Calculation of Value of Goodwill Goodwill = Amount paid to purchase the company – (Fair…

Q: Financial Corporation wants to acquire Great Western Inc. Financial has estimated the enterprise…

A: Data given: Estimated enterprise value = $104 million Market value of long- term debt = $15 million…

Q: If PROMDI Co., a new company would acquire the net assets of CARDO Co and SYANO Co. PROMDI Co will…

A: PROMDI CO. acquired the net assets of CARDO CO and SYANO CO Purchase consideration of CARDO CO =…

Q: Pillow Company is purchasing an 80% interest in the common stock of Sleep Company. Sleep’s balance…

A: a.

Q: ABC Co. is contemplating on acquiring XYZ Inc. The following information was gathered through a…

A: Goodwill is recorded by an organization when it acquires assets and liabilities by paying price that…

Q: ccur on March 31, 2013, at an estimated gain of $375,500. The segment had actual and estimated…

A: Operating profit: Operating profit: operating profit can be defined as profit earned from ordinary…

Q: ABC Corporation will be acquiring XYZ Corporation. The latter's fair value has not yet been…

A: In the context of the given question, we need to determine the value of control over XYZ company…

Q: Gulf sands LLC Company had two operating divisions. One division manufactured washing machine and…

A: As per the requirement of the question, we will answer “c” part.

Q: On September 15, 2020, ZTH Inc.'s Board of Directors developed a formal plan to dispose of its Horse…

A: Transactions of the Horse division must be recorded separately after the company has decided to…

Q: When a merger takes place between two companies to form a single firm, the target company to operate…

A: Given: Particulars 1 2 3 After tax cash flows $19.00 $28.50 $34.20 Growth rate 3% Beta…

Q: Reyd Company has bought the entity from previous owners through a leveraged management buy-in (MBI).…

A: As per IAS 38 of International financial reporting standards Intangible asset is an asset which…

Q: Glass Company is thinking about acquiring Plastic Company. Glass Company is considering two methods…

A: Hello, since the student has posted multiple requirements, only the first one is answerable. Thank…

Q: Northwest Paperboard Company, a paper and allied products manufacturer, was seeking to gain a…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: On the negotiation for the business combination, DIMINUTIVE Co. incurred transaction costs amount…

A: Good will or gain on bargain purchase is calculated by deducting Net Assets Acquired from purchase…

Q: King’s Road recently acquired all of Oxford Corporation’s stock and is now consolidating the…

A: A) Deferred Tax liability: Deferred Tax liability = $ 51200.

Q: ABC Construction Corporation is planning to purchase STUVW Mining Corporation which is owned by S,…

A: When two or more companies join together or one company tends to acquire the other company, it is…

Q: On December 31, 2015, Hanzo Company is planning to purchase Buff Incorporated. Hanzo is not sure how…

A: Introduction: A minimum price is the lowest legal rate that must be imposed, such as a minimum…

Q: Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its…

A: 1.

Q: Pillow Company is purchasing a 100% interest in the common stock of Sleep Company. Sleep’s balance…

A: If the purchase price is higher than fair value of net asset, then the excess payment is recognized…

Q: What amount should Draco Malfoy report as earnings from subsidiary in its 2020 income statement? а.…

A: Business combination is the merger of two or more than two companies into a single company or even…

Q: Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires…

A: hey there since you have multiple questions, we will answer first question for you,please re-submit…

Q: Meryll Company is negotiating to acquire the net assets LeMans Company. Under the plan, Meryll is…

A: Goodwill refers to a company's excellent brand and reputation in the market, which allows it to…

Q: Goodwill arises when one firm acquires the net assets of another firm and pays more for those net…

A:

Q: Firm A has a total market value of RM 200 million. It is planning to acquire Firm B, which has a…

A: Firm Value of B = RM 630 million Premium paid = RM 24 Million Merger charges = RM 42 Million

Q: Gaffney Corporation is a wholesale distributor of auto parts and uses the cash method of accounting.…

A: Here discuss about the details of the threshold limit which are related with the cash method…

Q: Type 2D: ABC Inc. is considering the acquisition of Togo Company. respectively. ABC's financial…

A: Given, Value of ABC is $ 40 million Togo is $15 million

Q: Sailor Company's has brought the entity from previous owners through a leverage management buy-in…

A: Intangible asset refers to those assets which does not exist in any sort of physical aspect. It…

Q: ABC Co. is contemplating on acquiring XYZ Inc. The following information was gathered through a…

A: Goodwill means the reputation of the company due to any factor like location , product , price ,…

Q: Company A is preparing a deal to acquire company B. One analyst estimated that the merger would…

A: Solution:-1 Computation of the value of the synergy (In $ Million) as estimated by the analyst as…

Q: ney Co sa wholesale orstnoutor or auto parts and uses the cash method of accountbing. The company's…

A: Here discussion about the details of the threshold limit which are related with the cash method…

Q: If the company's assets in TL: cash 100.000, accounts receivable 50.000, inventory 150.000, and…

A: The goodwill is calculated as excess of purchase price over net value of assets.

Q: From the data given, compute the goodwill or gain from bargain purchase for the different items. If…

A: Calculation of Net Consideration paid: Calculation of Net Identifiable Asset:

Q: Please provide detailed instructions to help me solve this problem .. I’m confused on solving both…

A: Meaning of goodwill: Goodwill is the reputation of the business name. this help to generate the…

Step by step

Solved in 2 steps

- If PROMDI Co., a new company would acquire the net assets of CARDO Co and SYANO Co. PROMDI Co will be issuing 30,000 shares to CARDO and 12,000 shares to SYANO. The following is the balance sheet of PROMDI Co, followed by the fair values and additional unpaid costs incurred by PROMDI in the acquisition: Compute for the goodwillThe following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 600,000 $ 400,000 Sales 1,200,000 1,000,000 Investment income not given Cost of goods sold 600,000 500,000 Operating expenses 280,000 350,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $76,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $140,000 to Allister for $200,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Inventory Sales Cost of Goods Sold…During 20X4, the Pencil Corp. entered into negotiations to buy Stilo Company, finally agreeing on a final cash purchase price of $534,000. Pencil will acquire all assets and liabilities of Stilo effective 31 December 20X4, except for the existing cash balances of Stilo.The 31 December 20X4 balance sheet prepared by Stilo is shown below in column (a), and the revised fair values added later by Pencil are shown in column (b).STILO COMPANY BALANCE SHEETAt 31 December 20X4 (a) Book Values of Stilo Co. (b) Fair Values assigned by Pencil Corp.Assets Cash $ 50,000 n/aAccounts receivable (net) 106,000 $ 108,000Inventory 320,000 180,000Property, plant, and equipment (net) 618,000 570,000Land 22,000 80,000Franchise (unamortized balance) 38,000 42,000Total $1,154,000 Liabilities and shareholders’ equity Current liabilities $ 74,000 74,000Bonds payable 400,000 400,000Shareholders’ equity 680,000 n/aTotal $1,154,000 Required1. Compute the amount of goodwill purchased by Pencil.2. Give the entry for…

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 580,000 $ 380,000 Sales 1,160,000 960,000 Investment income not given Cost of goods sold 580,000 480,000 Operating expenses 270,000 340,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $72,000 that was unrecorded on its accounting records and had a six-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $138,000 to Allister for $196,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:Kiln Corporation is considering the acquisition of Williams Incorporated. Kiln has asked you, its accountant, to evaluate the various offers it might make to Williams Incorporated. The December 31, 2015, balance sheet of Williams is as attached:The following fair values differ from existing book values:Inventory . . . . . . . . . . . . . . . . . . . . $250,000Land. . . . . . . . . . . . . . . . . . . . . . . . 40,000Building . . . . . . . . . . . . . . . . . . . . . 120,000Record the acquisition entry for Kiln Corporation that would result under each of the alternative offers. Value analysis is suggested.1. Kiln Corporation issues 20,000 of its $10 par common stock with a fair value of $25 per share for the net assets of Williams Incorporated.2. Kiln Corporation pays $385,000 in cash.ABC Corporation is planning to purchase another entity. ABC gathered the following information based on the publicly available financial reports: On the target acquisition date, the fair value of the net assets of the entity is expected to be at P6,000,000. ABC deems a 15%-rate appropriate for capitalization purposes. If ABC is willing to value the goodwill using the capitalization of average earnings method based on the past five years, how much should its offer price be on the entity?

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 500,000 $ 300,000 Sales 1,000,000 800,000 Investment income not given Cost of goods sold 500,000 400,000 Operating expenses 230,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone’s book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,000. Of this amount, 10 percent remains unsold in Allister’s warehouse at year-end. Determine balances for the following items that would appear on Allister’s consolidated financial statements for 2021: What is cost of goods sold?Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount, it will pay $730,000 in cash to Yount and acquisition costs of $20,000. The January 1, 2015, balance sheet of Yount, Inc., is anticipated to be as attached:Fair values agree with book values except for the inventory and the depreciable fixed assets, which have fair values of $70,000 and $400,000, respectively. Your projections of the combined operations for 2015 are as follows: Combined sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $200,000 Combined cost of goods sold, including Yount’s beginning inventory, at book value, which will be sold in 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,000 Other expenses not including depreciation of Yount assets . . . . . . . . . . . . . . . . . . . . . . . . 25,000Depreciation on Yount fixed assets is…The following are several figures reported for Allister and Barone as of December 31, 2021: AllisterBaroneInventory$400,000$200,000Sales 800,000 600,000Investment incomenot given Cost of goods sold 400,000 300,000Operating expenses 180,000 250,000 Allister acquired 70 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $65,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $120,000 to Allister for $160,000. Of this amount, 20 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 570,000 $ 370,000 Sales 1,140,000 940,000 Investment income not given Cost of goods sold 570,000 470,000 Operating expenses 265,000 335,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $70,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $137,000 to Allister for $194,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:If PROMDI Co., a new company would acquire the net assets of CARDO Co and SYANO Co. PROMDI Co will be issuing 30,000 shares to CARDO and 12,000 shares to SYANO. The following is the balance sheet of PROMDI Co, followed by the fair values and additional unpaid costs incurred by PROMDI in the acquisition: compute for the consolidated total assets at the date of acquisitionIf the management of Beauty Co. demands a price of P28,000,000, should the management of Gwapo Co. pursue the acquisition? yes no