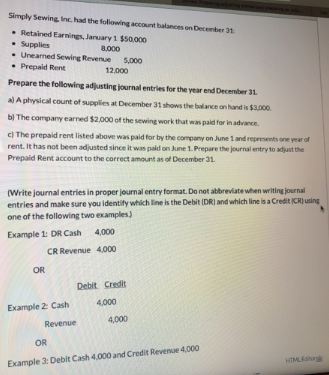

Simply Sewing Inc. had the folowing account balances on December 31: • Retained Earnings, January 1 $50.000 • Supplies • Unearned Sewing Revenue • Prepaid Rent 8,000 5,000 12,000 Prepare the following adjusting journal entries for the year end December 31. a) A physical count of supplies at December 31 shows the balance on hand is $3.000. bị The company earned $2,000 of the sewing work that was paid for in advance. c) The prepaid rent listed above was paid for by the company on June 1 and represents one year of rent. It has not been adjusted since it was paid on June 1. Prepare the journal entry to adjust the Prepaid Rent account to the correct amount as of December 31. (Write journal entries in proper journal entry format. Do not abbreviate when writing journal entries and make sure you identify which line is the Debit (DR) and which line is a Credit (CR) using one of the following two examples) Example 1: DR Cash 4,000 CR Revenue 4.000 OR Debit Credit 4.000 Example 2: Cash 4,000 Revenue OR HIMLEdr Example 3: Debit Cash 4,000 and Credit Revenue 4,000

Simply Sewing Inc. had the folowing account balances on December 31: • Retained Earnings, January 1 $50.000 • Supplies • Unearned Sewing Revenue • Prepaid Rent 8,000 5,000 12,000 Prepare the following adjusting journal entries for the year end December 31. a) A physical count of supplies at December 31 shows the balance on hand is $3.000. bị The company earned $2,000 of the sewing work that was paid for in advance. c) The prepaid rent listed above was paid for by the company on June 1 and represents one year of rent. It has not been adjusted since it was paid on June 1. Prepare the journal entry to adjust the Prepaid Rent account to the correct amount as of December 31. (Write journal entries in proper journal entry format. Do not abbreviate when writing journal entries and make sure you identify which line is the Debit (DR) and which line is a Credit (CR) using one of the following two examples) Example 1: DR Cash 4,000 CR Revenue 4.000 OR Debit Credit 4.000 Example 2: Cash 4,000 Revenue OR HIMLEdr Example 3: Debit Cash 4,000 and Credit Revenue 4,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

Transcribed Image Text:Simply Sewing Inc. had the folowing account balances on December 31:

• Retained Earnings, January 1 $50.000

• Supplies

• Unearned Sewing Revenue

• Prepaid Rent

8,000

5,000

12,000

Prepare the following adjusting journal entries for the year end December 31.

a) A physical count of supplies at December 31 shows the balance on hand is $3.000.

bị The company earned $2,000 of the sewing work that was paid for in advance.

c) The prepaid rent listed above was paid for by the company on June 1 and represents one year of

rent. It has not been adjusted since it was paid on June 1. Prepare the journal entry to adjust the

Prepaid Rent account to the correct amount as of December 31.

(Write journal entries in proper journal entry format. Do not abbreviate when writing journal

entries and make sure you identify which line is the Debit (DR) and which line is a Credit (CR) using

one of the following two examples)

Example 1: DR Cash

4,000

CR Revenue 4.000

OR

Debit Credit

4.000

Example 2: Cash

4,000

Revenue

OR

HIMLEdr

Example 3: Debit Cash 4,000 and Credit Revenue 4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning