Show Attempt History Current Attempt in Progress Sheffield is unable to reconcile the bank balance at January 31. Sheffield's reconciliation is as follows. Cash balance per bank $4,060.20 Add: NSF check 440.00 Less: Bank service charge 34.00 Adjusted balance per bank $4,466.20 Cash balance per books $4,375.20 Less: Deposits in transit 780.00 Add: Outstanding checks 939.00 Adjusted balance per books $4,534.20

Show Attempt History Current Attempt in Progress Sheffield is unable to reconcile the bank balance at January 31. Sheffield's reconciliation is as follows. Cash balance per bank $4,060.20 Add: NSF check 440.00 Less: Bank service charge 34.00 Adjusted balance per bank $4,466.20 Cash balance per books $4,375.20 Less: Deposits in transit 780.00 Add: Outstanding checks 939.00 Adjusted balance per books $4,534.20

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 47E

Related questions

Question

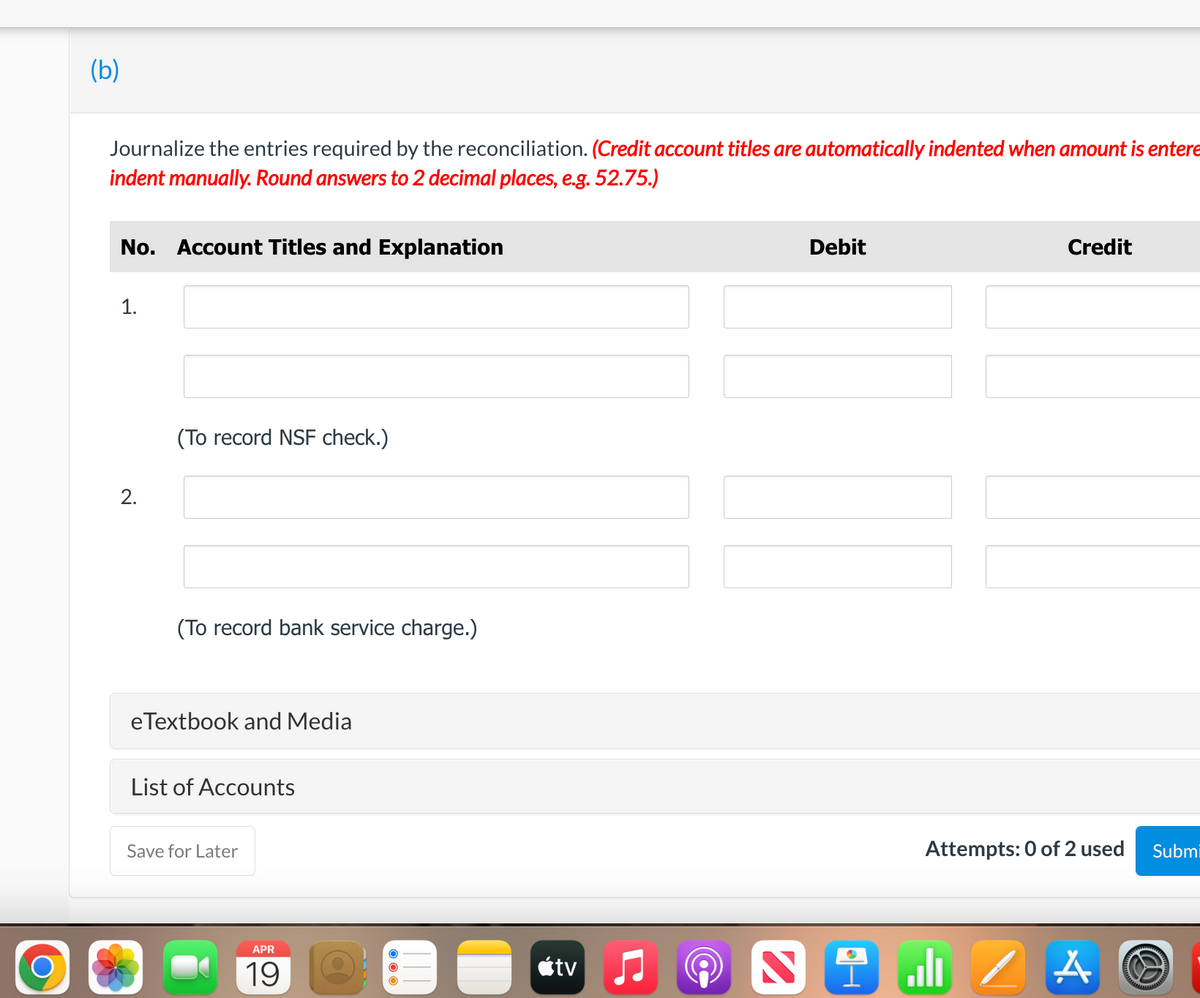

Transcribed Image Text:(b)

Journalize the entries required by the reconciliation. (Credit account titles are automatically indented when amount is entere

indent manually. Round answers to 2 decimal places, e.g. 52.75.)

No. Account Titles and Explanation

Debit

Credit

1.

(To record NSF check.)

(To record bank service charge.)

eTextbook and Media

List of Accounts

Save for Later

Attempts: 0 of 2 used

Submi

li Z A

APR

19

étv

2.

Transcribed Image Text:View Policies

Show Attempt History

Current Attempt in Progress

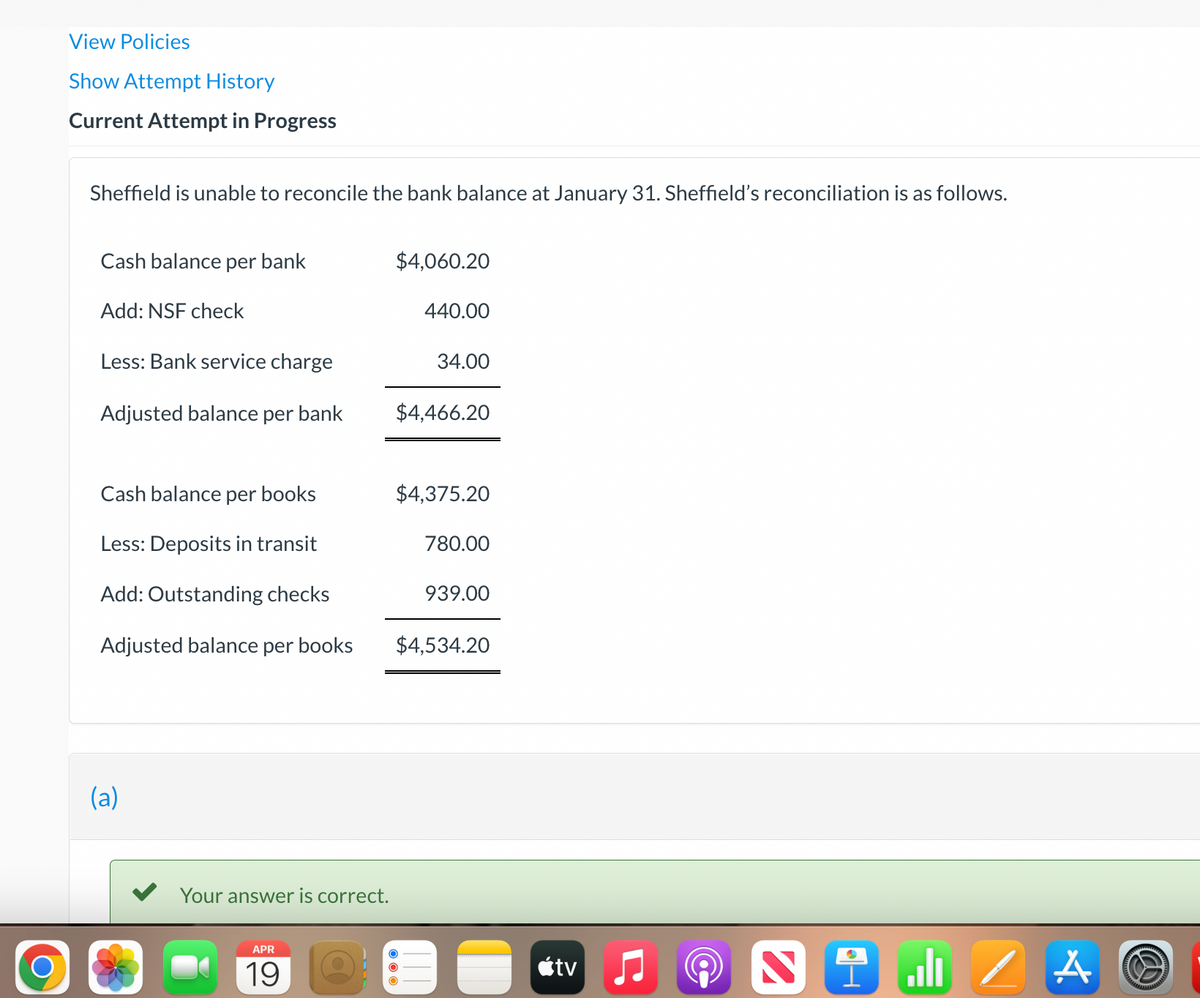

Sheffield is unable to reconcile the bank balance at January 31. Sheffield's reconciliation is as follows.

Cash balance per bank

$4,060.20

Add: NSF check

440.00

Less: Bank service charge

34.00

Adjusted balance per bank

$4,466.20

Cash balance per books

$4,375.20

Less: Deposits in transit

780.00

Add: Outstanding checks

939.00

Adjusted balance per books

$4,534.20

(a)

Your answer is correct.

APR

1 ali Z A

19

étv

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College