simlar hobbles. They formed a partnershlp with a written partnership agreement to trade in pastry and related products as Tasnaz's Pastry. Required: Prepare the statement of changes In equity for Tasnaz's Pastry for the year ended 30 June 2021. You may elminate the Total column but must include an appropriation column

simlar hobbles. They formed a partnershlp with a written partnership agreement to trade in pastry and related products as Tasnaz's Pastry. Required: Prepare the statement of changes In equity for Tasnaz's Pastry for the year ended 30 June 2021. You may elminate the Total column but must include an appropriation column

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 1CP

Related questions

Question

Tasneem and Nazreen were friends with simlar hobbles. They formed a partnershlp with a written

Required: Prepare the statement of changes In equity for Tasnaz's Pastry for the year ended 30 June 2021. You may elminate the Total column but must include an appropriation column. Show all workings. Round off all calculations to the nearest Rand.

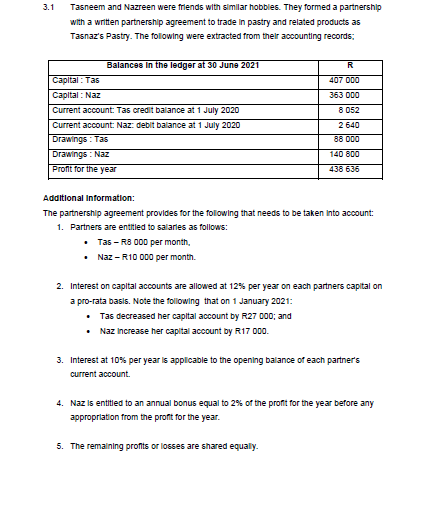

Transcribed Image Text:3.1

Tasneem and Nazreen were friends with simlar hobbles. They formed a partnershlp

with a written partnership agreement to trade in pastry and related products as

Tasnaz's Pastry. The following were extracted from their accounting records;

Balances In the ledger at 30 June 2021

R

Capital : Tas

407 000

Capital : Naz

363 000

Current account: Tas credit balance at 1 July 2020

8 052

Current account: Naz: debit balanoe at1 July 2020

2 640

Drawings : Tas

Drawings : Naz

88 000

140 800

Proft for the year

438 636

Additional Information:

The partnership agreement provides for the following that needs to be taken Into account:

1. Partners are entitled to salaries as follows:

Tas - R8 000 per month,

Naz - R10 000 per month.

2. Interest on capital accounts are allowed at 12% per year on each partners capital on

a pro-rata basis. Note the following that on 1 January 2021:

• Tas decreased her capltal account by R27 000; and

• Naz Increase her capital account by R17 00.

3. Interest at 10% per year is applicable to the opening balance of each partner's

current account.

4. Naz is entitied to an annual bonus equal to 2% of the profit for the year before any

appropriation from the profit for the year.

5. The remaining profts or losses are shared equaly.

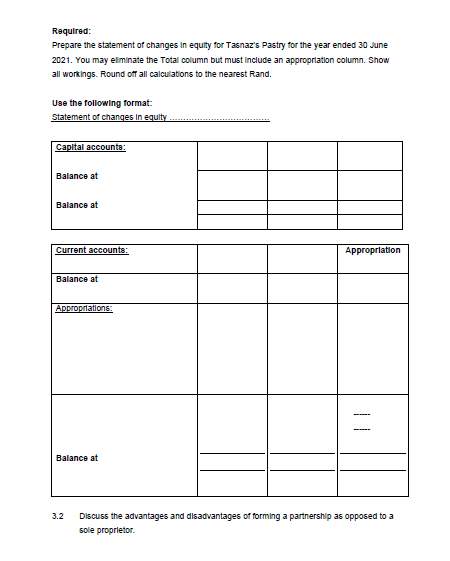

Transcribed Image Text:Required:

Prepare the statement of changes In equity for Tasnaz's Pastry for the year ended 30 June

2021. You may elminate the Total column but must include an appropriation column. Show

all workings. Round off all calculations to the nearest Rand.

Use the following format:

Statement of changes In equity

Capital accounts:

Balance at

Balance at

Current accounts:

Appropriation

Balance at

Appropriations:

Balance at

3.2

Discuss the advantages and disadvantages of forming a partnership as opposed to a

sole proprietor.

| |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage